ZenithOptimedia Global Advertising Report: 4.6% Growth in 2013, Led by Developing Markets & Digital Media

by Romany Reagan on 2nd Oct 2012 in News

ZenithOptimedia predicts global ad expenditure will grow 4.6% in 2013, reaching US$525bn by the end of the year. As has been the case since the economic downturn began in 2007, this growth will be led by developing markets, which they forecast to grow by 8% on average in 2013; expecting Central and Eastern Europe to bounce back after a tough 2012 with 7.4% growth in 2013, while Asia Pacific (excluding Japan) grows by 8.2%, and Latin America grows by 10.1%.

North America has had a particularly strong 2012, thanks to record Olympic audiences and heavier than expected political advertising in the US. Despite the tough comparison, ZO still expects solid 3.6% growth from North America in 2013.

Digital media – particularly internet advertising – are supplying most of the growth in spend by medium. ZO forecasts internet advertising to grow by 15.1% in 2013, with traditional media growing by 2.3%.

Steve King, Global Chief Executive Officer for ZenithOptimedia Group, comments: “Advertisers are broadly continuing to invest, despite the global economic concerns and issues. However, they are seeking to ensure that any expenditures are delivering strong return on investment. The US continues to deliver solid growth. This, combined with the growth in developing markets and in digital media, has helped mitigate the drop in eurozone spending.”

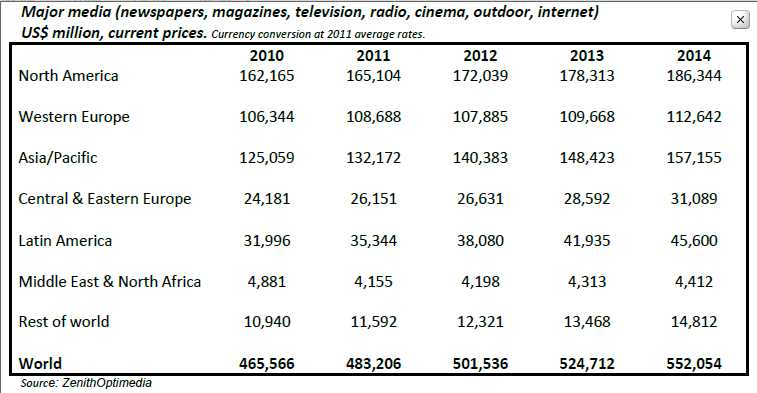

Advertising expenditure by region

Uncertainty over the future of the eurozone has weighed on the global economy since ZO published their last forecast in June. The eurozone as a whole has slipped from stagnation to probable recession; other markets in Europe have weakened; and many developing markets have slowed as their exports to the developed world have fallen off, although their growth generally remains much firmer than in developed markets. Nevertheless, ZO still forecasts recovery in ad expenditure growth over the next two years, expecting sustained and strong growth in Asia Pacific and Latin America, rapid recovery in Central and Eastern Europe, slower but substantial growth in North America, and slow improvement in Western Europe. Overall they forecast ad expenditure to decline 3.1% in the eurozone in 2012.

The European Central Bank’s plan to buy bonds as necessary to reduce the borrowing for member countries has bought some time, but the EU needs to put a long-term solution in place before the crisis can be declared over. ZenithOptimedia’s forecasts assume that the eurozone avoids economic disaster (such as a break-up of the euro) this year, followed by slow but steady economic improvement. On this basis ZO predicts eurozone ad spend will grow 0.9% in 2013 and 2.3% in 2014.

The eurozone is weighing down predictions for Europe as a whole. Since June, ZO has reduced their 2012 forecast:

- Western Europe: 0.4% growth down to -0.7%

- Central and Eastern Europe: 6.2% growth to 1.8%%

Western Europe’s recovery is expected to be a slow one, with 1.7% growth in 2013 and 2.7% in 2014. Central and Eastern Europe, however, should bounce back rapidly with 7.4% growth in 2013, led by Russia, where they forecast ad expenditure to accelerate from 13.0% in 2012 to 14.5% in 2013. Russia is by some distance the largest ad market in Central and Eastern Europe, accounting for 36% of the region’s ad expenditure in 2012, a proportion we expect to rise to 41% by 2014.

The advertising recovery remains robust in North America, which ZO have upgraded from 3.6% growth in 2012 to 4.2%. North America has been boosted this year by the very strong performance of the Olympics in the US, where ratings were 30% higher than expected. 41 million viewers watched the opening ceremony, making it the most-watched Summer Olympics opening ceremony in US history.

ZenithOptimedia has downgraded Asia Pacific and Latin America slightly, after their exports to developed markets weakened further. They now predict ad expenditure in 2012 to grow 6.2% in Asia Pacific (down from 6.7% in June), and 7.7% in Latin America (down from 7.8%). It is then expected that Asia Pacific will expand at a consistent annual rate of 6% in 2013 and 2014, or 8% to 9% excluding Japan, while Latin America expands at 9% to 10%.

Ad markets in Middle East and North Africa are still constrained by the region’s social and political turmoil, which has left many advertisers cautious about attracting negative attention. ZO forecasts just 1.0% growth in ad expenditure here this year, followed by 2.8% in 2013 and 2.3% in 2014.

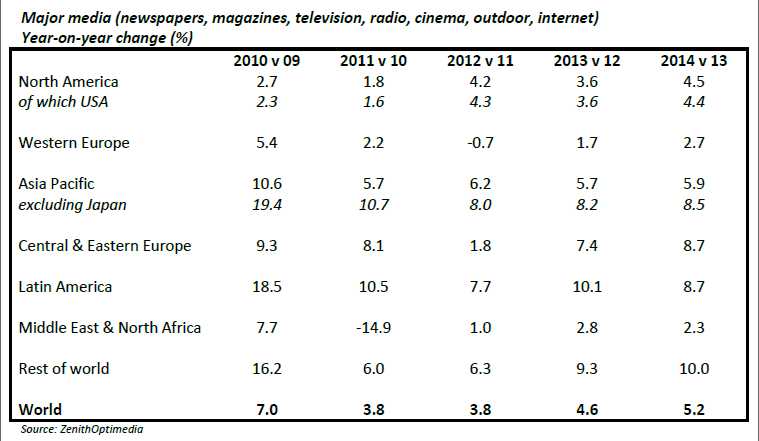

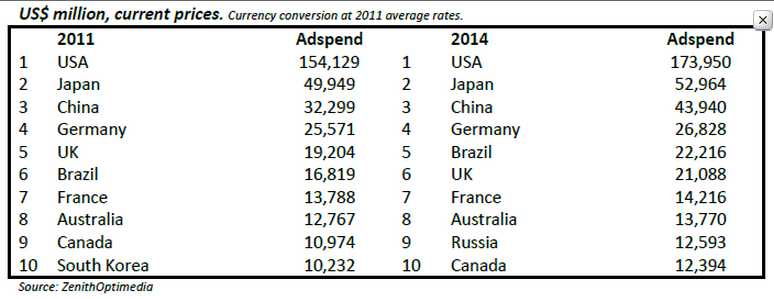

Despite the rapid growth of the developing markets, the US is still the biggest contributor of new ad dollars to the global market. Between 2011 and 2014, ZO expects the US to contribute 29% of the US$69bn that will be added to global ad spend. Between them, China, Brazil, Russia and Indonesia will contribute another 36%. Overall, ZO predicts developing markets will account for 59% of all ad spend growth over this period, increasing their share of global ad expenditure from 33.0% to 36.2%.

Top ten contributors to ad spend growth (2014 v 2011)

ZenithOptimedia predicts Brazil will overtake the UK to become the fifth largest ad market in 2013, and in 2014, Russia will overtake Canada to become the ninth largest. China is already third largest and is steadily approaching Japan.

Top ten ad markets

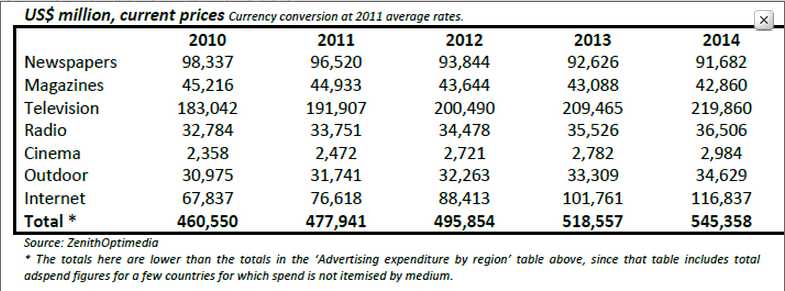

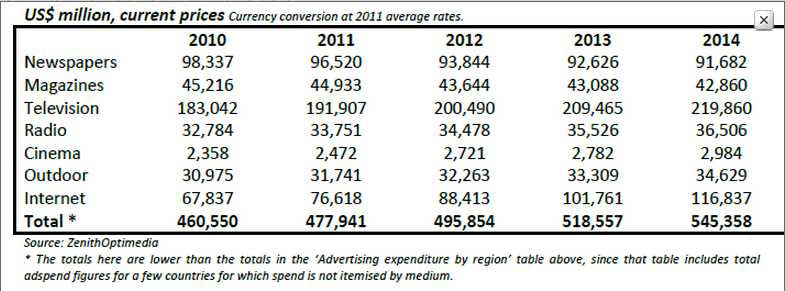

Global advertising expenditure by medium

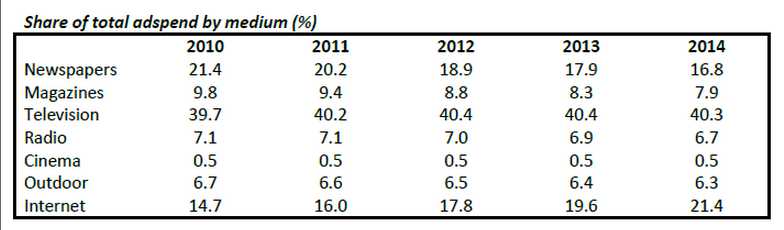

The internet is by far the fastest growing medium – ZO forecasts it to grow on average by 15% a year between 2011 and 2014. Display is the fastest-growing sub-category, with 20% annual growth, thanks to the rapid rise of social media and online video advertising. Display advertising is now growing substantially faster than paid search (which they forecast will grow by 14% a year to 2014) and classified (6% a year). Display advertising accounted for 36% of internet advertising in 2011; by 2014 it is expected this proportion will increase to 40%.

Overall, ZO predicts internet advertising will increase its share of the ad market from 16.0% in 2011 to 21.4% in 2014. Internet advertising already accounts for more than 25% of ad expenditure in five markets (Denmark, Norway, South Korea, Sweden and the UK), and by 2014, they expect it to account for more than 30% in seven markets (Australia, Canada, Denmark, Norway, South Korea, Sweden and the UK). In the most advanced market – the UK – internet advertising attracted 33% of expenditure in 2011, and they forecast it to attract 40% in 2014. There is clearly potential for the internet’s global market share to continue to grow for many years to come.

The internet is also the biggest contributor of new ad dollars to the global market. Between 2011 and 2014, ZO expects internet advertising to account for 60% of the growth in total expenditure. The next biggest is television, which they forecast to contribute 41% of growth. (The two add up to more than 100% because newspapers and magazines are subtracting from total growth.)

Television’s share of the global ad market has risen steadily over the last few years: it reached 40.2% in 2011, up from 36.9% in 2005. ZO expects the European football championship, the Summer Olympics and the US elections to help lift television’s share to 40.4% of global ad expenditure in 2012, its highest ever.

The internet has risen principally at the expense of print. Between 2001 and 2011 the internet’s share of global advertising rose by 14 percentage points, while newspapers’ share fell 12 points and magazines’ share fell by 5 points. ZO forecasts newspaper and magazine advertising to continue to shrink, by an average 2% a year over the rest of the forecast period. (Note: these figures include only advertising in printed editions of these publications, not on their websites, or in tablet editions or mobile apps, all of which are picked up in the internet category. The prospects for newspaper and magazine publishers are therefore not quite as bleak as the headline figures would make them appear!)

Advertising expenditure by medium

Share of total ad spend by medium (%)

Follow ExchangeWire