ExchangeWire European Weekly Round-Up

by on 2nd May 2014 in News

ExchangeWire rounds up some of the biggest stories in the European digital advertising space.

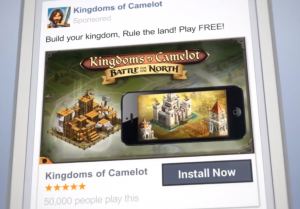

Facebook unveils FAN

Facebook this week announced it is to further roll out its Facebook Audience Network (FAN), which effectively increases the competition in the mobile, social retargeting sector with the latest development offering advertisers the ability to deliver and measure in-app ads off Facebook.

The latest formats include native, interstitial and banner ad formats and offer developers now have a new way to effectively monetise mobile apps and comes just a week after rival social network Twitter unveiled a similar service through the MoPub Marketplace.

This was quickly followed by Google unveiling its mobile app install ad units, meaning the second half of 2014 will see all three companies rival one another for app developers’ marketing budgets suggesting they all see the value in the long tail of advertising dollars as well as the big brand budgets.

Ciaran O’Kane, ExchangeWire, CEO, says: “After many years of speculation around its intentions to build out an ad network, Facebook finally announced the launch of the FAN at its F8 conference this week.

“Basically FAN allows Facebook to leverage its huge social data set outside of its own domain. Facebook is clearly trying to become the Adsense of mobile.

“Facebook will look to extend its reach among apps in standard and non-standard (that would they are calling "native") ad units. Its first major customer will be app developers themselves, selling on mobile performance metrics like CPI.”

It is likely that FAN will go aggressively after agency spend in the coming months. It will look like, in the initial launch period anyway, a traditional ad network that will sit on media plans, managing mobile buys on behalf of agencies.

O’Kane adds: “But having spoken to several Agency Trading Desk executives, ExchangeWire understands there will be a big push for Facebook to make its offering self-serve as mobile programmatic spend becomes consolidated within the ATDs.

“Are we going to see Facebook's move into the crowded data-driven bidder space later in the year? And will they buy or build?”

Twitter’s share prices drop 11% on slowing users numbers

Twitter this week announced its latest quarterly results this week, and even though its revenues ($250m) were up 119% year on year, the fact its monthly average users (MAUs) were 255 million as of March 31, 2014, an increase of 25% year-over-year, represented a slowdown in growth saw its share price drop 11% in the early hours after the announcement.

The results revived investors’ earlier concerns that Twitter’s ability to achieve scale comparable with that of Facebook is limited, hence the drop in their valuation, despite the otherwise optimistic figures.

Twitter CEO Dick Costolo also pointed out how crucial mobile advertising revenue is to the social network revealing that ad revenues from such devices accounted for 80% of its ad income, indicating how crucial the launch of its mobile app install service will be to its ongoing interests.

Trade bodies announce transparency milestone, but Google still not on board

JICWEBS – a cross industry trade body with representation from the IAB, AOP and IPA – has announced that auditing body ABC has issued “kitemarks” to nine ad tech vendors for meeting industry-agreed standards to reduce the risk of ads being served next to inappropriate or illegal content online.

The organisations – which include Ad2One Crimtan, Exponential Interactive, IgnitionOne, Quantcast, Specific Media, Tubemogul, Unruly, Vibrant Media – all submitted their advertising misplacement policies and processes reviewed by ABC.

The announcement underlines a significant effort to bring standards to the industry, and is to be lauded but is equally remarkable for the names absent from the list, notably Google, which was among the initial signatories to the Digital Trading Standards Group’s list of best practice principles.

ExchangeWire sources (speaking upon condition of anonymity) assert that larger US companies are unwilling to vary their business practices from its global policies.

This effectively means the JICWEBS policies here in the UK are a thorn in the claw of these global giants, which itself raises question marks over its chances of becoming a success, and as a result, the moves towards fully implementing effective transparency are greatly impeded.

Premium publishers eye further programmatic

The majority of the UK’s premium publishers are planning an increased investment in programmatic media trading, according to figures released by the Association of Online Publishers (AOP) earlier this week.

The AOP survey has identified “data monetisation” as a key issue among publishers this year, with 89% of the 700 surveyed planning to increase their investment into data technology – including 58% intending to hire more data analysts – in 2014, with the vast majority opting for the private ad exchange model.

The figure represents a 30% increase from last year according to the trade body, which also reported that 70% of digital publishers will use more private ad exchanges in 2014, while 61% of respondents claimed they’ll increase their use of Real Time Bidding (RTB).

Opera Mediaworks acquires Apprupt

This week it emerged that Opera Mediaworks has acquired German mobile advertising service provider Apprupt for an undisclosed fee, as it hopes to make further inroads to the German market, as it reported first quarter sales of $87m, up 40% over the same quarter a year ago.

The acquisition is Opera’s second acquisition in the sector in recent years following the purchase of UK-based 4th Screen advertising, and accounts for a comparatively rare instance of European-based companies in the ad tech sector expanding.

The Norway-based company also used the quarterly announcement to reveal Opera Mediaworks Ad Exchange, as it hopes to enter the programmatic sector offering services to both publishers and advertisers.

Follow ExchangeWire