Advertising Industry Financials H1 2024

by Mathew Broughton on 13th Jun 2024 in News

In this feature article, ExchangeWire research lead Mat Broughton delves into how public companies across the media supply chain have fared thus far in 2024, and how the landscape may evolve as we head into H2. As is fitting for the British seaside season, this periodic analysis also features brand new buckets for companies according to where they sit within the industry. Such lark.

The big picture

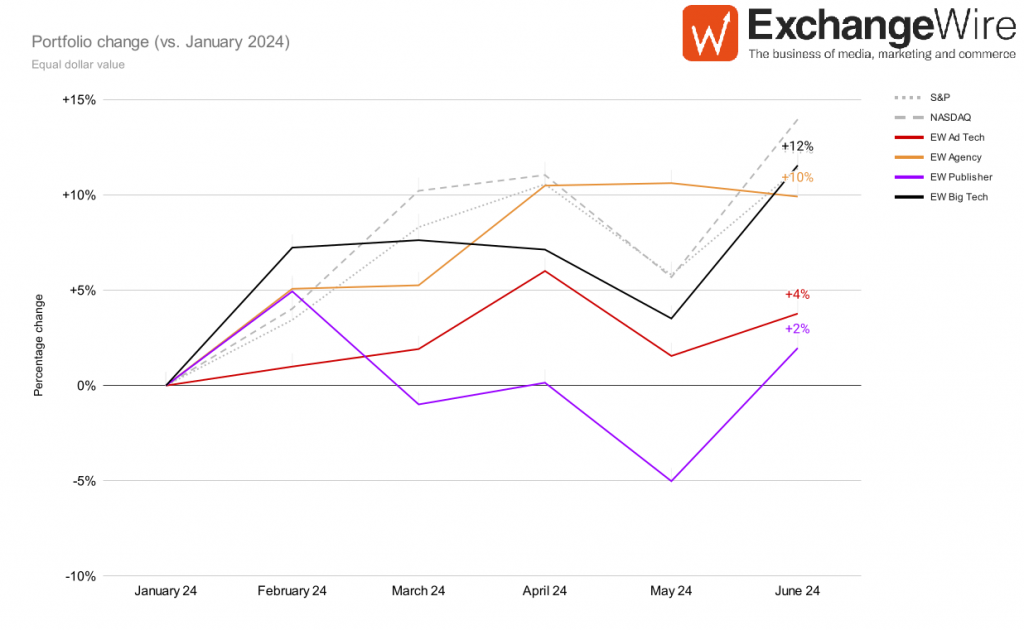

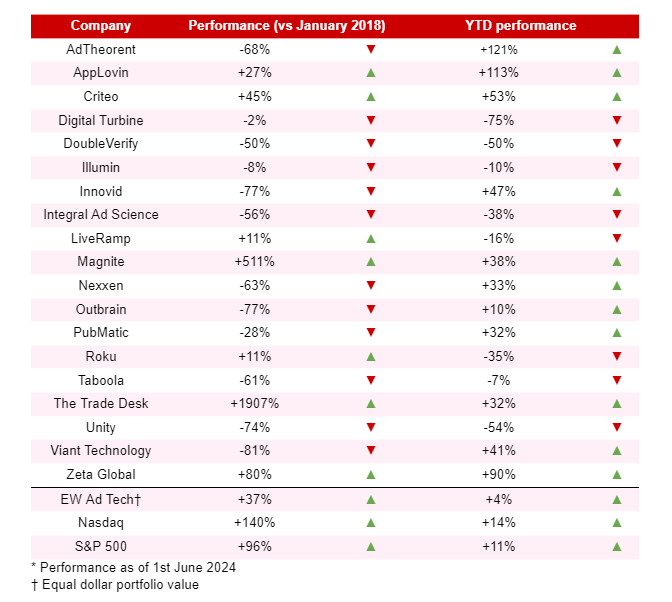

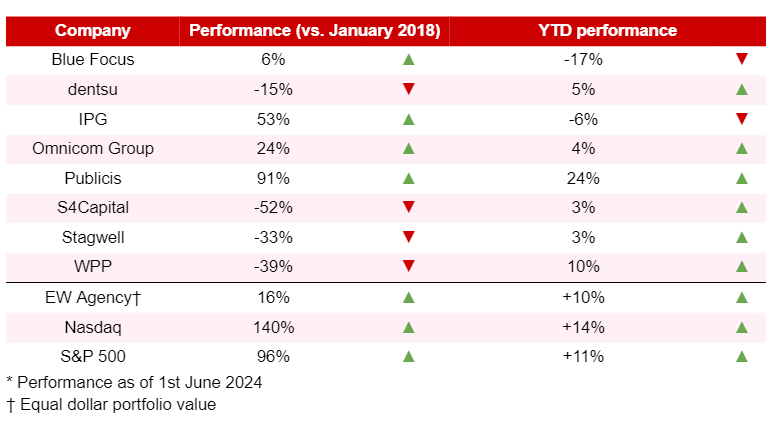

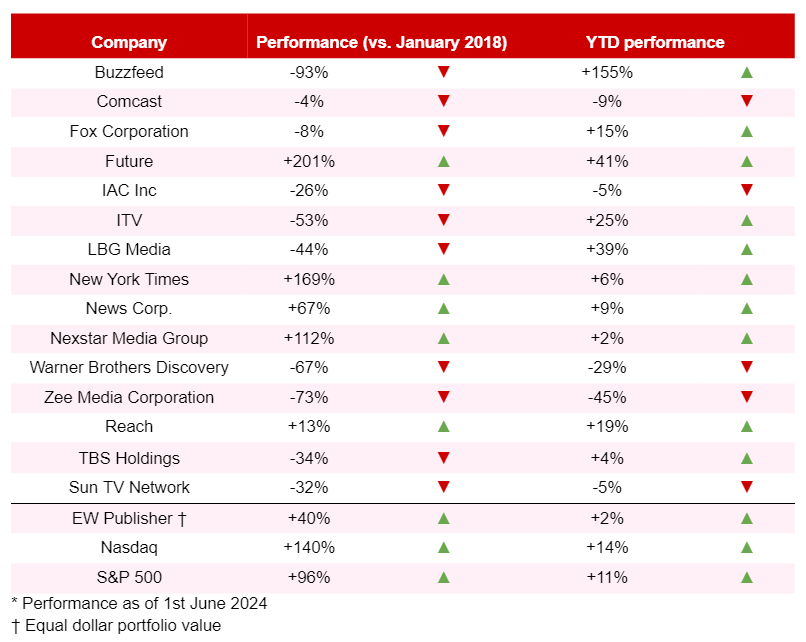

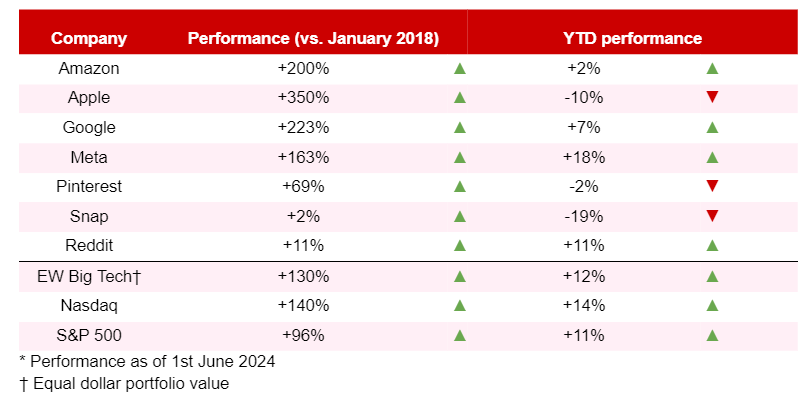

Overall, it was a positive H1 across the industry in terms of stock price performance, with equal-dollar portfolio share price up across the board compared to the start of the year. The ad industry was outpaced by general indices (S&P 500 and NASDAQ) predominantly through growth in Microsoft and particularly Nvidia (up 153% year-over-year) as a result of continued investor interest in AI. June returned the publisher cohort to 2024 growth, though the overall trend through 2024 is still negative at this point.

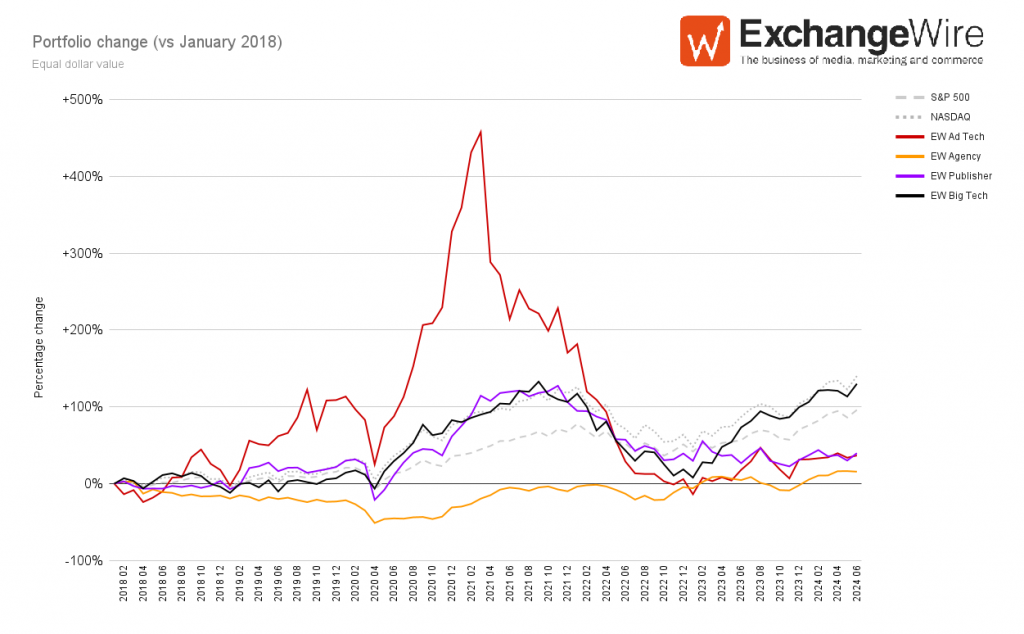

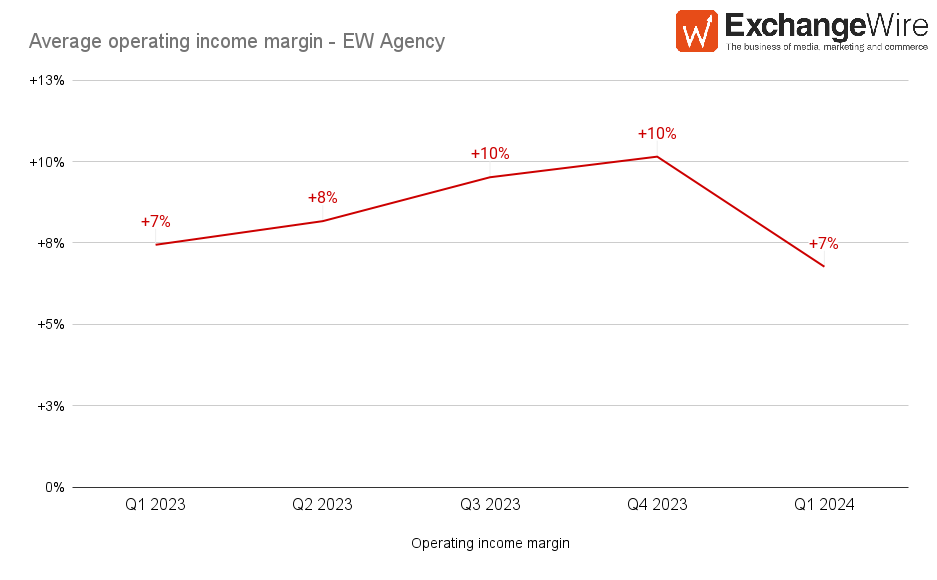

Assessing cohort performance relative to 2018, equal dollar growth is converging at the +40% mark for EW Ad Tech (+37%) and EW Publisher (+40%). Meanwhile, the EW Agency portfolio is holding steady at +16% since April, though it will be interesting to see whether it can avoid substantial dips in the latter half of the year, with a dip in Q4 observed since 2021, or whether key sporting events and a volcanic global electoral scene will drive gains for the buy side.

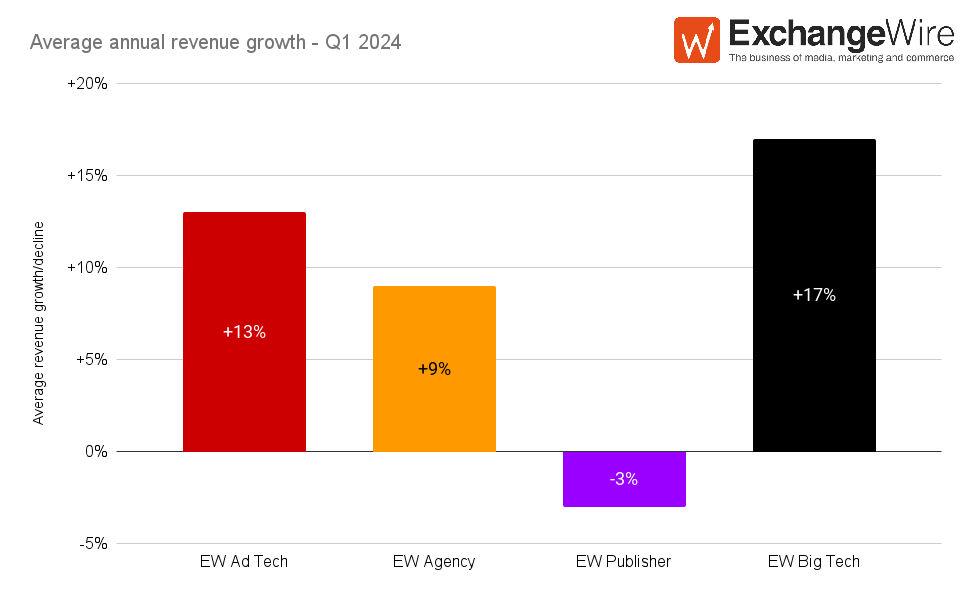

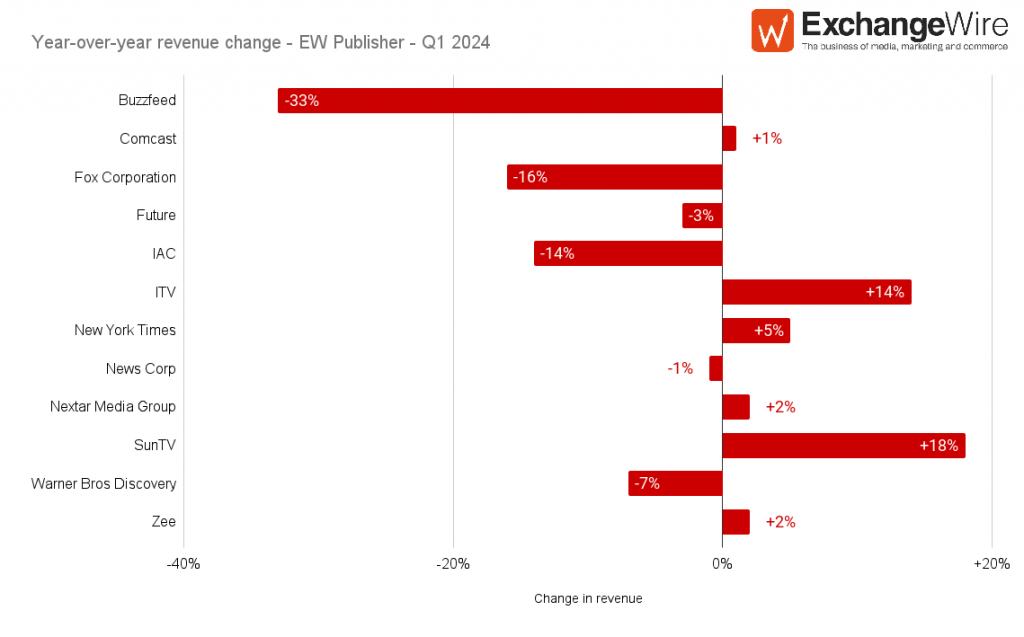

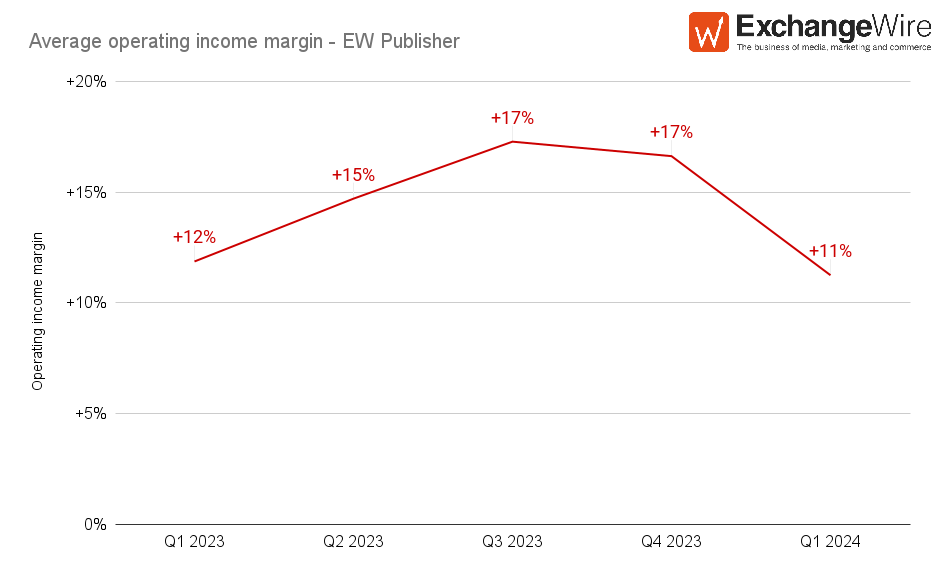

In terms of average revenue growth, technology (both independent and scaled) providers saw double-digit gains, while agencies also saw healthy growth. However this growth was not reflected on the sell side, with the EW publisher cohort seeing a slight contraction in revenue. With global advertising revenue forecast to surpass USD$1tn (£786bn) for the first time in 2025, looming cookie deprecation (we think?) and with referral traffic for news publishers set to be impacted by the rollout of generative AI solutions within search platforms, efforts to ensure publishers receive their fair share of advertising spend must continue to be forthcoming.

Ad Tech

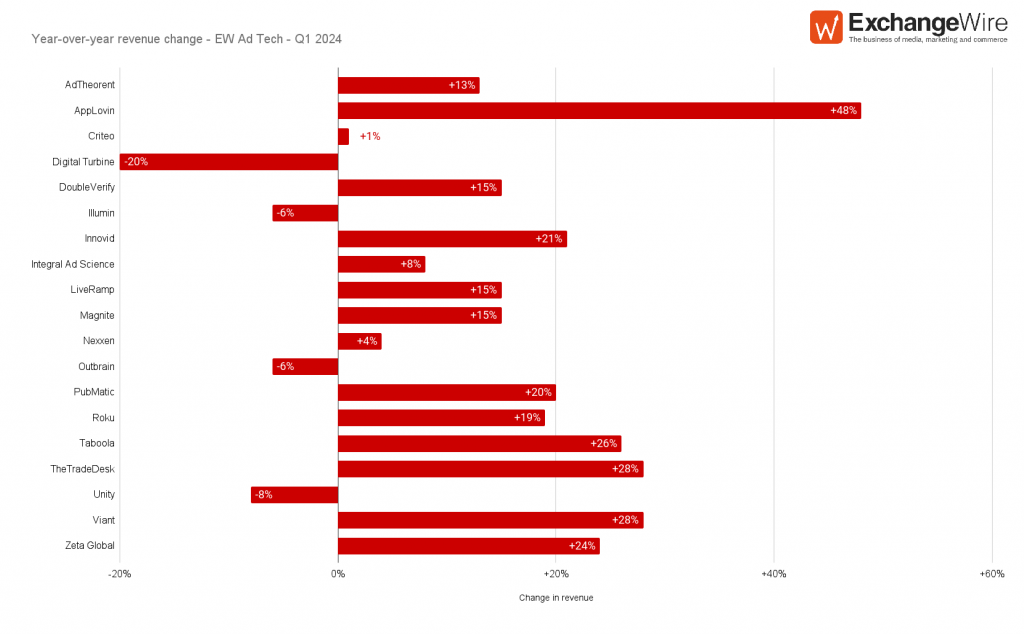

In positive news within the mobile segment, AppLovin is soaring, with revenue climbing by nearly 50% year-over-year. Executives at the platform have attributed this to continued gains from its AI-powered technology which seeks to capture user acquisition spend, a segment which took a significant hit when Apple rolled out Do Not Track as standard.

AdTheorent, flying high from strong revenue growth at the tail end of last year, was rewarded in April in the form of a USD$324 (£245m) acquisition offer from Cadent LLC. After flirtations from an unnamed third-party were withdrawn (somedays I truly feel like Lady Whistledown), the purchase is expected to close in Q3 2024, which will see AdTheorent bid farewell to the EW Ad Tech cohort to become a private subsidiary. Pour one out.

The final buoyant story to note in EW Ad Tech is that of Zeta Global, one of a remarkable seven companies to report 20%+ year-over-year revenue growth in the quarter. In associated remarks on the firm’s performance, CEO David Steinberg attributed recent gains to new agency clients and longer-lasting partnerships with enterprise clients (and generative AI, of course).

In less vibrant news, Digital Turbine continues to sail in turbulent waters. A fall in revenue in all segments which amounts to a total year-over-year dip of 20%, a USD$208m (£164m) impairment of goodwill (ie overspend on previous acquisition), and a heavy debt portfolio are grim tidings. Looking at Digital Turbine against fellow mobile monetisation platform AppLovin, which is now bringing in 10x the revenue, puts its troubles into an even harsher perspective.

Verification platforms DoubleVerify and Integral Ad Science also experienced a rough start to 2024. Both witnessed double digit declines in their share prices, following weakened guidance for the year compared to analyst expectations. Both DV and IAS have taken a reputational hit over recent scrutiny over made-for-advertising (MFA) websites, and particularly their perceived failure to halt, or even identify, alleged MFA spending by multiple blue chip brands as well as activity by Forbes which mimicked domain spoofing, a form of ad fraud. Several reports detailing advertiser dismay with the firms have recently been released - if this dismay continues to reflect in verification spend, 2024 could prove a difficult year for both.

Positively, year-over-year revenue growth was observed in 15 out of the 19 EW Ad Tech cohort, only Digital Turbine (-20%), Illumin (-6%), Outbrain (-6%), and Unity (-8%) recorded losses.

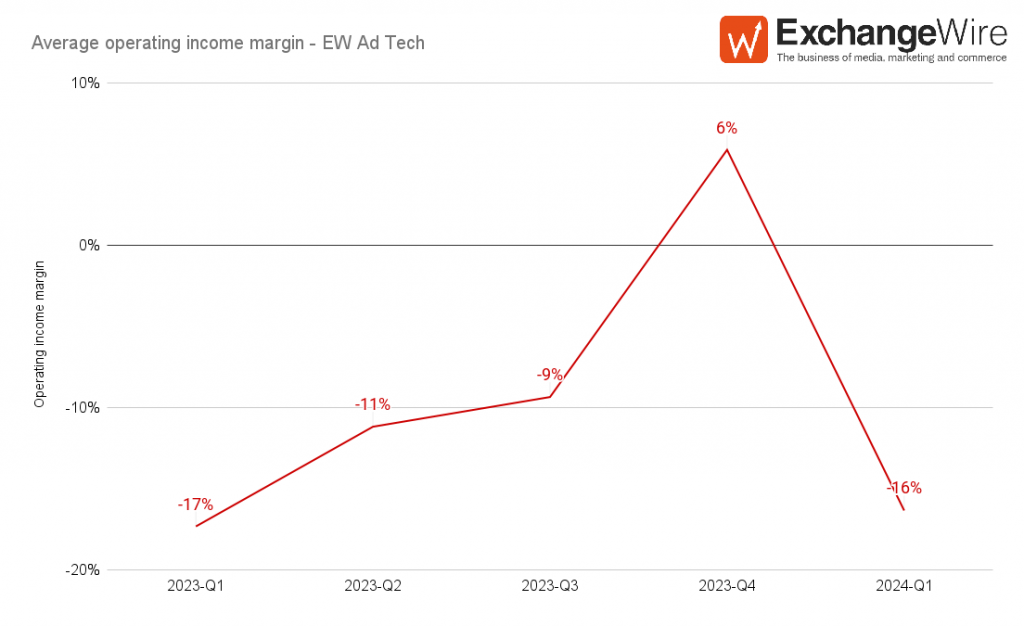

Average operating income margin across the EW Ad Tech cohort was unduly impacted by Digital Turbine margin (-185% through Q1 2024) - excluding the firm, average operating income margin across EW Ad Tech portfolio amounts to -7%.

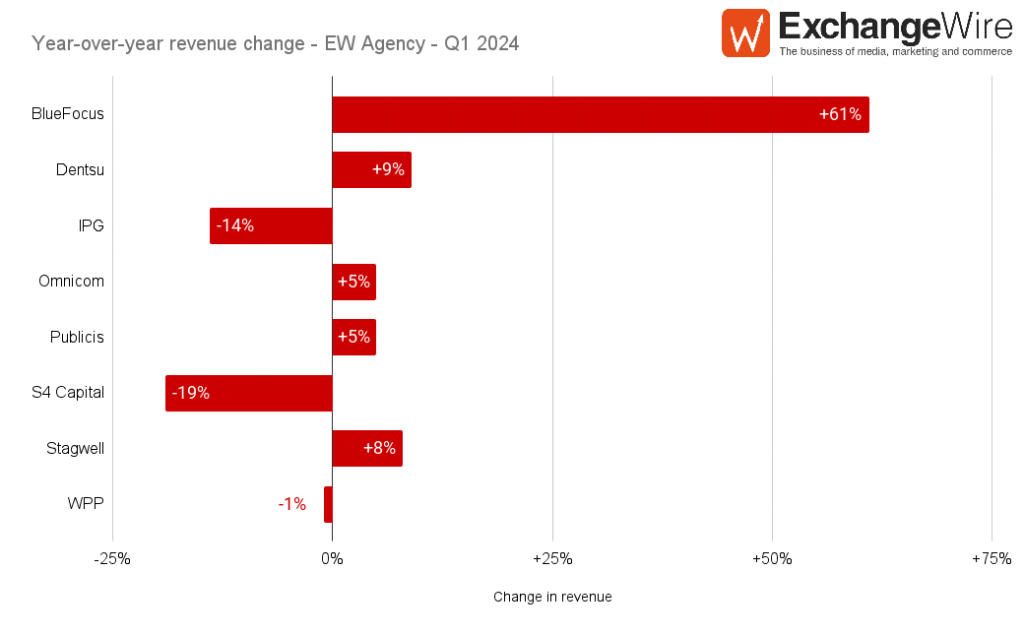

Agency

It has been a positive, if unspectacular, 2024 thus far from the agency contingent, with only two firms (BlueFocus Group and IPG) seeing their YTD share performance dip into the red. BlueFocus’ dip is notable given its sharp gains in revenue -the Beijing-based firm’s results announcement hit many of the right notes in terms of international expansion and use of generative AI, but also some eyebrow-raising bum notes such as a heavy focus on the somewhat troubled DTC sector.

On the flip side, Publicis has had a symphonic start to 2024 as the only holding group to register a double-digit rise in share price over the year thus far. All regions (US, Europe, Asia-Pacific, Middle East & Africa, and Latin America) saw organic revenue growth in their most recent filings, despite wider macroeconomic uncertainty.

Publisher

It’s comin’ home. UK publishers (Future, ITV, LBG Media, Reach) have all seen double-digit growth since the start of the year. Future’s growth has now surpassed 3x since the start of 2018, the most significant gain within the EW Publisher cohort, and the group is looking to capitalise on its programmatic gains by opening up its solutions to other publishers.

Buzzfeed shares have risen since the start of the year, thanks predominantly to former US presidential candidate Vivek Ramaswamy buying up nearly 8% of the company, and subsequently placing activist pressure on the current board. However, the firm is still down 93% since its IPO, and its revenue fell by one-third year-over-year during the most recent quarter. CEO Jonah Peretti claimed (remarkably loudly for someone with their head wedged so firmly in the sand) that Buzzfeed is currently “the biggest player in digital media”. A sustained recovery seems similarly detached from reality. Taking an imagined example of its famous quizzes, “What kind of financial recovery are you?”, one suspects Buzzfeed’s result would be “dead cat bounce”.

Big tech & social media

More of a mixed bag to report with big tech firms than wall-to-wall gains. Apple is generally perceived as being slower on the uptake of customer-facing AI solutions, something which it is attempting to rectify through a wide-ranging partnership with OpenAI. Per Eric Seufert, the firm is also rebranding its mobile (SKAdNetwork) and web (Private Click Measurement) ad attribution products under the “AdAttributionKit” marque. At first glance, the rebrand is somewhat surface-level, but offers both a carrot (re-engagement information for clickthrough attribution) and a stick (harsher terms around the use of IP addresses to identify users) to drive advertisers to use the rebranded kit.

Investor confidence continues to flood back towards Meta, though ongoing legal queries in Europe as to how the firm manages user consent could turn the tide once more. Moreover, the firm appears remarkably resilient against the ongoing onslaught of MFA scrutiny, despite suggestions that it is the primary source of traffic towards these dubious domains. Scale conquers all?

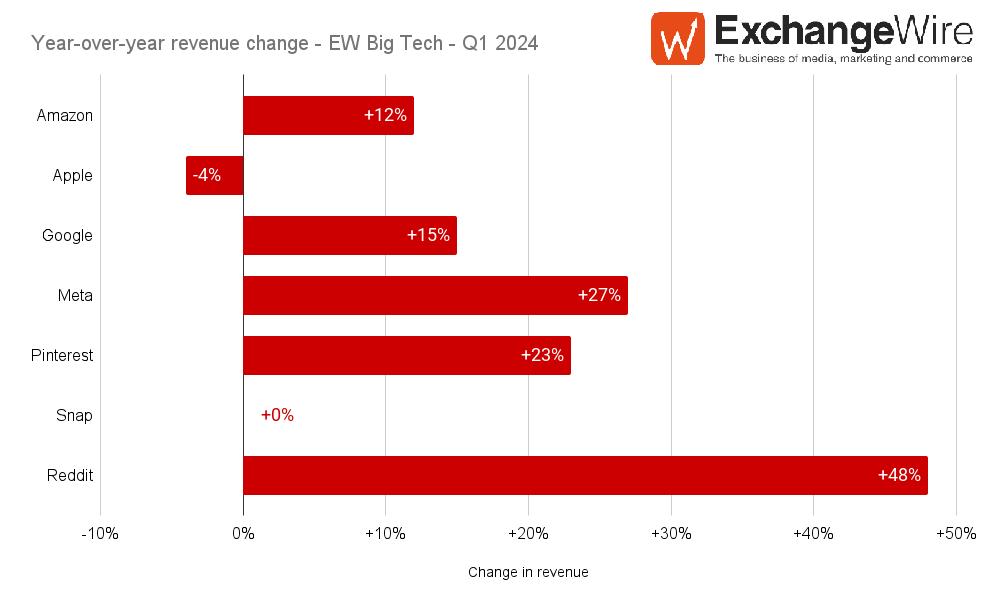

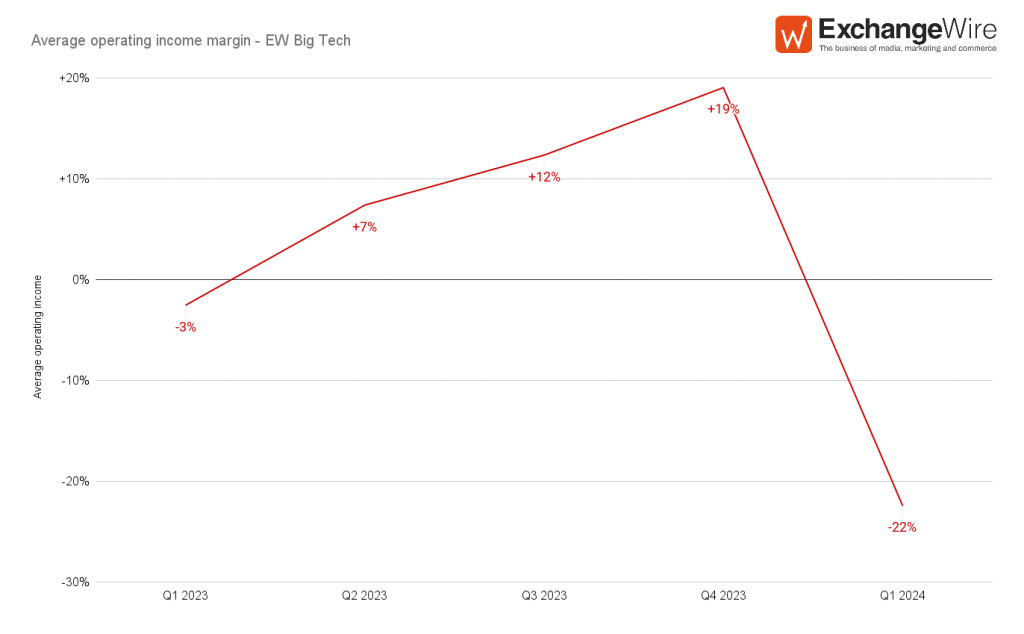

As noted, the average -22% operating income margin for EW Big Tech in Q1 was impacted heavily by Reddit’s -237%, which in turn was as a result of issuance of restricted stock units associated with its IPO. Excluding Reddit, average operating income across EW Big Tech through Q1 was +13%, the highest among all portfolios. Good for them…

None of the above should be considered investment, financial, or other forms of advice, and is for informational and entertainment purposes only. The writer accepts no liability for incorrect details provided, on account of the fact he is a complete pillock.

Ad TechAgencyBig TechEarningsPublisherSocial Media

Follow ExchangeWire