High-Value App Users Represent Smallest User Base, But Drive Most Revenue

by Lindsay Rowntree on 28th Mar 2016 in News

A recent report by RadiumOne has found that high-value users drive 85% of app revenue, yet represent just 17% of the user base. The 'State of Mobile Acquisition' report uncovered activities of high-value users within apps, which are users who have generated revenue in the last 30 days.

The data was derived from in-app events and ad engagement across third-party apps for more than 100 million devices. The report showed that marketers have a huge opportunity to acquire more high-value users via their own apps, and even outside of them.

According to the report, as well as making up 85% of revenue, high-value users engage with an app four times more than the average app user. This was even higher in communication apps, where it increased to five times, representing a significant opportunity to engage with users outside of the app environment and encourage higher app usage through push notifications, retargeting, and promotions.

Bill Lonergan, CEO, RadiumOne, said: "This report further underscores the need for marketers to look outside their own app for signals to truly get to know their high-value users. Taking in data from the entire ecosystem, including third-party apps and web sites, determines how customers act outside of apps and will only help marketers reach them in a more effective way, ultimately leading to increased revenue."

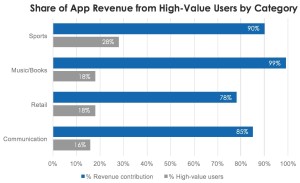

The report found that, while high-value users contribute the most revenue, they only make up 17% of the user base, on average. Sports apps skew highest, at 28%, with high-value users only making up 16% of the share of total users of communications apps. Yes, these small user bases make up 90% of revenue within sports apps, and 85% within communication apps. This may seem obvious, as it's the classic advertising 80:20 rule, where 80% of your revenue comes from 20% of your inventory, but it signifies a wider opportunity to refine targeting to this small, yet valuable, user base, rather than blanket targeting the entire app user base, resulting in significantly lower yield. The ability to identify this powerful subsection could result in a significant increase in ROI.

Source: RadiumOne

Further to this, the report delved deeper into behaviours in retail apps and offered up some interesting insights into the unique signals these high-value users display outside of the app environment; which is valuable insight for refined targeting. Average users have three shopping apps on their devices on average; whereas the high-value user only has one. Conversely, the high-value user has a greater percentage of sports apps, compared with the average sports app user. High-value users also access 45% more lifestyle apps (such as weather, dating, maps) than the average user. However, they are not fans of social gaming; with the report finding that high-value users have 62% fewer social gaming apps on their devices than the average user. This suggests that high-value users view their devices as a shopping tool, as opposed to a gaming platform – functionality over fun.

As well as identifying high-value users, the report also identified users who have the potential to be high-value by applying the signals of high-value retail users to the rest of the user base. Signals included apps that have been installed, websites visited and ads clicked, unlocking a further 28% of users that could be high value.

With this information, it's important to be able to understand not only who your high-value users are, but also how you can unlock yield from them through effective targeting. The report identified three key strategies for this:

– Focus on the segment driving the revenue majority – and in-app analytics is a must for this, allowing you to focus in on the behaviours and characteristics of your highest value users and to understand which triggers cause them to purchase.

– Don't just focus on your own app; look outside of it for further data signals; taking in data from the entire ecosystem, including third-party apps and websites, to piece together a rounded understanding of the user.

– Target high-potential users, both in-app and through the mobile web; the data signals derived from the campaign will help to further refine the campaign as it develops and maximise yield.

It's important not to neglect the rest of the user base, especially if those users have the potential to become high-value. But understanding the source of app revenue, either through purchase or ad monetisation, ensures that marketers can be effective in their efforts to produce highly targeted campaigns.

Follow ExchangeWire