Alibaba Eyes Bigger Ad Revenue with AdChina Acquisition

China's Alibaba Group is evidently looking to beef up its advertising revenue, which already accounts for the bulk of its revenue, as it kicks off the new year with an acquisition in the ad tech space.

The e-commerce giant this week bought a majority stake in online marketing firm, AdChina, paving the way for enhancements to its advertising platforms, including online and mobile.

The acquisition will be a significant boost to Alibaba's advertising unit, Alimama, which provides marketing tools to e-commerce merchants peddling their wares on the company's popular shopping sites, including Taobao Marketplace and Tmall.com.

Merchants do not fork out a cent to sell their products on Taobao, but most will pay for advertising and other marketing services to stand out from other sellers on the online marketplace. For instance, they can buy up product keywords so their ads will appear when consumers search for the items on Taobao.

The online marketplace also offers free data analytics to small vendors, which they can use to better peddle their wares to online shoppers.

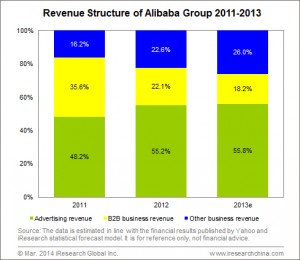

According to stats from iResearch, advertising has accounted for more than half of Alibaba's overall revenue since 2012 and estimated to hit 55.8% in 2013. The company also is the second-largest player, by revenue, in China's online advertising market, where it ranks behind search giant Baidu.

Noting that advertising currently accounts for most of Alibaba's revenue, Forrester Research analyst Wang Xiaofeng said it was not surprising that the e-commerce bigwig is investing to improve its advertising revenue, including previous investments in content companies, and now, an ad tech firm.

"Programmatic buying and RTB (real-time bidding) is the trend of digital advertising globally. It is emerging in China, but marketers and advertising agencies are all very positive about this," Wang said. "As marketers in China increasingly spend on digital advertising, they require better targeting ability and analytics, especially the mobile side, which is still at very early stage and has great potential to grow."

In an email interview with ExchangeWire, the analyst said Alibaba holds a formidable client list as China's largest B2C and C2C e-commerce platforms. This will give AdChina a great opportunity to access and work with the country's large marketers.

She added that the e-commerce operator also owns more consumer data than any other player in the market, in particular, it has detailed purchasing behaviour data. This will better support programmatic and RTB tools which rely on the granularity of consumer data to achieve better targeting capabilities.

Alibaba did not reveal any financial details involved in the acquisition of AdChina, which was founded in 2007 and based in Shanghai. The ad tech vendor offers a hosted platform that pushes its clients' digital ads onto online and mobile sites, as well as tracks available advertising space and analyses audience data.

It had filed for a US$100 million Nasdaq IPO in February 2012, but withdrew its plans the following year due to the bleak stock market environment.

In its statement on the acquisition, Alibaba said the deal would enable AdChina to, "enhance its competitive strengths in its existing businesses". Apart from working with Alimama, the newly acquired unit will also liaise closely with the company's cloud computing business arm, Aliyun.

The addition of AdChina is aimed at supporting Alibaba's plan for a data-driven digital marketing platform that cuts across its entire business. The ad tech firm said it is China's largest multi-screen integrated advertising platform, reaching 97 percent of the country's online population each month via personal computers and 80% of mobile internet users.

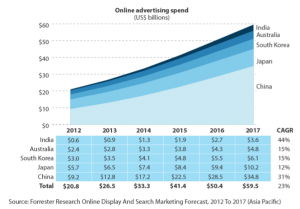

According to Forrester estimates, China will account for 58% of all Asia-Pacific online advertising spe nd by 2017.

nd by 2017.

Challenges ahead in creating ad inventory

Alibaba, however, will face challenges in the road ahead where it will need to find ways to maintain as well as grow its ad inventory.

Wang told ExchangeWire that the advertising space shrinks when consumers move from the desktop environment to mobile. For example, she explained that the available ad inventory for the Tmall app is much smaller than Tmall.com due to the smaller real estate on a mobile screen. At the same time, marketers' demand for ad inventory continues to grow.

"That means Alibaba will need to find more content to create more ad inventory, which is why they have been investing in online video channel and content companies," she noted. "They also need to make the available ad inventory more effective, and this is where programmatic and RTB come into play."

The Forrester analyst noted that the Chinese ecosystem is still "incomplete" and has few third-party data management platforms (DMPs), adding that RTB requires three categories of market players--supply side platform (SSP), demand side platform (DSP), and DMP.

"In other more mature markets such as the US and Australia, programmatic and RTB are developed for more vertical and specialised media, such as video and mobile RTB. The China market, however, is still at a very early stage," Wang said.

AdvertiserAnalyticsBrandingChinaDisplayMartechMobileTargeting

Follow ExchangeWire