FLoC, ATT, and Core Web Vitals: The Opportunities for Independents

by Mathew Broughton, Grace Dillon on 5th May 2021 in News

Advertising technology has always been somewhat difficult to explain to those not in the industry. “What do you really do? What the heck is a programmatic?” Questions we have all had to field. The last couple of months will surely have intensified such queries when, over the dining tables and hastily-purchased desks of the ad tech home-office, loved ones have witnessed an outbreak of “FLoC”. A single word to convince partners and housemates that we have finally lost purchase from reality, after months of having little to do in our spare time except observe pigeons and gull.

However, Google’s introduction of FLoC and its wider Privacy Sandbox, and the deprecation of the third-party cookie, goes far beyond aviary nonsense. It has given rise to a maelstrom of privacy concerns; intra-GAFA conflict; the renaissance of contextual; concerns over identity solutions; and, most importantly: the opportunity to regain consumer trust. In this in-depth feature article, ExchangeWire editors Mat Broughton and Grace Dillon assess the impact Google’s moves are set to have on the industry, how they compare to other GAFA-led initiatives, and the opportunities for independent ad tech and publishers.

Birds of a feather...

In short, FLoC, or Federated Learning of Cohorts, replaces the tracking of individuals via third-party cookies by bundling these users into groups based on their browsing behaviour, with adverts then served anonymously by targeting these clusters rather than the individual, fulfilled via another birdy sandbox resident: the TURTLEDOVE API.

Ostensibly, the switch from biscuit to bird has been made in order to protect user privacy, though regulators have taken issue with the protocol from both a privacy and antitrust perspective. Initial FLoC trials are not taking place in Europe over ongoing debate as to whether it violates GDPR by auto-enrolling users on a site-wide basis, while the UK Competition and Markets Authority (CMA) is currently investigating the Privacy Sandbox as a whole over fears it could undermine competition in digital advertising.

Alongside FLoC and Turtledove, a whole host of proposals outlines by Google and other firms in the ecosystem are currently under review, some of which may address the above concerns. SWAN (storage with access negotiation), submitted by 1plusX, aims to widen the definition of first-party data so that publishers can make a greater range of information available to in-browser auctions, as well as to enable third-party data sharing within the privacy-centric FLoC framework. Under SWAN, domains with a shared owner will be allowed to share data between them, although any information collected and shared across domains will only be made accessible to “pre-registered scripts with a constrained signature”. These signatories will be able to use this information to create the common-interests based cohorts hosted within FLoC.

Whilst SWAN has been well-received by the World Wide Web Consortium (W3C), some are concerned that the technology undermines publishers by discounting the second-party data sharing. The proposals also run contrary to Google’s stated intent of removing third-party tracking in its entirety, and its countless actions over the years designed to promote its own ecosystem. Google's sole retention of the ability to monitor and alter cohorts, again in the name of "privacy" serves as ample reason to be cautious. Nonetheless, it will be interesting to note whether proposals such as SWAN gain traction in the heat of antitrust fires.

"Media buyers need to move closer to media owners and work together directly"

Back onto FLoC as it stands. The most cursory glance at the revenue sheets of a GAFA firm will show that some companies have done very well in the age of the third-party-based targeting era. However, while being deleterious to the consumer, it has also led to a continuing slide in fortunes for premium and independent publishers. A shift towards targeting based upon first-party data can only serve to benefit these publishers, which tend to have this data in spades. This in turn opens the door for partnerships with independent ad tech providers and platforms, where privacy-compliant contextual data can further enhance publisher data, for instance.

Speaking to ExchangeWire, Zack Sullivan, CRO UK at Future plc commented, “Overall, Google’s deprecation of third-party cookies is a positive change as it puts privacy first and will stop the exploitative practices of third-party data vendors. Targeting solutions will remain effective as premium publishers have excellent first-party data, but media buyers need to move closer to media owners and work together directly, rather than using intermediaries – who will be shaken out of the market.”

Google vs. Apple

To some extent, FLoC and ATT are not so much about delivering a more secure service to users as they are about proving which internet giant cares the most about privacy. Google, Apple, and their Big Tech compatriots are having to work hard not just to convince global regulators that they’re handling the reams of information at their fingertips with care, but also to win back the trust of consumers worldwide.

On the outside, Apple seems to be winning the battle of appearing most sensitive to users’ data concerns. On top of a self-styled reputation as privacy-centric (propagated via a typically idiosyncratic marketing campaign), their ATT puts user consent at its centre, making it impossible for an app to gather information on an individual unless they have been granted permission to do so. This stipulation applies to every single app available on iOS, meaning that users can pick and choose who (if anyone) can track them. “Without the user’s permission, you will not be allowed to track them and the device’s advertising identifier value will be all zeros,” a statement posted on Apple's developer site read.

FLoC, on the other hand, is not built around user consent - the privacy sandbox is for advertisers and their technology partners, and Google has done little to convince anyone otherwise. Now one of the leading ad networks, it should come as no surprise to anyone that Google is more preoccupied with how their infrastructure impacts buying and selling.

"FLoC collapses the power of the market into the hands of the Google Chrome browser, and increases the leverage of first-parties and their closest tech partners"

However, Apple is still a business, and the notion that they’re utterly devoted to users’ sense of security is severely misguided. We mustn’t forget that Apple’s insular ecosystem includes their own ad network, SKADNetwork, and whilst SKAD does offer greater privacy by keeping user- and device-level data out of the equation, it also puts Apple squarely in the driving seat when it comes to iOS ad buying. With ATT, Apple have “taken an axe to personalised advertising and ad revenue by requiring app developers to get consent to collect and use an iOS user’s IDFA via its ATT framework”, says Clearcode CEO Piotr Banaszczyk. By making ID for advertisers, which had been integral running campaigns on Apple products, rely on ATT, the tech heavyweight have proven their power over the ad tech ecosystem - the power to relegate competition under a guise of philosophy.

All this isn’t to say that Google have any kind of moral high-ground when it comes to the intention behind their privacy framework. The tech giant rocked the beleaguered ad tech boat once again in March when they announced that they will neither build, nor support, any form of alternative IDs on Chrome once cookies expire. Whilst they put this down to concerns that such technology would likely quickly be rendered obsolete by future legislation, the decision effectively nullifies the post-cookie targeting solutions of dozens of tech providers and puts the core revenue stream of thousands websites at risk.

“For Google, the goal is to increase user data security, and they are doing this by incapacitating the core tech capabilities of the third-party ad tech community,” outlines Lucid Privacy Group founder and principal Colin O’Malley. “This will dramatically reduce the number of embedded companies that have the ability to leverage consumer data, which has an inherent benefit to user privacy overall. It also collapses the power of the market into the hands of the Google Chrome browser, and increases the leverage of first-parties and their closest tech partners. Ironically, all of this disruption may result in little to no perceptible difference to the consumer. They will still see the same number of ads. Those ads will still benefit from knowledge about their interests, and retarget their past behaviours. The underlying data will simply be managed by the browser sitting on their own computer, rather than a hundred plus ad tech companies working behind the scenes.”

“Apple’s approach is fundamentally more disruptive, and clearly more obvious to the user. The app economy has blossomed with embedded third parties which pool data across apps for a range of commercial purposes. With iOS 14.5, any third party benefiting from IDFA will simply be turned off. If they want IDFA, they can ask, only once, for each device. We’re seeing initial opt-in rates hover around 40%, but this may change over time. The IDFA opt-in is partnered with a series of prominent consumer notices and combined privacy disclosures which give the consumer a real sense of control. Like Google, Apple is also asserting control over the ad ecosystem running on its rails, with a new SKAdNetwork attribution reporting API, and oh, look over here, at our expanding ads business. Apple is also dumbing down the core IDFA consent dialogue to a degree that is arguably so simplistic that it can’t possibly tee up an informed decision, and is certainly well short of GDPR requirements. Apple is clearly optimising for full privacy glamour shot in front of the consumer, while building an Apple controlled advertising ecosystem behind the scenes.”

Whether or not such an outcome was inevitable, we cannot disregard the fact that making a core targeting alternative redundant whilst building their own post-cookie toolbox reaffirms Google’s already disproportionate level of control over the online advertising infrastructure. Likewise, whether or not tighter regulations would have been forced Apple to introduce ATT or some kind of alternative, it remains clear that they've used their position to tighten their stronghold on the industry.

"On the surface, the introduction of FLoC and ATT appear to be consumer focused initiatives which will shine a privacy friendly-light on Google and Apple in the eyes of those concerned with Big Tech's growing influence,” sums up Matt Barash, SVP global publishing and platform partnerships at Zeotap. “In reality both initiatives create even deeper industry dependencies on those behemoth platforms and a reliance on aggregated data sets with delayed reporting, challenges with proper accounting for reach and frequency and a whole lot of TBD to be sorted over the coming months.”

Under the radar - Core Web Vitals

While the deprecation of the third-party cookie has naturally attracted eyeballs within the ad tech ecosphere, further Google-enforced changes are afoot. In a rare display of openness from the giant, which has traditionally rendered hindsight and the reading of tea leaves as the best ways to interpret changes to its search rankings, it announced in November that from May 2021 that “Core Web Vitals” will be incorporated into its page experience signals, on which it bases rankings.

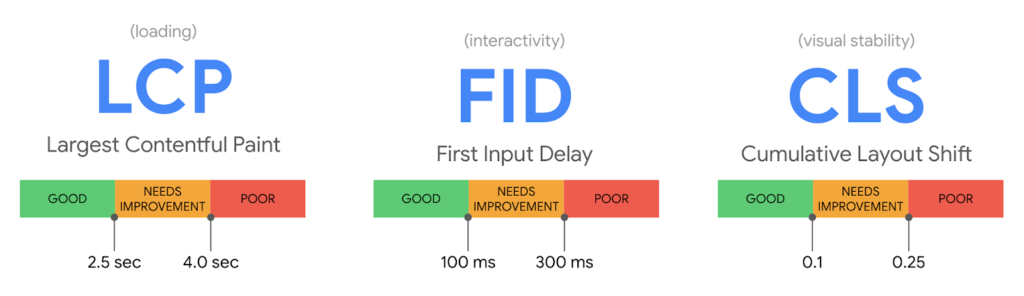

Initially, the three vitals of note will be:

- Loading speed, measured via largest contentful paint (LCP) in seconds.

- Interactivity, measured via first input delay (FID) in milliseconds.

- Visual stability, measured through a cumulative layout shift (CLS) score derived from the amount of user viewpoint affected by shifting page content and the distance said content shifts.

Publishers, vying for the dwindling number of positions in organic rankings, are already ejecting third-party tech providers if they impact their core vitals negatively. As with the deprecation of the third-party cookie in Chrome, the introduction of Core Web Vitals has been met with positivity among many scaled publishers. However, smaller-scale independent and local publishers are likely to need support from their agency partners to ensure their sites meet the requirements.

Sullivan comments, “The rollout of Core Web Vitals feels like a natural evolution, as Google continues to improve the overall user experience and build some standardisation. It follows similar work of The Coalition for Better Ads, of which Google was a facilitator, and can only be a good thing as Google broadens the measures of what makes a good website and content. The move will be beneficial for premium publishers that have the resources and proprietary technology to adapt to the change, while having their own data on user engagement to ensure quality content and the user experience is rewarded.”

AppleCookiesGooglePost-CookieSearch

Follow ExchangeWire