AU Ad Spend Climbs to AUD$5.9bn; Video Ads More Likely to Move SEA Viewers

In this weekly segment, ExchangeWire sums up key industry updates on ad tech from around the Asia-Pacific region – and in this edition: AU ad spend climbs to AUD$5.9bn; Video ads more likely to move SEA viewers; Data Alliance eyes growth in Indonesia; China forecast to spend USD$40.4bn on digital ads; and Syndacast & Sojern ink data partnership.

AU ad spend climbs to AUD$5.9bn

Australia's online ad spend made a significant climb in the fourth quarter of 2015 to close the year at AUD$5.9bn (£3.1bn), up 24% of the previous year.

According to IAB Australia, this marked a "major milestone" for the industry, having clocked a double-digit year-on-year growth of more than 21% since 2010.

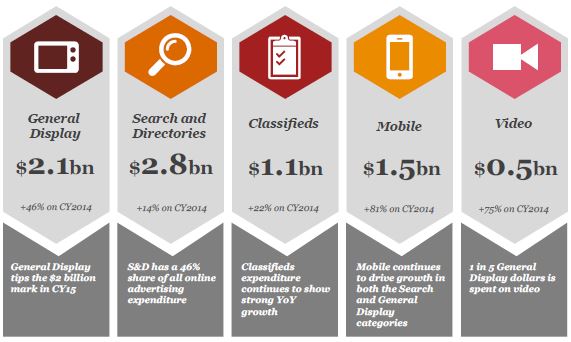

All ad categories saw growth over 2014, led by general display's 46% climb to hit AUD$2.1bn (£1.1bn) last year, while classified ads grew 22%, to AUD$1.1bn (£578m). Search and directories increased 14% to AUD$2.8bn (£1.47bn).

IAB CEO Alice Manners said: "This is an outstanding result for the industry. When the IAB first started recording online ad expenditure in 2003, it was at AUD$1.3bn (£683m) and, today, we are poised to break the AUD$6bn (£3.15bn) barrier."

Mobile ad spend grew 81% to AUD$1.55bn (£815m), of which 65% went to smartphones and 35% to tablets. Mobile accounted for 40% of overall general display ads, compared to 25.5% in 2014. Video ads also grew by more than 75%, to reach AUD$484m (£254m), accounting for 23% of total general displays.

Source: IAB AU

Video ads more likely to move SEA viewers

Consumers in Southeast Asia are more likely to love a brand or buy a product after watching an online video ad, compared to their counterparts in the US and Europe.

Some 58% of consumers in the region viewed a brand more favourably after watching an ad. In comparison, 41% in the US, 28% in the UK, and 26% in Germany felt the same way, according to findings from Unruly's Pulse platform, which analysed responses from more than 550,000 consumers.

In addition, purchase intent was higher, at 52%, among Southeast Asian consumers, compared to 40% in the US, and 31% in the UK and Germany.

Unruly's co-CEO Sarah Wood explained: "Consumer emotions drive product sales as well as brand love. So, it's not surprising that smart marketers appreciate the important role that emotional intelligence has to play in delivering effective video ad campaigns.

"Marketers using Unruly Pulse will have their finger on the pulse of consumer emotions and be able to plan more effectively for video launches around zeitgeist events and seasonal trends", Wood added.

The regional findings were released to mark the launch of the platform in this region. The data also revealed that advertisers were struggling to make consumers laugh, with humour highlighted as one of the least common emotions, felt only by 4% of consumers worldwide.

Data Alliance eyes growth in Indonesia

The WPP company has expanded its operations into Indonesia, where it is looking to tap the growing demand for data-driven campaigns focused on social, e-commerce, and mobile.

Based in Jakarta, Data Alliance's local outfit would integrate both global and local data sources and develop localised campaigns across various channels, including traditional and digital, the ad tech firm said.

Home to 240 million residents, the Indonesian market marked Data Alliance's fourth global presence after India, Sub-Saharan Africa, and North America.

Data Alliance Indonesia is led by its country head, Wijaya Santoso, who has more than 18 years of industry experience in mobile, technology, and marketing operations.

WPP Indonesia and Vietnam Chairperson Ranjana Singh said: "Data Alliance is speaking true to our vision of 'horizontality'. It's about getting us to work together in a data-driven market and essentially making our clients' lives easier, especially when it comes to leveraging data assets."

China forecast to spend USD$40.4bn on digital ads

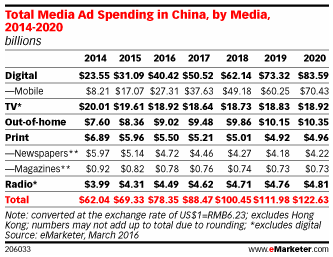

The Chinese economy may be experiencing a slowdown, but its digital sector is expected to clock USD$40.42bn (£28.42bn) in ad spend this year, up 30% over 2014, according to eMarketer.

The market researcher said this figure would more than double to hit USD$83.59bn (£58.78bn) by 2020, adding that focus would shift from traditional to digital media, with spend on TV and print expected to dip in 2016.

This year, TV ad spend would account for 24.2% of overall media ad expenditure, pulling in USD$18.92bn (£13.3bn), while print would account for just 7% at USD$5.5bn (£3.87bn).

Mobile video ads would see significant growth this year, clocking USD$3.09bn (£2.17bn), or 55% of total digital video spend. By 2020, mobile video would make up 73% of China's digital video ad spend, hitting USD$9.15bn (£6.43bn).

Ad spend on display and search pushed to web-connected mobile devices would climb to USD$14.54bn (£10.22bn) and USD$10.96bn (£7.71bn), respectively, this year.

eMarketer's forecasting analyst Shelleen Shum said the shift of ad dollars from traditional media, such as TV and print, towards digital and mobile would be fuelled by the increasing number of young internet-savvy consumers; who are spending more than the older generation.

"The slower economic growth also has caused advertisers to look more closely at ad budgets, with some preferring to spend more on targeted digital formats", Shum explained.

Together, Baidu, Alibaba, and Tencent would rake in 72.8% of China's mobile internet ad spend in 2016; with Alibaba claiming the largest share of mobile internet ad revenues, at USD$9.16bn (£6.44bn), up 54.8% over 2015.

Syndacast & Sojern ink data partnership

Syndacast and Sojern have inked an agreement that will see the latter's travel data and inventory deployed across Syndacast's hotel clientele.

The Asian online marketing agency has offices in Singapore, Thailand, and India, and specialises in the hotel and travel sectors, offering attribution modelling and real-time campaign reporting.

Syndacast CMO Doy Moreau said: "With the rise of travel intent data providers in Asia-Pacific in the last year, we are proud to have selected a strong leader such as Sojern as one of our main partners in this space."

Sojern taps and analyses anonymised traveller data from various organisations, including airlines, online travel agencies, hotels, and rental car companies, which it feeds into its performance marketing engine to support ad campaigns.

AdvertiserAgencyAnalyticsAPACAustraliaChinaMedia SpendMobileProgrammaticTargetingVideo

Follow ExchangeWire