EMEA Round-Up: Microsoft Hooks Up With Adform; AudienceScience Awarded European ePrivacyseal; Google's Display Business Trends: Publisher Edition

by Romany Reagan on 5th Jun 2012 in News

Microsoft Advertising Selects Adform for Rich Media Solutions

Display marketing specialists Adform announced last week its global appointment by Microsoft Advertising to offer brand marketers and media agencies a full service of rich media solutions to optimise their display marketing campaigns. Adform’s technologies will deliver more targeted and creative campaigns for brands working with Microsoft Advertising, with the aim of providing more engaging advertising for consumers over the display channel.

Microsoft Advertising’s deployment of Adform technologies will offer digital marketers a number of new rich media formats for display campaigns, including innovative interactive banner formats, video advertising platforms and mobile solutions. All adverts additionally conform to the IAB’s rich media branding unit standards.

The video technologies offered by Adform include a video converter tool to serve adverts across different platforms, as well as a bandwidth detection module so that content renders appropriately for each viewer. In addition, Adform’s mobile solution offers first-party cookie support and HTML5 solutions to ensure all display campaigns are delivered across any device.

The deal will additionally enable a richer reporting platform for Microsoft Advertising’s customers, which aims to help them understand which combination of formats and channels produce the best brand engagement rate. Adform’s real time bidding offering will additionally enable users to produce more personalised adverts, using real time data to complement consumer interest and effectively retarget with relevant products and services.

David Fulton, Chief Commercial Officer, Adform comments: “With rich media advertising and new channels propelling investment in the digital space, brands are increasingly looking for exciting, cross-platform digital marketing solutions that readily engage the consumer. Our global partnership with Microsoft Advertising is testament to our creative and rich media credentials and will serve to support their customers growing needs in this space.”

Peter Bell, CTO, Microsoft Advertising adds: “With the welcome addition of Adform to our portfolio of technology partners, we are delighted to see the innovation they are driving in the digital marketing space. Their approach to the creation and production of rich media makes it even easier for brand marketers and media agencies to ensure campaigns run to specification and schedule to deliver outstanding results”.

AudienceScience Awarded European ePrivacyseal

AudienceScience®, a global digital marketing technology company has been awarded the European ePrivacyseal for The AudienceScience Gateway, their industry leading technology platform. The independently issued privacy seal, verifies that AudienceScience’s data management and media transaction platform conforms to strict data protection standards established by ePrivacyconsult as part of the organisation’s comprehensive privacy practices. This acts as a symbol of trust for consumers, assuring them that AudienceScience considers users’ privacy of paramount importance by adhering to the strict data protection requirements in Europe.

ePrivacyseal is an initiative of ePrivacyconsult, an independent centre for privacy protection. The certification and awarded seal of ePrivacyseal shows that the AudienceScience platform has completed a rigorous certification process for the collection and use of data.

Stuart Colman, Managing Director, Europe and VP International, AudienceScience, comments: “As a global leader in audience targeting, our commitment to protecting consumer privacy as well as ensuring our partners adhere to the same high standards is of utmost importance. By attaining the ePrivacyseal we are demonstrating our continued global commitment to online privacy and consumer trust.”

Google's Display Business Trends: Publisher Edition

Click here for full report & infographics.

What’s trending in display for publishers?

This premiere issue focuses on trends in the publisher display business. It is not meant to be a comprehensive industry report or forecast; rather its purpose is to share trends that publishers worldwide may find useful in planning digital strategies, gleaning new insights, and supporting their hunches.

The metrics in this publication are derived from Google publisher products—DoubleClick for publishers (DFP), the DoubleClick ad exchange, and Google adsense network—to allow us to provide commentary on various display patterns, including geographic, vertical, and ad size trends over time.

Based on rigorous methodology, the data sets contain tens of billions of impressions served by publishers globally, and are aggregated to preserve publisher confidentiality.

1. Channel Mix

An ongoing challenge for publishers is to strike the right balance between direct sales (reserved) to advertisers and indirect sales (unreserved) through third-party channels such as networks and exchanges. how inventory is allocated between these two channels impacts overall ad revenue, since reserved inventory is generally sold at a higher price. in DFP, publishers assign different levels of inventory according to each channel. These levels are aggregated here to illustrate what we’re calling the channel mix: the ratio of impressions between reserved and unreserved inventory.

How do sell-through rates vary during the year?

Sell-through rates (the percentage of reserved ad inventory sold by the publisher’s sales team) vary according to the time of year, with higher sell-through rates trending towards the end of the year. Although seasonal impact on sell-through rates is a generally observed phenomenon, we wanted to understand its magnitude and variation by region. Overall, publishers worldwide sold more unreserved than reserved impressions in 2011, and all regions exhibited similar compositions in channel mix. it’s also worth noting that overall total impressions have grown between 2010 and 2011.

The rise in reserved impressions tends to be cyclical, with seasonal advertiser demand causing an increase in sell-through rate in the fourth quarter. Globally, the percentage of unreserved sales remained consistently higher than reserved throughout 2011, but the ratio between them steadily narrowed from a 28 percentage point spread in the first quarter to a 16 percentage point difference in the fourth. We observe that towards the end of the year, EMEA publishers experience a more pronounced shift in channel mix compared with APAC publishers displaying a slight divergence in channel mix in the fourth quarter.

2. Publisher Vertical & Geographic Comparisons

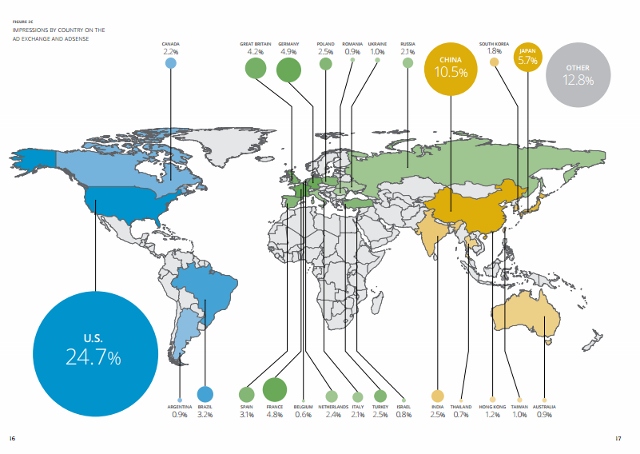

Using the aggregated impressions running through DoubleClick ad exchange and Google adsense, this section compares how unreserved publisher inventory is spread across vertical subject content and geographic areas worldwide.

Which vertigals show growth in ad impressions?

In 2011, 15 out of the 25 publisher verticals experienced double-digit growth in monetised impressions across adsense and the ad exchange. Arts & entertainment ranked number one in impressions, while posting a healthy 11% year-on-year increase. We also observed that both shopping and sports sites showed very strong growth, at 37% and 25% respectively. Online Communities and Business & industrial sites experienced shifts in inventory mix, and contracted during the year.

How do vertigals rank by CPM?

For this report, CPM is defined as the amount a publisher earns for delivering a thousand impressions through a single ad unit. This is different from the page-level or site-level CPM. For various reasons, including advertiser demand, some verticals command higher CPMs than others. Here, verticals are indexed from highest to lowest CPM. Indexes are compiled from the DoubleClick ad exchange because its composition of ad formats more accurately reflects the mix generally bought by advertisers.

Real-time Bidding Impact

For years, publishers have monetised their unreserved impressions via third-party ad networks. Increasingly, they are using ad exchanges and other yield management tools to maximise their revenue from these partners in ways that complement their direct sales strategies. In 2011, publisher earnings continued to grow via these channels, and we observed the highest growth occurring in exchange-based platforms.

Spend on the ad exchange via real-time bidding grew from 58% at the end of 2010 to 72% by the end of 2011. In 2012, we anticipate this growth to continue as buyers increase their spend through this programmatic channel. Although much has been debated about whether aggregated spending on ad exchanges with RTB might cause a race to the bottom in publisher revenue, we’ve observed this not to be the case. In previous studies, we’ve seen U.S. publishers gain an average of

188% lift in revenue when the Ad Exchange wins the auction, compared with fixed upfront sales of non-guaranteed display advertising. In a separate study, we’ve observed EMEA publishers gain 73% in revenue where the ad exchange won against a complete channel mix of direct sales teams and other networks.

Which countries generate the most impressions?

One of the most fascinating aspects of online advertising is seeing content originate from all over the world. North America and Western Europe have traditionally produced the largest online publishing businesses, and remain the powerhouses of online content. However in 2011, Asia-Pacific publishers, especially from East Asia, are delivering an even larger share of global impressions. With rising internet accessibility and usage growing worldwide, some of the fastest growth rates are being experienced by publishers outside these traditional hotspots of digital advertising, presenting attractive regional diversification opportunities for publishers.

This global map calls out the 2011 impression contributions of the top 25 publisher countries on DoubleClick ad exchange and Google adsense.

We’ve been incredibly impressed by the size and growth from publishers based in China and Japan, who comprise 11% and 6% of total impressions, respectively. We also observe that publishers located in EMEA are experiencing significant impression growth.

Publishers included in this report come from 235 countries and territories—from established, highly populated nations like Japan, right through to the island country of Palau, one of the world’s newest sovereign states. Below, we’ve highlighted some emerging markets that are posting extraordinary ad impression growth in 2011, and are ones to watch.

More and more ad networks—of which Google adsense is one—allow anyone with an internet connection and original content to earn revenue as an online publisher, facilitating creation of local content and new business models. some are very small countries in terms of population, but post ad impression growth rates that are (almost!) out of this world.

- Egypt 45% growth

- Indonesia 85% growth

- Venezuela 79% growth

- Kenya 157% growthlaos 382%

- Equatorial Guinea 4635% growth

- Montserrat 990% growth

- Palau 1106% growth

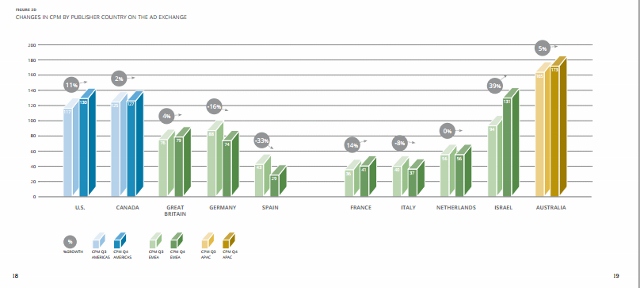

Has CPM changed in top publisher countries?

A snapshot of CPM changes during Q3 and Q4 of 2011 for the top 10 largest countries by impressions on the ad exchange shows that CPMs varied widely.

We observe that in many countries—including the U.S., Great Britain, and France—CPM grew over Q3-Q4. In some EMEA markets, notably Spain and Italy, CPMs fell significantly in the fourth quarter, but this seems to correspond with the overall slowdown in advertising spend in late 2011. Germany also experienced a change in inventory that produced an atypical decline that was restricted to this quarter. In conjunction, we observed that reserved inventory sales nearly matched unreserved sales in EMEA over Q3 and Q4, indicating a higher sell-through rate of premium-priced inventory.

3. Ad Sizes

Which ad sizes are growing in popularity?

Publishers can maximise their revenue by choosing to offer ad sizes that are in higher demand by advertisers. They aim to strike a balance between customised ad packages with exclusive sizes that can be tailored to the needs of an individual advertiser, and standardized sizes that will accommodate creatives from the majority of advertisers and networks.

Publishers make decisions on ad sizes based on the audience they wish to target, the content environment, and the ad size that advertisers prefer to use to reach that audience. To determine the most popular ad sizes and identify any growth trends, we took a look at ad sizes trafficked through the DFP ad serving platform. The top three ad formats—the medium rectangle, leaderboard and skyscraper—comprise nearly 80% of all served ad impressions. However, the remainder of impressions span a wide variety of uncommon sizes. There were over one thousand different ad sizes trafficked—yet only 300 unique sizes posted more than 1 million impressions during 2011.

The growth in non-standard ad sizes is notable, and it has mostly been at the expense of traditional ad sizes like the 468 x 60 banner and 120 x 600 skyscraper. Of interest is the growth of larger “premium” formats, which offer advertisers a richer visual canvas for their creatives.

How do ad sizes compare by CPM?

The CPM index of the 10 most popular ad sizes on the ad exchange shows that the 300 x 250 medium rectangle posted a 12% increase over the leaderboard and an 18% increase over the skyscraper formats in 2011. The top three ad sizes in the ad exchange comprise approximately 95% of all impressions served, and they are identical to the top three ad sizes seen on DFp.

Ad size comparisons on the ad exchange

Ad networks show fewer ad size variations since most sellers and buyers have standardised their offered inventory to reflect the most popular ad sizes. One explanation for the relatively high CPM of the 336 x 280 large rectangle may be the result of lower publisher supply for this format. However, advertiser demand is also correspondingly lower.

4. Mobile Web Ad Impressions

With consumer mobile usage growing rapidly, publishers are rethinking their content monetisation strategy. Advertisers look to reach audiences across screens and formats, and publishers are responding to this demand with ever-more sophisticated channels for monetizing mobile content. mobile has become essential to the overall ad inventory mix, but some publisher verticals on the mobile web are growing faster than others.

Is mobile growing across the board?

There has never been a better time for publishers to engage mobile users, whether through a mobile-optimized site or a full-featured app. Growth in mobile usage has exploded with impressions on the ad exchange and adsense platforms increasing by 250% over Q3 and Q4 2011. This growth is not just happening in highly mobilised cities like Seoul and San Francisco, but also in emerging markets where users are first interacting with the internet not on a desktop but on a mobile phone. Both mobile and desktop ad impressions exhibit strong growth, but due to increased mobile web usage, mobile ads are growing at a faster rate and have increased as a proportion of overall ad impressions.

We took a look at mobile web impressions over the last quarter of 2011 to get a sense of average vertical impression growth. Globally, all publisher verticals, with the exception of Travel, experienced double-digit growth in mobile web ad impressions in the fourth quarter of 2011. as might be expected from seasonal consumer mobile usage, the strongest vertical market in mobile usage was shopping, with 69% growth, followed by Food & Drink at 61%.

5. Video Ads

Videos tell stories—from publishers as well as advertisers. Video is becoming a lucrative part of a publisher’s ad inventory, partly because it offers creative opportunities that attract brand advertisers, and partly due to tremendous viewer demand.

How do video ads impact viewers?

Video content monetisation is now one of the fastest-growing segments in advertising. Publisher video impressions grew nearly 70% in the second half of 2011 across the DFP video platform. As measured across in-stream video impressions in DFP, the average midpoint and completion rates of a video ad come in at 79% and 72%, respectively. About 51% of video ads run between 15 and 30 seconds in length, with 36% running more than 30 seconds, and only 13% running less than 15 seconds. We’re also seeing a 175% increase in impressions on the 640 x 360 ad unit that fits widescreen players. Conversely, we’ve observed a decrease in standard aspect-ratio video player impressions, indicating that they’re phasing out.

DataProgrammaticPublisherVideo

Follow ExchangeWire