PTD 2.0: The Next Evolution Of The Publisher Trading Desk

by Ciaran O'Kane on 27th Jun 2012 in News

ExchangeWire has long been a strong advocate of the publisher trading desk solution (original piece on this new business model was published on this site well over 12 months ago), and it seems this strategy is now being executed by some (not enough) European publishers beyond the market's uber sell-side traders, namely A&NY Media and DeTelegraaf. If anything two incidents over the last 10 days has focused attention on how publishers engage with the automated channels:

1) Facebook "launched" its exchange. Details on the execution of this are still confused (we can thank all the "tech" press for educating us). But one thing is sure, billions of low cost impressions are about to flood the market.

2) Some brands clearly see exchanges as a vehicle to hammer pubs on pricing. At a recent IAB US event, Kellogg's took to the stage to discuss its adoption of programmatic buying. The most pertinent points were the statement about how Kellogg's doesn’t care about clicks, and the data shared with the attendees focused on how the average CPM of their investments over the past year have decreased by circa 50% to $0.48c. And this from a top tier brand.

It would be ill-informed to jump to any conclusions, from a premium publisher perspective, but you can expect the above to be interpreted as follows:

- The brand budget you seek through automated channels is not far down the line.

- The measurement criterion is not about clicks. However, even when brand campaign objectives are (presumably) about audience reach and viewability, there is still a downward pressure on CPMs and yield.

- Add to this another huge injection of cheap supply and you have a situation where your ‘premium’ just became even harder to monetise in real time”

There is an underlying issue simmering below the surface right now: premium publishers are growing wary and increasingly frustrated by the (in)ability of technology to correctly value premium content. It is why we will start seeing the next phase of the publisher trading desk as a counterbalance in the market.

How Publishers Should Be Looking To Reclaim Ground

Publishers are currently in a vulnerable position. They need to find ways of connecting to agency trading desks. They need to follow the money. The PTD v1.0 does not match up to agency’s more sophisticated trading desk model.

What it makes up in access to audience data (large PTDs win out here) it will inevitably lose out in access to premium inventory. Agencies have been smart enough to leverage trading agreements to surface premium content through SSPs.

But if the PTD as a model gains traction and a large number of strong publishers launch their own desks, what is stopping them taking their premium off the table and start working with each other on a private basis?

Premium publishers have experimented trading remnant and non-remnant into private marketplaces, allowing access to ATDs and certain Ad nets. But if publishers are not convinced that the current wave of buy-side vendors can efficiently monetise their most premium inventory, then it is not inconceivable for them to start partnering to help power each other’s PTD.

Dark Pools Of Premium Inventory: The Off-Exchange Inventory Source For The PTD

Last year AOL, Microsoft and Yahoo tried to execute an off-exchange inventory strategy that was only open to their ad networks. The idea was interesting, but ultimately failed because of similarities between the three portals, and conflicting business units. Added to they couldn't decide which technology thy should use to run its internal marketplace.

The plan looks to have been shelved for the moment. While this was probably a JV too far for all parties involved, the idea was a sound one in the context of maintaining price stability and remaining competitive in a heavily commoditised market.

The creation of this “off-exchange” pool of supply could be developed here in Europe. By putting in place an off-exchange inventory marketplace, the participating PTDs could effectively stem the flow of inventory to the majority of agency trading desks. Now let's be frank here, this isn't going to happen. A move like this would be financial suicide for many publishers.

But a lot of top tier European publishers are frustrated and increasingly concerned with the floor prices and T&Cs the ATDs are pushing into the market. And if you were listening to pan-European publisher concerns at recent ExchangeWire events in Sydney, Hamburg, Stockholm and Berlin you'd know that is a fact of the current eco-system.

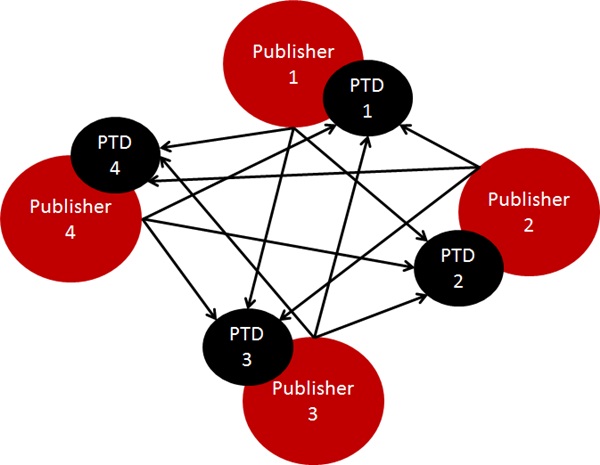

How would an off-exchange solution actually work? The idea is simple enough. All participating publishers must be running their own internal buying desks. You sell and buy premium to other publishers, running their own PTD. You could keep some agency trading desks in the buying mix to help stimulate even more demand/bid prices. But then the idea here is to have unique supply and create scarcity in the market.

Why would an agency buy from a PTD? And how does an off-exchange supply strategy help a publisher get access to more spend?

The reality of the market is the agencies still operate media plans, and on that plan you invariably have the agency trading desk - Vivaki, Analect, Xaxis etc. No mandates are in place - yet. But more spend is finding its way to the ATDs as they lock down supply in the market.

Buyers still require the FT's and the Guardian's of the world for context and audience. But how long for? As more inventory floods the market, it is likely that these publisher with available impressions in the automated channel are likely to be forced down on pricing - especially if the ATDs are only buying vanilla impressions, unbundled from publisher audience data.

Let's say a number of the top 100 European publishers (country specific, in the first instance) were to take impressions off the market to trade among themselves, what affect would that have on the nascent PTD model? If this was to happen, then the PTD model would be just as strong as the ATD, if not stronger. This is mainly down to the fact that while everyone has similar access to the same premium inventory, the publishers will have maintained full ownership over their audience and data.

This is just a glimpse of what could play out over the next 6 – 12 months. ExchangeWire cannot offer any more detail than this - as it is difficult to predict given expected moves on the sell-side very. Tehe PTD solution outlayed in post last year, and still some publishers have continued to wander down blind alleys with promises of premium monetisation.

The ideas presented here are designed to help publishers think about the collective strength of the industry. It would take co-operation and collaboration. Choose to continue down the same path and ultimately you will get the inevitable outcome: low fill rates and reducing yields. And for years to come, industry panels will be filled with irate publishers bemoaning the state of the industry, and questioning the commercial viability of the ad funded model. This strategy is really in the best interests of the industry, as publishers need to make decent revenue to keep quality content free. The evolution of the PTD is inevitable.

Want To Learn More About The Future Ad Models For Both The European Buy-Side And Sell-Side, Then Get Your Early Bird Ticket To ATS London Today!

Ad NetworkAd ServerDisplayProgrammaticPublisherTradingTrading Desk

Follow ExchangeWire