How French Publishers Are Winning Together

by on 31st Mar 2015 in News

The emergence of publisher consortia was underlined in recent weeks as UK publishers began to band together en masse. A month ahead of ATS Paris, ExchangeWire examines the French market, where publishers there were early to adopt this approach, exploring the intricacies of the co-op offering, and asks if it makes sense to have dual offerings in a single market?

Premium publishers the world over are under pressure to retain ad spend, particularly when they come up against the hugely scaled operations, data sets and targeting capabilities of internet players such as Facebook and Google.

The scenario is made painfully clear if you consider that most premium publishers (predominantly with a print legacy) define success by 'halting revenue declines', with management often quick to highlight their digital gains – as opposed to overall losses – in earnings call after earnings call. This is in stark contrast to the regular year-on-year double-digit revenue growth filed by Google, et al.

It is this market dynamic, which has given rise to a host of ad tech companies – including AppNexus and Rubicon Project – which profess to help premium publishers with the transition from a print-first, to a channel-agnostic set-up.

One of the principal solutions they espouse is for premium publishers to band together, and use the respective players' technology to better fulfill advertisers' need for both scale, and a premium, brand-safe environment to place their ads.

This co-op model has been buoyed in recent weeks predominantly by UK media buyers, with the unveiling of Pangea – a co-op between The Guardian, CNN International, among others – as well as the unveiling of the AOP publisher alliance, which boasts Telegraph Media Group, Time Inc., and Bauer Consumer Media, among its number.

Confidence in the French co-op scene

However, premium publishers in France have been operating similar outfits for almost two years with the formation of La Place Media (LPM) - a co-op of over 100 media brands powered by Rubicon Project - plus Audience Square (ASQ) - a similar outfit running on AppNexus technology.

Fabien Magalon, LPM, managing director, (featured in the video above) assures ExchangeWire the publisher co-op's members continue to go from strength-to-strength, as a result of the emergence of the two publishing blocks. Additionally, he confidently states that LPM members’ yields from media trading are improving, not decreasing as some had earlier feared, as a negative effect of joining such a coalition.

Forming such unions has enabled premium publishers to achieve the scale necessary to compete with Google when it comes to advertisers' demands for reach and scale, according to Jay Stevens, Rubicon Project, general manager, international.

"The coalescence of the LPM's premium publishers means they are better equipped to offer brands programmatic brand campaigns at scale. In markets that don't offer the scale of somewhere like the USA, premium publishers are under a lot more pressure from the likes of Google. France helped set the model for the rest of the world to adopt," he adds.

Oliver Whitten, Rubicon Project, SVP, Europe, further explains: "A lot of publishers are starting to see how Google is their enemy, not necessarily L'Equipe, or Le Figaro."

The past

Despite publishers voting with their pockets and joining co-ops, some queries remain about the model. For instance, if scale is key to warding off the offensive threat posed by the aforementioned rivals, then why do they not all band together to form a 'mega-consortium'?

David Baranes, AppNexus, country manager, Southern Europe, (pictured right) explains how the genesis of the French consortium project was to form a single entity.

David Baranes, AppNexus, country manager, Southern Europe, (pictured right) explains how the genesis of the French consortium project was to form a single entity.

However, citing the developments within the French market, LPM's Magalon, adds: "This is how the history has been written. I can’t provide the details on how it happened, but it’s pretty obvious that co-operation between competitors is a complicated alchemy, and it’s easier to make it [a co-op] successful and more efficient within a smaller group."

Although, Baranes does point out that co-operation is embedded within the French media landscape, with multiple co-operative precedents already set. He adds: "For instance Mediametrie, who serves as a monopolistic standard for audience measurement, is a joint-venture between all major major TV and Radio channels.

"Another example, is the GIE E-Press which is an alliance between all major French newspapers to create a single point of access (in the form of an app) to [form a] digital version of their issues for mobile devices."

The initial publisher consortium idea span-out of GIE E-Press, recounts Baranes, although he does confirm Magalon's account of the subsequent split was: "because of divergent visions between the publishers."

Adeline Queroix-Gabay, AOD France, head of programmatic, (pictured left) agrees that theoretically it would be simpler for media buyers to have just one publisher consortia to deal with, but for 'political concerns', this was just not possible

Adeline Queroix-Gabay, AOD France, head of programmatic, (pictured left) agrees that theoretically it would be simpler for media buyers to have just one publisher consortia to deal with, but for 'political concerns', this was just not possible

The present

However, despite persistent rumours to the contrary, parties with intimate knowledge of both LPM and ASQ claim that a merger between the two is not on the horizon. The reason for this continued dichotomy is that the respective offerings cater to different existing needs of the market.

The LPM offering combines both the Rubicon ad tech stack with other players' technology (mobile inventory is supplied using Twitter's MoPub offering, and also incorporates Turn's DSP). Magalon states the LPM proposition has developed from a blind RTB solution to a sophisticated programmatic solution, including all devices, all formats, and advanced proprietary first-party data, and targeting solutions.

He adds: "We have built non-trivial proprietary layers of technology on top of it from opened API when possible."

Meanwhile AS partnered with AppNexus to provide a more holistic solution using its technology, according to Baranes.

Checks and balances?

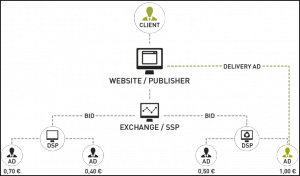

AOD's Queroix Gabay agrees the respective co-ops have helped accelerate the take-up of programmatic media buying, especially with brand advertisers — many of whom require additional assurances around brand safety. Although, she also notes how the 'blind buying' element (where the URL addresses of the websites of where the ads are served are masked) brings with it some concerns.

"A lot of the publishers in both LPM and ASQ consulted with us ahead of their [respective] formations, and we said we wanted more transparency as regards the domains [of where ads were specifically being served]," she explains.

"A lot of the publishers in both LPM and ASQ consulted with us ahead of their [respective] formations, and we said we wanted more transparency as regards the domains [of where ads were specifically being served]," she explains.

This sentiment about 'brand safe' premium exchanges was also expressed by Mark Syal, Essence Digital, director of media, in an earlier exploration of the publisher co-op model, but some highlight how such an approach is required to adhere to the collective ethos among the publishers.

However, ad tech providers AppNexus and Rubicon are both at pains to assuage such concerns. For instance, AppNexus' Baranes reports how assurances are given to advertisers that their ads appear above-the-fold (ATF), or below-the fold (BTF), etc, even though it is essentially sold "blind" via both offerings.

![]()

Rubicon's Stevens also points out that tools are in place for advertisers to ensure there are no instances of brand collisions (i.e. two rival brands' ads appearing on the same page), and Queroix Gabay agrees the respective offerings' abilities to offer white- and black-lists (i.e. where it is and is not acceptable to serve an ad) are acceptable at present.

The future?

The immediate benefits of premium publisher co-op membership are apparent. They act as a focal point of programmatic expertise that can act a single point of inventory access to encourage brands' take-up; plus, an experimental hub where all members can test new ideas at scale, sharing risks and cost, meaning all shareholders collectively benefit, according to Baranes.

He adds: "In addition to managing R&D/innovation/building on top of APIs, they can also service the publishers uniquely [i.e. help to acquire new expertise, share best practices, etc.]"

Such offerings also help capture new business (such performance budgets typically the domain of Google, etc). This is a sentiment expressed by Rubicon's Stevens. He explains further: "You need only look at Google – the biggest digital advertising company in the world – and its earnings, only about 5% of its revenue comes from WPP (the biggest single advertiser in the world). This shows you the scale of the potential."

Thus far, remnant inventory monetisation has been the core business of the publisher consortia, and will remain a key part of its offering due to the legacy business of their shareholders, according to Magalon.

Can co-ops and programmatic-direct co-exist?

However, the rise of 'programmatic direct' – where advertisers buy inventory not on an RTB basis, but through more direct deals with publishers – does this not call into question the longevity of the co-op model when such offerings are used as clearing houses for remnant inventory?

The emergence of this model (as an important potential revenue stream for publishers) was underlined in recent months with AppNexus' purchase of Yieldex, which quickly followed Rubicon's dual purchase of ShinyAds and iSocket.

Baranes explains the AppNexus vision where the two models of programmatic media trading can co-exist (i.e. both through more direct channels as well as collective exchanges).

He says: "It should not affect much the current dynamics: the consortia are media businesses with a unique media value proposition (size, reach, data, inventory, etc.). The holistic ad server is the underlying technology that can support their business.

"However it will certainly create major efficiencies in operations (one single tool to handle everything, shared technology with the publishers, full control of monetisation channels, etc.) that will inevitably translate into incremental revenue and ability to innovate."

Magalon adds: "It has already evolved beyond monetisation of remnant inventory: LPM has been putting its own technological stack and expertise available to its publisher partners in order to develop internal sales of programmatic direct.

"Future evolutions being discussed involve multiple options. Common to all is the willingness to take advantage of the unique assets around scale that a premium publisher alliance provides to its partners. I can’t provide further details, but our thinking process evolves around technology, data and mobile."

AOD's Queroix Gabay further explains how the co-existence of both the 'collective' and 'direct' models of media buying can both co-exist. She says: "We still need the basic offering of the collective[s] as the prices through direct can sometimes be a bit high [to meet the campaign objectives of an advertisers' campaign goals]."

Hence, it appears clear that the dual publisher co-op model and programmatic direct can continue to meet the needs of both ends of the market, despite them appearing to be contradictory to each other.

The future of publisher consortia and how they are helping members shape their data strategies will be debated further during ATS Paris, which will take place on 22 April. Tickets are still available but selling out fast, click here to avoid disappointment.

AdvertiserAutomated GuaranteedDigital MarketingDisplayEMEAExchangeMedia SpendPerformancePMPProgrammaticPublisherSSPTargetingTradingTrading DeskTransparencyViewability

Follow ExchangeWire