UK Publishers Remain Optimistic Following Positive Growth in 2015; Video Ad Popularity Throughout the Day by Device

by on 19th Aug 2015 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, ExchangeWire, head of research and analysis. In this week’s edition: UK publishers remain optimistic following positive growth in 2015; video ad popularity throughout the day by device; and global mobile advertising revenue reaches $31.9bn

More than a quarter of UK publishers achieved annual growth of more than 25% for the first time since early 2014

Deloitte, the business advisory firm, and the Association of Online Publishers (AOP) this week released the latest findings from its Digital Publishers Revenue Index Report (DPRI). The report reveals that UK publishers have experienced positive growth in the last year, with 26% of participants displaying annual growth of more than 25% for the first time in five successive quarters.

The AOP Sentiment Index Report, part of the DPRI which questions AOP board members on how they anticipate the market will perform over the coming year, showed UK publishers had a positive outlook; 100% of participants expect to see growth in digital advertising over the next 12 months. Publishers cited advertising revenue as their focus for growth during the next quarter, while fewer cited cost reduction as a source for future growth, a 24% decline compared to the previous quarter.

Mobile advertising revenue continued to rise in Q2 of 2015, showing an increase of 21%* over the year, with a 44%* growth in smartphone display advertising revenue.

AOP Managing Director, Tim Cain, commented: “The Q2 report once again highlights that advertising revenue reflects the increasing consumption of media on mobile and will remain a key focus for publishers during the next quarter. Publishers and advertisers alike need to recognise the impact of cross device, particularly mobile, when planning budgets and understand the value different devices hold along the path to purchase.”

| UK Digital Publisher Advertising Revenue GrowthQ2 2015 vs. Q2 2014 AOP & Deloitte DPRI Report | |

| Digital advertising format | % Change* |

| Total | 5.9% |

| Desktop Video | 15% |

| Recruitment | 4% |

| Sponsorship | 34% |

| Display | -4% |

| Classified | 19% |

| Mobile (smartphone, tablet) | 21% (44%, -9%) |

Industry average derived from revenue data supplied by 23 AOP publisher members.

Howard Davies, Deloitte media partner, said: “Publishers are now aiming to achieve growth through increasing advertising revenue, rather than simply cutting costs. The optimism surrounding digital marketing is refreshing to see. This sea-change is largely down to the continuing growth of mobile and video advertising revenue that has been prevalent in the last 12 months and looks set to continue.”

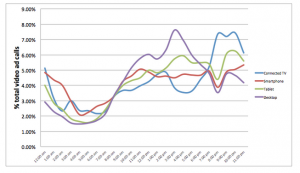

Video ad popularity on desktop devices peaks at 3pm, on connected TV and tablets at 10pm, smartphones at 11pm. US Internet users’ exposure to video ads throughout the day, on different devices has been exposed by research from Tremor Video. Between 6am and 8am smartphones are the device of choice, and between 6pm and 7pm tablets are the device of choice. Desktop enjoys the longest spell as the top device, between 10am and 6pm - closely aligned with the standard working day. Connected TV is the most popular device between 7pm and midnight.

Source: Digital Publishers Revenue Index Report (DPRI)

The data provides support for media planners who believe in an always on, cross-device strategy as the pattern of use that has been revealed proves that consumers are increasingly using more than one device at the same time, or multi-screening.

Global mobile ad revenue reaches record high

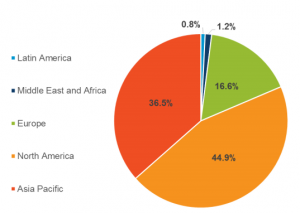

Globally, mobile ad revenue saw a 64.8% year-on-year rise to $31.9bn, according to IAB Europe’s ‘Global Mobile Report.’ Mobile display saw the highest growth (88.1%), whilst mobile search increased 55.2% year-on-year, with the growth being driven by a continued shift in device usage and consumer usage patterns.

Globally, display now accounts for the majority of ad spend accounting for 47.4% of ad spend revenue ($15.1bn), overtaking search which now accounts for 46.1% of revenue ($14.7bn). North America remains the largest mobile advertising market, accounting for 44.9% ($14.3bn) of global mobile ad revenue, followed by APAC, which accounts for 36.9% ($11.7bn) of global mobile ad revenue. North America had the largest year-on-year growth at 76.8%, followed by EMEA (68.5%).

Source: IAB Europe’s ‘Global Mobile Report’

DisplayMedia SpendMobileProgrammaticUK

Follow ExchangeWire