Melt DSP Announces Another Partnership; Programmatic Represents Half of Display Market

by on 27th Jul 2015 in News

This week's Roundup brings news about another partnership that Melt DSP announced in Brazil; a debate about the legal perspective of programmatic buying in the same country, which is known for its unique approach and rules for the advertising industry; and data from a recent study by PwC and IAB North America, showing the market share of programmatic media -- a great market still concentrated in the hands of some ad tech players.

Melt DSP partners with In Loco Media

Melt DSP announced another partnership to enrich its platform with data that will enable it deliver better results targeting online and offline consumers. The deal with In Loco Media, that owns a geolocation technology allegedly 30 times more accurate than a conventional GPS, will put its technology in Melt’s platform. The technology can collect data from offline customers and relate them with online sources.

According to the press statement released by both companies, Melt DSP will be able to focus in a better targeting in mobile, “for example, reaching a group of consumers that have been visiting vehicle dealerships looking for a new car”.

In the past weeks, Melt DSP announced deals with Hagah and Ibope Nielsen in Brazil with the same goal: get better cross-device capabilities.

Programmatic Media legality in Brazil

Brazil is known for its specific rules and legislation. Melissa Kano, digital lawyer, Koury Lopes Advogados, explains in an article in her LinkedIn page what are the legal consequences of programmatic media in Brazil, emphasising the debates about media bureaux — currently forbidden.

Brazil has a local institution that set the rules for media trading, CENP (Executive Council of Standard Rules). Its Ethics Orientation Document was published in English and you can read it here.

Melissa explains that although CENP does not mention or forbids programmatic media, the current environment puts the method as an ‘auxiliar method of advertising, as a consulting service’, allowing players to operate inside agencies with dedicated teams or independent ones, as service providers.

She also states the differences of each kind of programmatic buying and how they fit the Brazilian rules.

Even though it is an area with some uncertainties from a legal perspective, Melissa concludes that programmatic is a ‘one-way ticket’ hardly to be dismissed, and therefore needs regulation in the country. You can read the article here (in Portuguese).

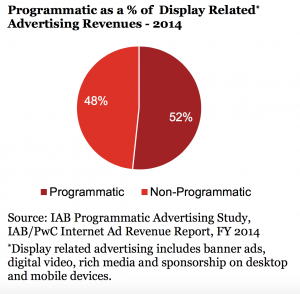

Programmatic Media reaches US$ 10 billion revenue and half of the display market

Going beyond Latin America and reaching North America, according to a recent study conducted by PwC on behalf of the IAB in the United States, programmatic media in 2014 reached US$ 10.1 billion worldwide. The total online ads revenue was US$ 49.5 billion.

With the numbers, it is possible to say that programmatic media buying already represents half of the investments in display media, according to the report. This format made up nearly 80% of the programmatic revenues. The majority of programmatic inventory was bought and sold through open auctions, approximately 70% of the programmatic revenue.

The study also reveals that ad tech revenues is bigger than publishers’ revenues in the period, 55% agains 45%, respectively.

Additionally, the top 10 companies command 66% of programmatic revenues in 2014. The top 25 in the ranking get 75% of the revenues. In terms of transactions and their distributions, the top 10 ad tech companies concentrate 66% of them.

The study also draws conclusions about the lack of transparency in the market, lack of consensus in definitions and a need for more clarity of the players. Read the full report here (in English).

Follow ExchangeWire