UK Tops Viewability League

by on 14th May 2015 in News

The UK is the leading market when it comes to ad viewability, according to numbers released today from advertising software firm TubeMogul, which has also released figures detailing the state of programmatic advertising in emerging markets for the first time.

The figures compile statistics from the first quarter of 2015, revealing the average ad viewability rate in the UK to number 46%, making it the the leading market in the world when it comes to media quality.

Although the number does represents a slight drop from the previous quarter – when UK ad viewability rates were 50% across all inventory – and pre-roll advertising inventory saw a 290% increase in uptake.

As a result of the increase in demand from advertisers, the cost of average pre-roll CPMs is up 20% from the previous quarter.

This was also accompanied by an almost fivefold increase in demand for mobile inventory, prompting an 29% average increase in CPMs from the previous quarter.

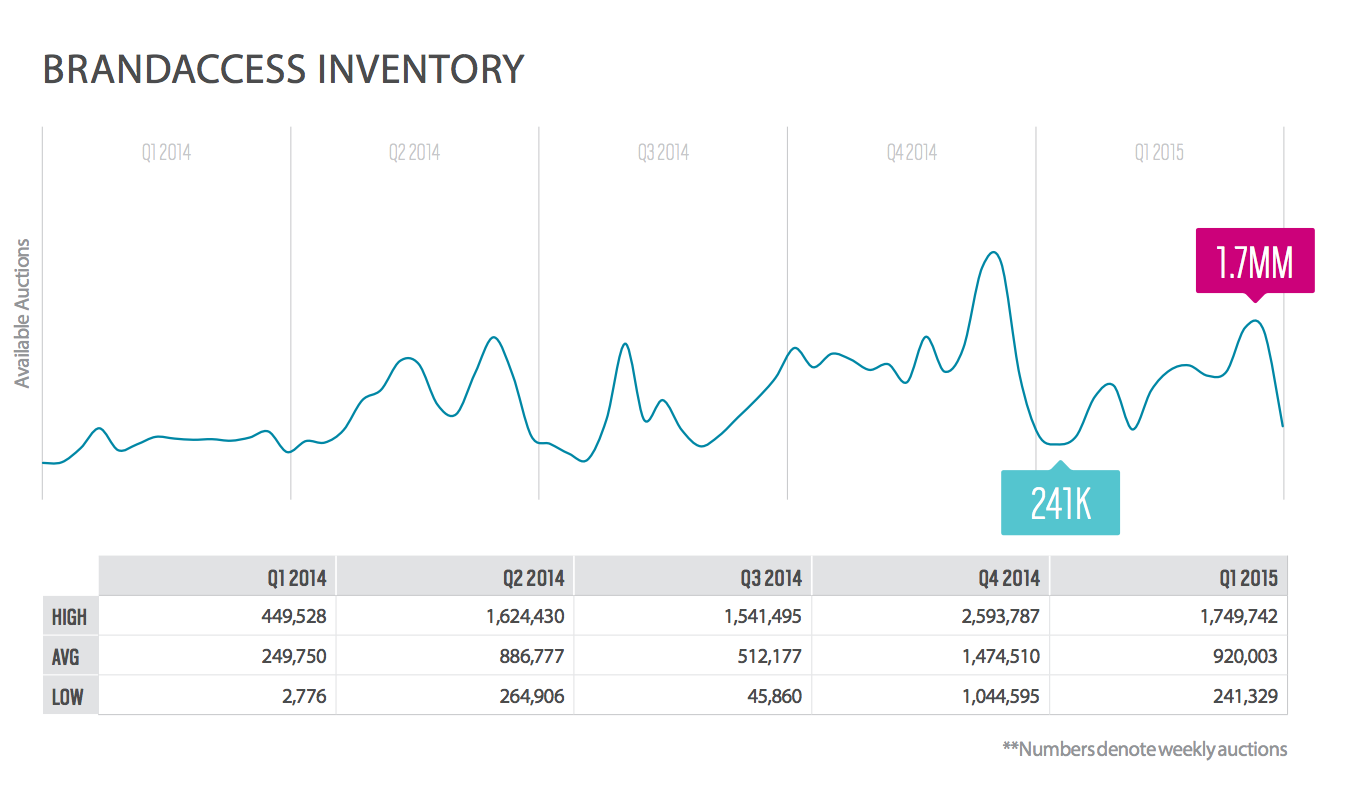

Meanwhile, average demand for inventory via TubeMogul’s automated direct-buy platform BrandAccess saw a dip in the number of available auctions, compared to the previous quarter (which included the seasonal spike in advertising activity over the festive period).

However, further analysis of this trend reveals the average number of weekly auctions on BrandAccess almost quadrupled, compared to 12 months earlier (see graph).

Taylor Schreiner, TubeMogul, VP of research, said: “Despite the growth in inventory, average pre-roll CPMs continue to increase at a rapid rate as advertisers fight for the premium inventory they know will deliver on their brand advertising needs. This is especially true on mobile as demand continues to keep pace with supply.”

Mobile-first markets

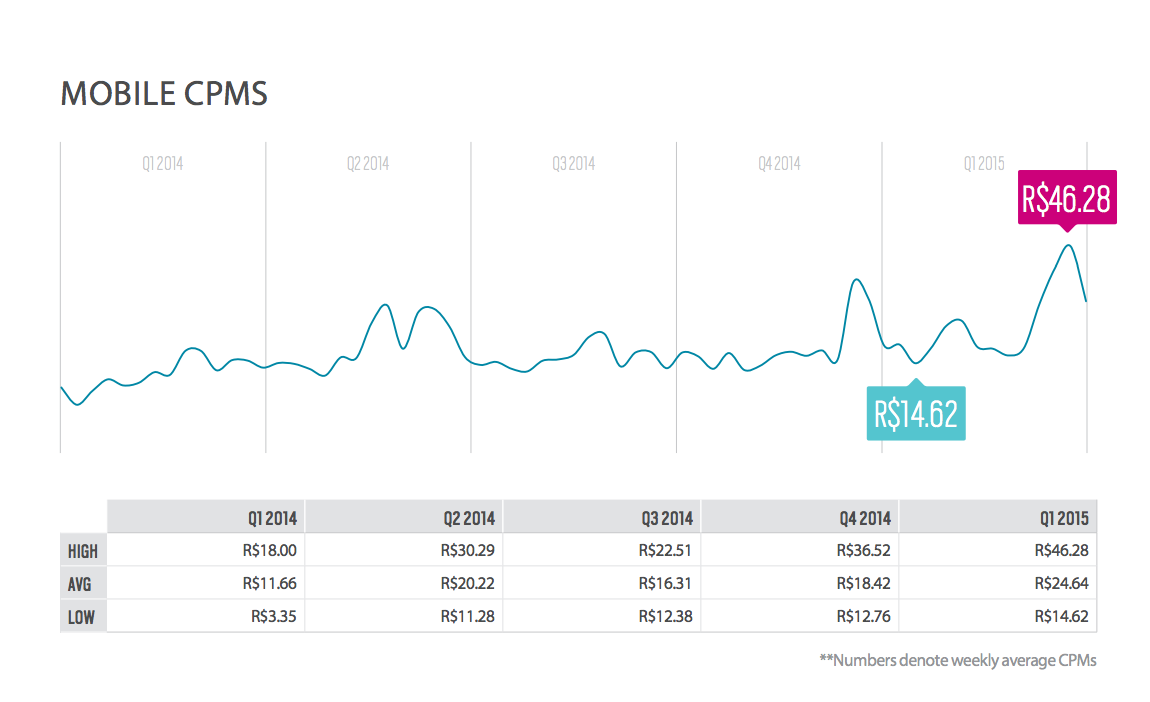

As mentioned above, the figures also revealed statistics for emerging markets for the first time, with the numbers revealing that mobile CPMs across such markets – where many consumers’ primary access to the internet is via wireless devices – continue to climb.

Meanwhile, the availability of mobile inventory skyrocketed throughout the period, with the number of weekly auctions rocketing from 40.2 million on average in Q4 2014 to 351.4 million throughout the surveyed period.

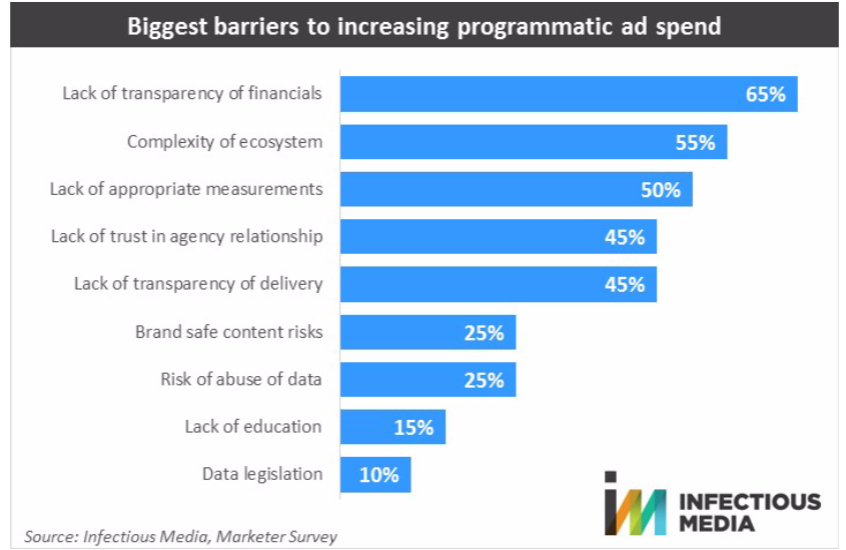

The fact that the UK ranks so highly in TubeMogul’s viewability rankings will be a welcome move for advertisers, as the topic increasingly tops advertisers’ list of concerns regarding the use of ad tech.

A recent survey of brand-side marketers from Infectious Media states that 75% of marketers plan to increase spend in programmatic, but concerns over the lack of transparency with the use of ad tech, would continue to trouble 45% of those questioned (see chart).

Moves to address the issue gathered pace last year when trade bodies representing advertisers, publishers and the ad tech sector laid down guidelines on viewable ad impressions in a move designed to introduce viewability as a media trading standard for the first time

These included the bodies instructing that 50% of pixels must be in the viewable portion of an internet browser for a minimum of one continuous second to qualify as a viewable display impression for a standard display ad.

In addition, the trade body has also issued further specifications for IAB Rising Stars/large canvas ad formats (those that measure in excess of 242,500 pixels, equivalent to the size of a 970 x 250 pixel display ad) stating that 30% of pixels must be in the view for a minimum of one continuous second to qualify as viewable.

More recently, measurement firms have moved to address such fears with comScore moving to launch its Industry Trust Initiative, offering to rate publisher environments giving them a ‘trust score’ in a bid to further trust between the buy- and sell-side of the industry.

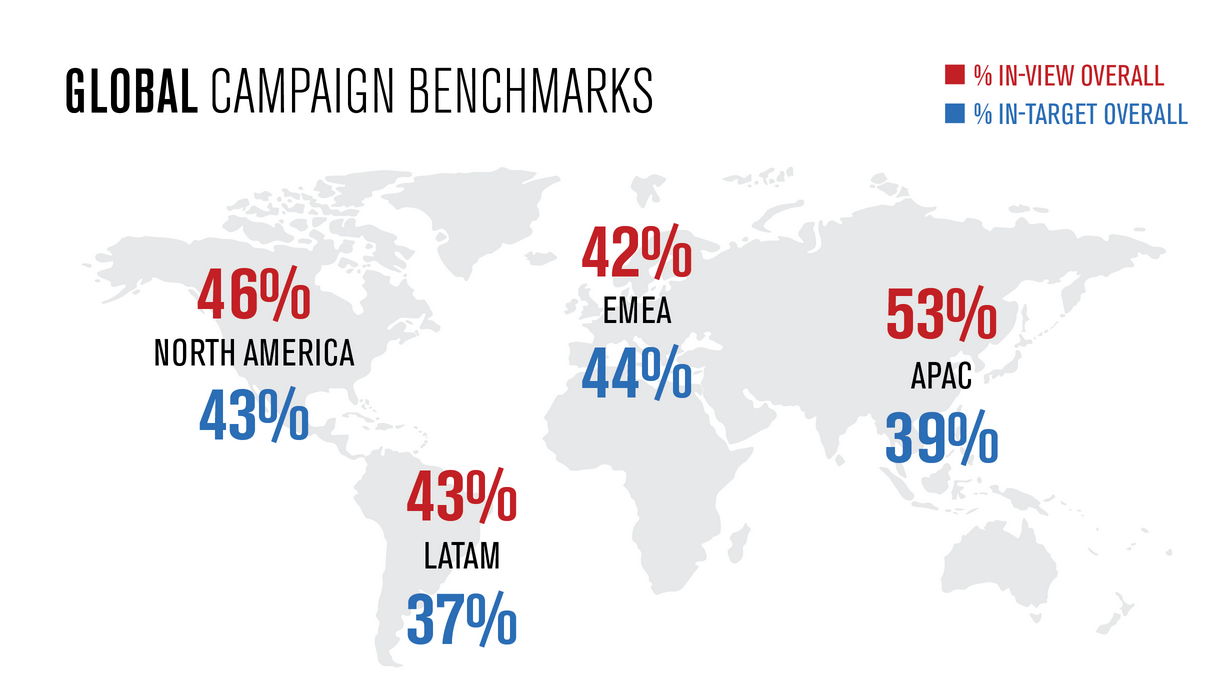

comScore has also published global benchmarks for ad viewability rates, with the EMEA region ranking as the worst territory for advertisers having the opportunity to be viewed by a human, with only 42% of all ads served in-view, see graphic.

Calls for improvements

However, moves are afoot to vastly increase viewability standards currently advocated by industry trade bodies. Speaking at the IAB RTA (real-time advertising) conference recently, Americo Campos Silva, Shell International Petroleum Company, global media manager, called for five times the industry standard before it pays for online ad space.

He added: "What we have seen through tests with different programmatic suppliers is that there is a correlation between the use of programmatic and decreased levels of viewability. Maybe this is just in our case, but these are our findings.

“I don’t accept ‘one second’ any more in terms of viewability. We are now targeting five seconds for viewability, and that is our benchmark, and our goal."

Da Silva went on to say: “As an advertiser, I think about buying advertising the same way as I think about investing money in the stock market, and guess what, I want my ad to perform. However, the problem [with programmatic], is that you buy, but you don’t know what you are buying."

Ad NetworkAdvertiserAPACCross-ChannelDataDigital MarketingLATAMLocationMartechMedia SpendMobileTargetingTradingTVVideoViewability

Follow ExchangeWire