Latest Earnings Reports Indicate Top 5 Tech Companies Will be Worth More Than USD$2 Trillion

by Rebecca Muir on 23rd Oct 2015 in News

Strong earnings reports from Google, Microsoft, Apple, and Amazon indicate that the top five tech companies (including Facebook) will be worth more than USD$2 trillion if they can maintain the combined growth from this quarter.

Mobile search drives Alphabet revenue

Yesterday (October 22, 2015) the successor issuer to, and parent holding company of, Google Inc., announced financial results of Google as it existed prior to the reorganisation that became effective on October 2, 2015 for the quarter that ended September 30, 2015.

“Our Q3 results show the strength of Google's business, particularly in mobile search. With six products now having more than one billion users globally, we're excited about the opportunities ahead of Google, and across Alphabet,” said Ruth Porat, CFO of Alphabet and Google.

Financial highlights

– Revenues of USD$18.7bn and revenue growth of 13% year-on-year; constant currency revenue growth of 21% year-on-year

– Substantial growth of mobile search revenue, complemented by contributions from YouTube and Programmatic Advertising

– GAAP and non-GAAP operating income of USD$4.7bn and USD$6.1bn, respectively

– GAAP and non-GAAP diluted EPS of USD$5.73 and USD$7.35, respectively

– Strong operating cash flow of USD$6.0bn

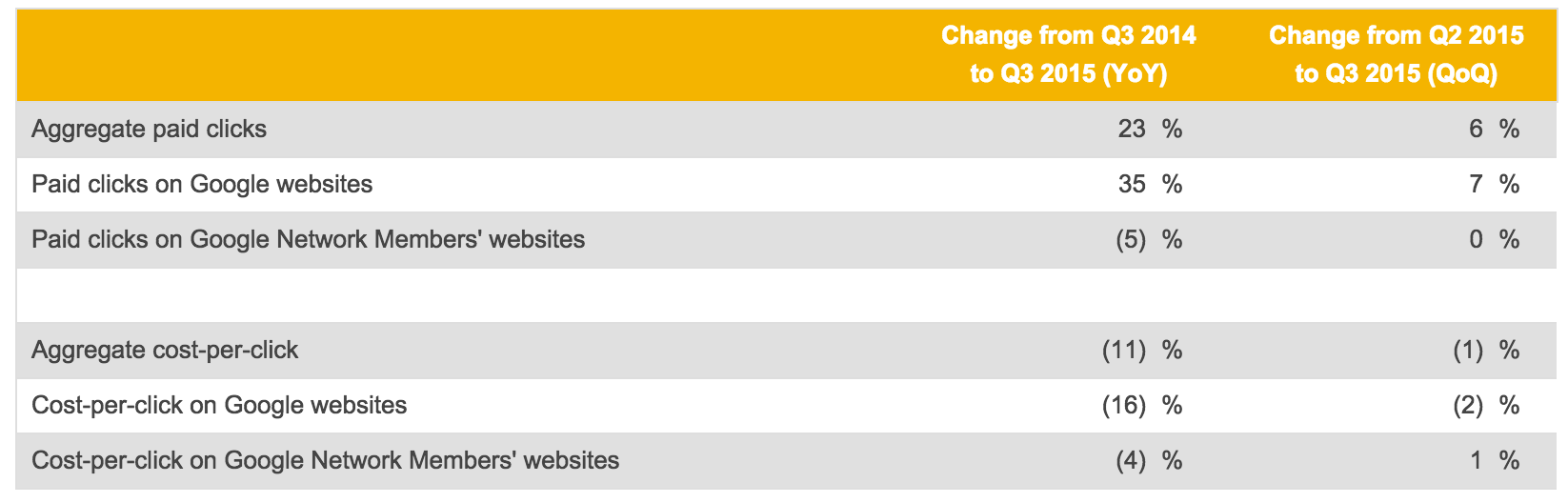

Paid clicks and cost-per-click information (unaudited):

In a call with analysts, Google CEO, Sundar Pichai, confirmed that more than half of Google search queries now come from mobile devices. However, Google Pichai was unable to report how much search revenue it gets from mobile versus desktop. He answered the question by saying it “is as compelling, or even better, than desktop”.

Fruitful cloud market for Microsoft

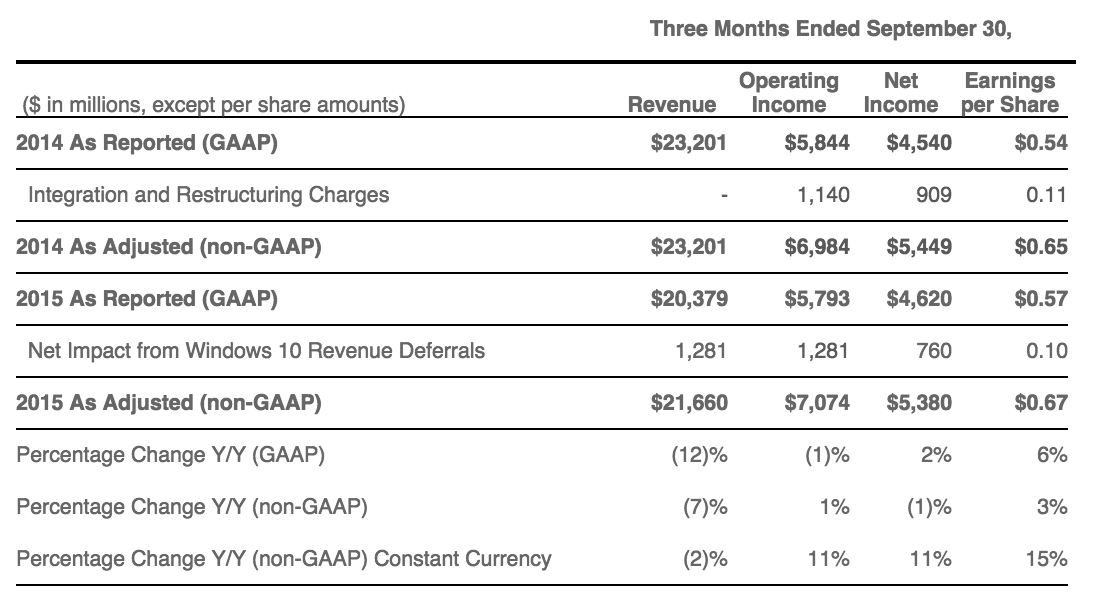

Microsoft also reported earnings yesterday for the quarter ended September 30, 2015:

– Revenue was USD$20.4bn GAAP (down 12% from 2014), and USD$21.7bn non-GAAP (down 7% from 2014)

– Operating income was USD$5.8bn GAAP, and USD$7.1bn non-GAAP, virtually no change from 2014 (-1% GAAP and 1% non-GAAP)

– Net income was USD$4.6bn GAAP (up 2% from 2014), and USD$5.4bn non-GAAP (down 1% from 2014)

– Earnings per share was up 6% from 2014 to USD$0.57 GAAP, and USD$0.67 non-GAAP (up 3% from 2014)

– Search advertising revenue, excluding traffic acquisition costs, grew 29% in constant currency, with Bing US marketshare benefiting from Windows 10 usage

"We are making strong progress across each of our three ambitions by delivering innovation people love," said Satya Nadella, chief executive officer at Microsoft. “Customer excitement for new devices, Windows 10, Office 365, and Azure is increasing as we bring together the best Microsoft experiences to empower people to achieve more."

Amazon is now worth more than Facebook

Amazon.com, Inc. also announced financial results for its third quarter ended September 30, 2015.

– Operating cash flow increased 72% to USD$9.8bn for the trailing twelve months, compared with USD$5.7bn for the trailing twelve months ended September 30, 2014.

– Net sales increased 23% to USD$25.4bn in the third quarter, compared with USD$20.6bn in third quarter 2014.

– Operating income was USD$406bn in the third quarter, compared with operating loss of USD$544m in third quarter 2014.

– Net income was USD$79m in the third quarter, or USD$0.17 per diluted share, compared with net loss of USD$437m, or USD$0.95 per diluted share, in third quarter 2014.

“For the first time, we’re recommending you bring home a six-pack for the whole family,” said Jeff Bezos, founder and CEO of Amazon.com. “At a price of $50 for one, or $250 for a six-pack, Fire sets a new bar for what customers should expect from a low-cost tablet. This is one more step in our mission to bring customers premium products at non-premium prices. Fire is the #1 best-selling product on Amazon.com since launch, and based on the strength of the customer response, we are building millions more than we’d already planned.”

USD$651.79 +9.18 (1.43%)

Ad NetworkDisplayEarningsMartechProgrammaticTV

Follow ExchangeWire