EMEA Round-Up: PubMatic collaborates with comScore to offer valuable “Viewability” metrics to premium Publishers; Cannes Lions Adds New Categories for 2012

by Romany Reagan on 26th Jun 2012 in News

PubMatic collaborates with comScore to offer valuable “Viewability” metrics to premium publishers

PubMatic, a digital media platform for publishers, announced last week that it will integrate comScore’s Validated Campaign Essentials (vCE) tool into PubLink, PubMatic’s enterprise app marketplace.

PubLink is a set of APIs that enables integration of industry-leading software solutions into PubMatic’s strategic-selling platform. comScore’s vCE tool enables both buyers and sellers of media to use “viewability” as a campaign metric. Ad viewability – whether an ad has been seen by a person, rather than simply loaded into a computer browser – is increasingly becoming more important to advertisers and the comScore vCE tool provides viewability data.

Kirk McDonald, President of PubMatic, comments: “The vCE tool is another way that publishers are differentiating their quality approach to ad placement. PubMatic supports industry transparency and we’re pleased to have comScore as a PubLink partner. Measuring campaigns on the percent of impressions that came into view is an important step toward increasing the comfort level for brand marketers with interactive media.”

The comScore vCE tool is consistent with the standards set by the Making Measurement Make Sense initiative, which focuses on aligning interactive measurement with television and other media measurement techniques that give consumers an “opportunity to see” the ad. The initiative is supported by the Interactive Advertising Bureau (IAB), the American Association of Advertising Agencies (AAAA) and the Association of National Advertisers (ANA). Publishers and buyers will be able to access vCE reporting through PubLink to integrate within their campaigns.

Kirby Winfield, comScore Senior Vice President of Corporate Development, concludes: “The integration of vCE into PubMatic’s platform makes it easier for publishers to sell with the viewability metric and for buyers to embrace it. This integration promises to expand and reinforce the impact of tools designed to help publishers determine which ads in their campaigns can achieve the desired results. It not only accounts for which ads are viewable, but also which ones are delivered to the right audience and geography. Publishers can feel comfortable working with a holistic solution for campaign validation in brand-safe environment that is absent of fraud.”

Cannes Lions International Festival of Creativity Adds New Category for 2012: Mobile

In the second of the four awards ceremonies in last week’s Cannes Lions International Festival of Creativity saw the addition of “Mobile” as a new category for 2012.

Mobile received 965 entries from 47 countries. Leading the jury for the inaugural category was Tom Eslinger, Digital Creative Director, Saatchi & Saatchi. 99 entries were shortlisted, with 11 going on to win Gold, 14 Silver and 28 Bronze. Grow Interactive Norfolk / Johannes Leonardo New York took home the first Mobile Grand Prix for their Google entry 'Hilltop Re-imagined for Coca-Cola'.

The winning work from these categories is now available to view online together with their credits here.

Criteo Responds to comScore CTR Whitepaper with a Whitepaper of Their Own

Criteo Research Paper: Measuring the Value of Users Who Click on Online Display Ads

A much-cited comScore research paper from 2008 entitled How Online Advertising Works: Whither the Click? found that a small subset of people – less than 10% of all internet browsers – were responsible for more than 80% of all clicks. It produced evidence to suggest that the demographics of clickers are skewed towards younger users aged 25 to 44 earning less than $40,000 per year. comScore concluded that clickers were “…hardly an attractive target segment for most advertisers”. Taken at face value, these findings cast significant doubt on the value of clicks and clickers. This study has been so often repeated that it has become axiomatic within the world of online advertising.

But it is often forgotten that the original intent of that study was to discover whether clicks in a brand context were meaningful, and that the study is based on untargeted, non-personalised banner ads. At some point, it became accepted that clicks in any online context are not valuable.

Normally, marketers go to great lengths to get responses from customers, using the marketing channels in which they invest. So before writing off the click, it is worth taking a second look. What we found was surprising and does much to counteract some of the myths that surround click-based advertising.

Dataset

Criteo collects purchase data from the sites with which it partners in order to provide personalised display advertising. For each purchase that occurs on one of our partners’ sites, we record the items bought and their prices, and link this to an anonymous unique identifier stored in a cookie. This provides Criteo with what may be the internet’s biggest structured database of e-commerce transactions. In 2011, Criteo recorded nearly $100bn of online transactions, an amount that is larger than the e-Commerce revenues of either Amazon or eBay.

For this study, we looked at internet browsers exposed to a Criteo retargeting ad during the first seven days of March 2012. This population numbered 147 million unique browsers.

We then split this population into two – those who had clicked on a Criteo banner in the previous six months, and those who had not. For each group, we looked at the sales that these browsers had completed online during the entire first quarter of 2012 – January 1st to March 31st, 2012. We should note that any browser who clicked on other ads but not on a Criteo ad is therefore viewed as a “non clicker” in this study.

The total sales considered in the study amounted to $11.5 billion dollars

This Criteo research paper aims to show that the bias against clicks is misguided. Over $10bn of e-commerce sales were reviewed and Criteo learnt that the audience who clicks on timely, relevant ads is extremely valuable.

Exploding Myths About Clickers

MYTH 1: “People who click don’t buy”

“The demographics of clickers are skewed towards younger browsers aged 25 to 44 earning less than $40,000 per year. This is hardly an attractive target segment for most advertisers”.

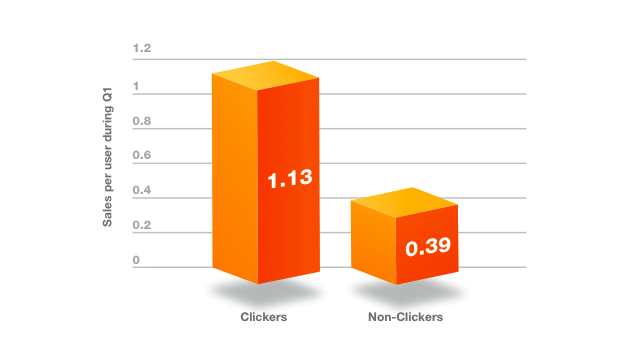

Demographics are taken by comScore as a proxy for user value. We have the luxury of being able to measure user value directly, in terms of the online purchases of clickers and non-clickers. We see that the clicking audience is much more valuable than the audience who does not engage with our ads.

REALITY 1: Clickers Buy 3x More Frequently than Non-Clickers

MYTH 2: “Nobody clicks on ads anymore”

MYTH 2: “Nobody clicks on ads anymore”

“Recent research conducted by comScore on behalf of Starcom and Tacoda showed that average click rates on display ads in 2008 were less than 0.1%....The comScore research also revealed that two-thirds of Internet browsers do not click on any display ads over the course of a month”

Our research shows very different results. Almost half of regular buyers on our clients’ e-Commerce sites are clickers on Criteo ads. In contrast, those who don’t buy are much less likely to click on an ad. Thus the behavior we see is what you would expect: the more interested you are in buying, the more interested you are in the ad.

This study is able to track only whether users clicked on Criteo ads: if we were able to track clicks on all (Criteo and non-Criteo) advertising, the proportion of regular buyers who click would be likely to be higher.

Our conclusion is that the most valuable browsers of an e-commerce site – their buyers – are engaging heavily with online display ads. We have wondered why comScore sees such different results. Our hypothesis is that the comScore results are based on traditional display ads, which are not personalised and targeted to an individual browser’s interests, and may not always be optimised to ensure that the ad is seen.

REALITY 2: Almost half of regular buyers click on Criteo ads alone.

MYTH 3: “A small number of people are responsible for a disproportionate number of clicks”

“The comScore research also revealed ….that only 16% of Internet browsers account for 80% of all clicks”

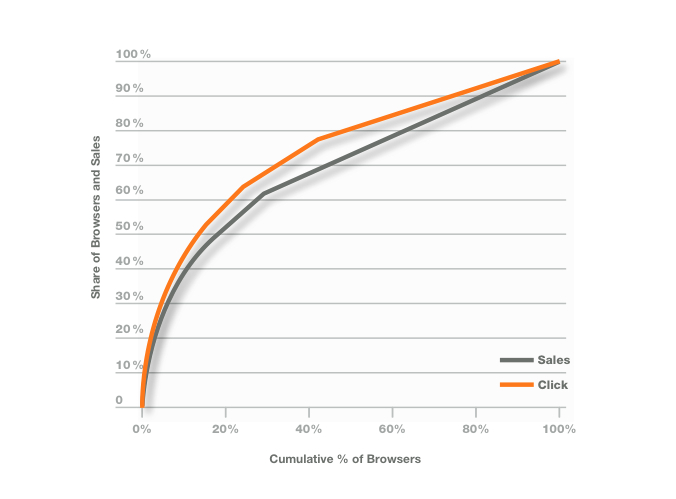

This statement is in fact partially true, but should not be taken as surprising, or even problematic. We see that 80% of clicks are contributed by 50% of clickers, so much less skewed than the comScore research, but still with most clicks coming from only half the browsers. This is actually a classic exponential distribution, which we see in many other cases.

One compelling example is the share of online sales that come from a small number of browsers. This shows a very similar distribution to that of clicks.

REALITY 3: 20% of browsers are responsible for 50% of clicks and sales.

MYTH 4: “People who click a lot don’t buy a lot”

MYTH 4: “People who click a lot don’t buy a lot”

A final variation on these myths is the idea that there is a small group of browsers who have nothing better to do than to click on online ads, but who are not serious shoppers. This too is inaccurate: those who click heavily are the same people who are buying heavily.

REALITY 4: The more browsers click, the more they buy.

Conclusion

Together, this data makes a compelling case that the “click” can be a genuine expression of purchase intent, and is not, as was suggested, mainly accidental or spurious. This is not to deny that some clicks on online display are of low value. If you show someone a badly-targeted, poorly-timed, or irrelevant ad, then the clicks gathered will not contain any meaningful intent. If your CTR is 0.06% – fewer than 1 in 1,000 impressions are leading to a click – then it should be no surprise that the clicks the ad is driving are inherently worth very little.

Nothing here should be taken to cast doubt on comScore’s original paper, which was based on the performance of low-CTR, branding-oriented advertising. However, the clear message is that their lessons cannot be applied to properly-executed performance display advertising. If your relevant and timely ad campaign shows a CTR of 0.8%, which means that almost 1 in 100 Ad impressions is sufficiently engaging to interrupt what the user was doing on that page, it is a strong sign of genuine interest from real browsers who want to buy your products.

Almost half of regular buyers on e-commerce sites click on Criteo’s online display ads. These clickers buy much more, on average, than non-clickers. Those who click more, buy more.

Follow ExchangeWire