Sojern Publishes Latest Insights into COVID European Travel

by on 30th Sep 2020 in News

With access to real-time traveller audiences and unmatched visibility into global travel demand, Sojern is in a unique position to share the current travel trends at the forefront of marketers’ minds. These latest insights are based on data on over 350 million traveller profiles and billions of travel intent signals collected on the 28th September, 2020. Whilst extensive, it does not capture 100% of the travel market.

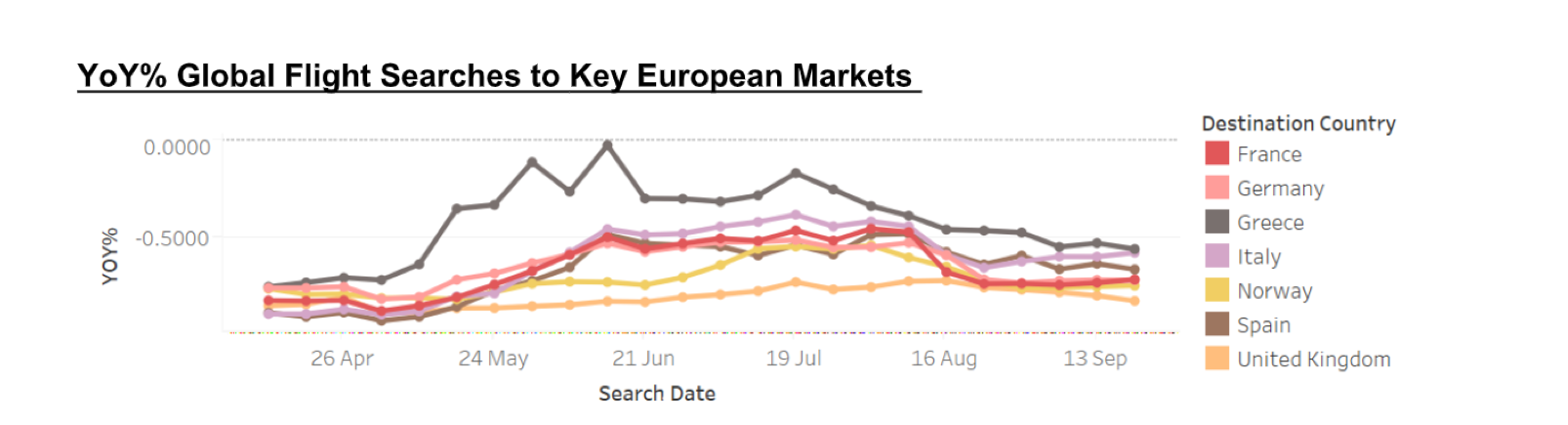

Global flight searches to the region remain in plateau

Across the region governments are carefully monitoring the increases and decreases in COVID-19 infection rates, and taking action accordingly . Examples of recent changes in restrictions and lockdown measures across European countries include a reduction in the number of people allowed to socialise together, implementation of earlier closing times for bars, restaurants, and businesses, the reinforcement of wearing face masks on public transport, and compulsory tests at airports for arrivals from high-risk countries.

Failure to follow the relevant government guidelines for each respective country can result in fines. With uncertainty around how long local restrictions across the region will remain in place, and the potential of lockdowns being reimplemented , it is likely that travel intent and confidence will waver for the coming weeks and months. Since late August, a number of key European markets have seen a plateau in inbound flight searches, with only slight increases and decreases in intent over the last few weeks. As it stands, Greece, Spain, and the UK have experienced a slight drop in travel intent over the past week, although Greece continues to have the highest level of searches compared to the same period last year out of the countries referenced. This highlights the importance of an always-on marketing strategy that enables travel brands to share their message with customers during those peaks, and as and when restrictions are lifted.

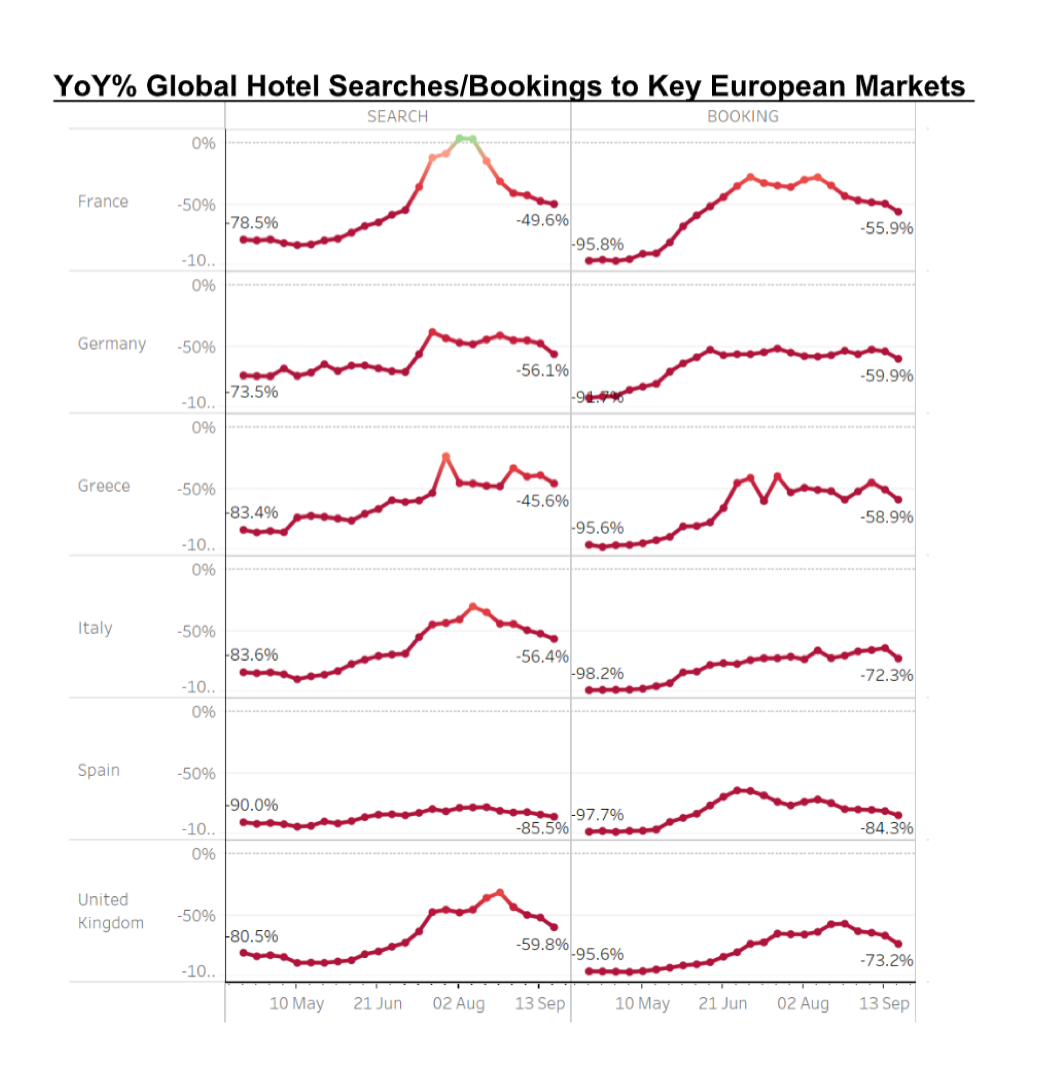

Interestingly, although Spain has managed to retain reasonably high levels of travel intent when compared to countries such as France, Norway, and the UK, hotel search and booking volume are considerably lower YoY compared to other key markets. For example, thanks to an increase in international travel, and the help of domestic demand, France and Greece have reached intent levels of above -50% YoY. This is a big increase when compared to early April where volumes were at -79% and -83% YoY respectively. Hotel searches and bookings for Spain however have only marginally improved, now standing at -86% and -84% respectively.

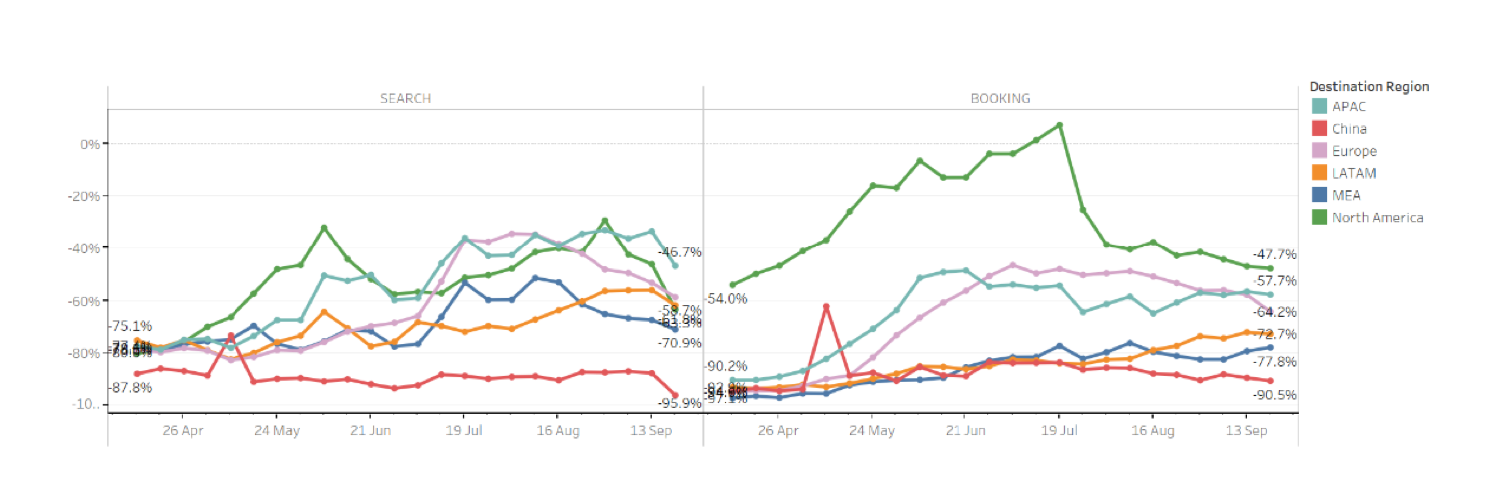

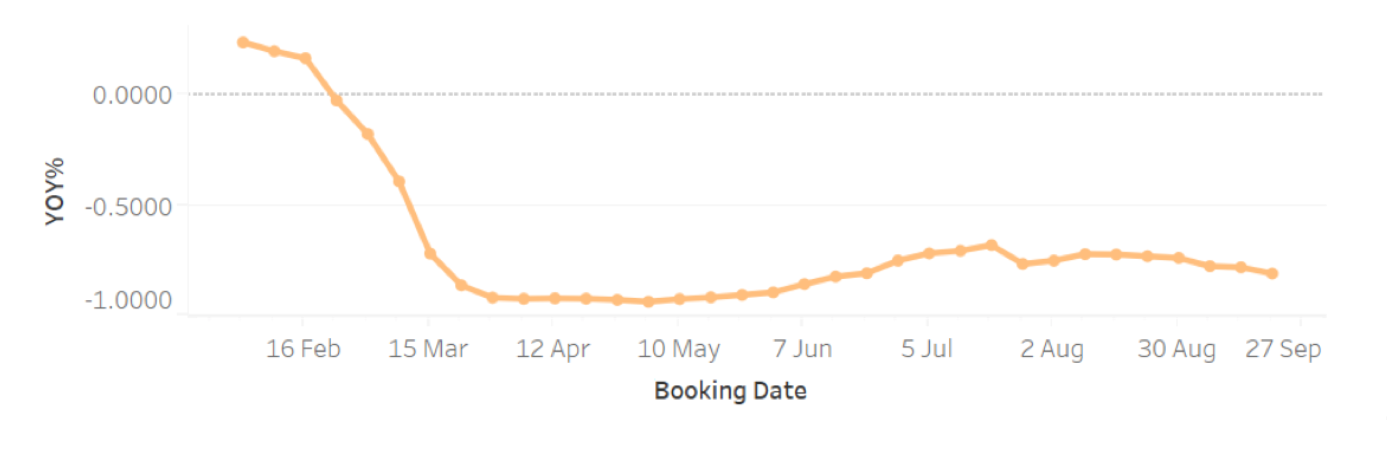

When looking at global hotel bookings, and comparing Europe’s recovery with other key regions, we also notice a plateau from early July through to now. Booking volumes are now 64% below those experienced in 2019, which compares to -91% and -78% YoY for China and the Middle East and Africa (MEA) respectively. This shows that global travel confidence has moved in a positive direction for European destinations, and will likely rise and fall in some reflection of infection rates.

YoY% global hotel searches/bookings - region comparison

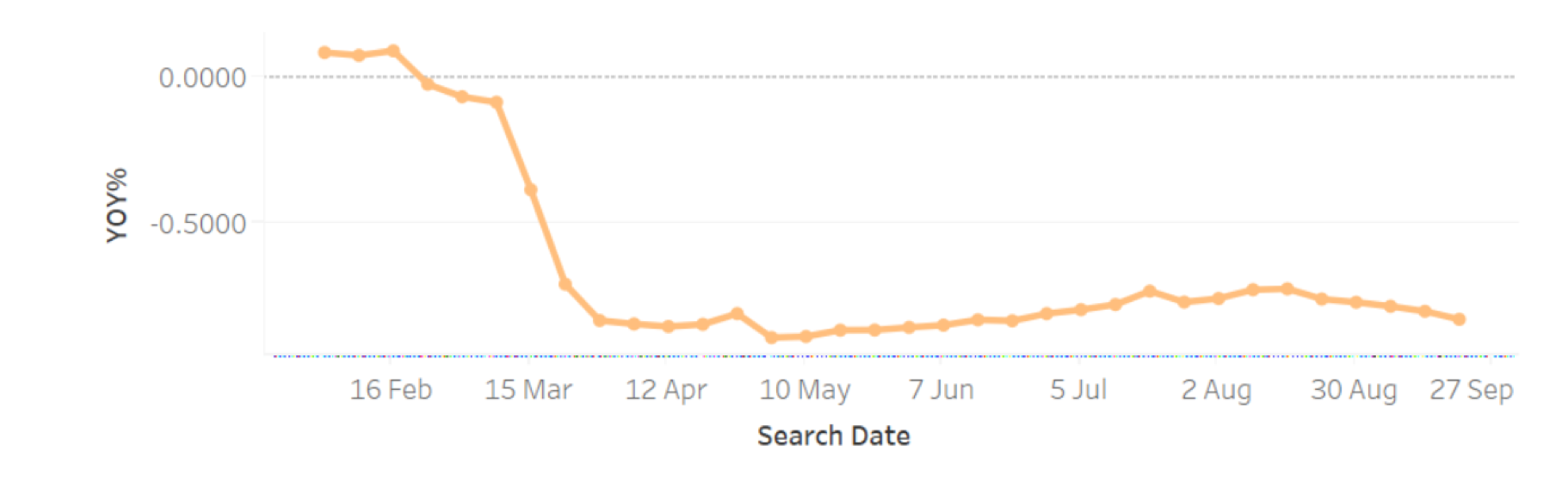

A look into the impact of daily COVID-19 cases on travel to the UK

The UK in particular has begun to see a spike in cases over the last few weeks, and as a result, on 22nd September the UK government announced new measures to suppress the virus . The below graph was shared by GOV.UK and outlines the daily cases by the date they were reported, and shows a weekly average of these figures. There is a clear peak in cases displayed between the start of April, and early-May, however reported cases reach their lowest levels in July. In the next few sections we will refer back to some of the figures in this graph, and see how they are reflected in travel intent and confidence.

Global flight searches to the UK were up 9% YoY back in the week commencing 16th February 2020, when new cases were reported at 0 on that day. Travel intent to the UK decreased to its lowest levels compared to 2019 at -89% YoY during the week of 3rd May where daily cases reached 4339. Week commencing 19th July saw flight searches increase to -73% YoY (daily cases at 726), and as cases have started to rise again, recorded at 3899 on 20th September, travel intent is back down to -83% YoY.

YoY% global flight searches to the UK

Global flight bookings to the UK show a very similar story, closely mirroring the rise and fall in daily case numbers. At the start of the year in the week commencing 16th February when daily cases were at 0, YoY bookings were up 17%. Travel confidence to the UK decreased over the following months as the cases rose to a daily rate of 4339 on 3rd May, and bookings dropped 94% below volumes in 2019. In mid-July YoY travellers regained confidence in travel to the UK and volumes were down only 68% YoY, following a decrease in daily cases to just 726. Last week saw daily cases in the UK reaching 3899, and as expected, volumes dropped to -81% YoY.

YoY% global flight bookings to the UK

When looking at the volumes of hotel searches made directly or via metasearch and online travel agents (OTA), the pattern is also very similar. Following the ‘peak’ in daily cases across the UK in May, there was a steady growth in global and local travel intent that reached its highest levels in August. In the week starting 19th July when daily cases were near their lowest levels since May, global travel intent to the UK was 890% above search volumes back in week commencing 3rd May. Domestic travel has seen even more of an uplift, with July experiencing an even larger increase in searches by 1590%. Although these are huge improvements in travel intent and confidence, it is important to remember that this is compared to the time where the country saw the greatest impact on travel from COVID-19. Searches remain down YoY.

Traveller intent and confidence continues to plateau for key European markets. As daily cases rise, governments are responding accordingly with tightened restrictions, and new lockdown measures. The uncertainty has almost certainly directly impacted traveller behaviour and has resulted in flight and hotel search and booking volumes wavering. However, since late-August volumes have plateaued and remain fairly steady, gradually rising and falling as announcements are made. Looking more closely at daily case figures, combined with search data for UK hotels, we can see this pattern more clearly. We will continue to share more insights as we monitor the situation. These forward looking insights will hopefully help travel marketers shape their strategies as the industry recovers from this outbreak.

UNWTO launches tourism recovery tracker

As restrictions on travel continue to ease and change, the World Tourism Organisation (UNWTO) has launched a new Tourism Recovery Tracker to support global tourism. It aims to guide recovery and lead the response of global tourism.

The comprehensive tracker is free and is the result of a partnership between international organisations and the private sector. Sojern’s data is included in the tracker to help provide key tourism performance indicators by month, regions and subregions, allowing for a real time comparison of the sector recovery across the world and industries.

For the rest of the COVID-19 insights series click here.

Covid-19EuropeMeasurementTravelUK

Follow ExchangeWire