UK Internet Ad Spend Grows 17.3%; RTB Media Auction Volume Increases 217%

by Sonja Kroll on 28th Apr 2016 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, head of research and analysis, ExchangeWire. In this week’s edition: Mobile drives UK ad spend; RTB media auction volume rises 217%; and Video investment impacts ROI.

Online Pulls Ahead of TV, Powered by Mobile

Online ad spend in the UK is now worth £8.6bn and has overtaken TV. According to the Advertising Association/Warc Expediture Report, mobile accounts for 78% of that growth and makes up a total ad spend of £2.6bn. Year-over-year, mobile has thus grown 61.1%.

Total ad spend in the UK amounted to £20.1 in 2015, a change of 7.5% when compared to 2014. While still rising itself, TV ad spend amounted to £5.3bn. Radio ad spend grew by 2.9% in 2015 and settled in at £592m. OOH ad spend increased 3.9% to £1.1bn.

The UK is comfortably the largest internet advertising market in Europe and ranks third globally, behind the US and China, the report finds. As a share of GDP, UK adspend rose to 1.08% in 2015, higher than any other G7 nation. For every man, woman and child in the UK, £308.56 was spent on advertising last year.

“The UK is the fastest-growing major advertising market in Europe, and its most successful exporter. It's a tribute to our creativity and technical innovation”, says Tim Lefroy, Chief Executive at the Advertising Association.

Looking to the future, the Expenditure Report expects internet ad spend to continue double-digit growth rates and increase by 11.5% in 2016. UK total ad spend is forecast to rise by 5.5%.

RTB media auction volume jumps 217%

Programmatic media trading continues to grow across Europe. According to the “Programmatic Media Market Pulse”, the volume of RTB media auctions increased by 217% year-on-year. In the UK, inventory traded on exchanges rose 14% during the first quarter.

Mobile is driving programmatic: on the mobile marketplace, smartphones had a share of 71%, growing 12 percentage points since Q4, 2015.

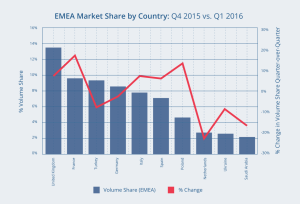

Within Europe, the UK is the largest programmatic market: 14% of total programmatic transactions were conducted in the UK. France overtook Turkey as the number two market in EMEA, accounting for 10% of the market share, followed by Turkey and Germany with 9% each.

Within Europe, the UK is the largest programmatic market: 14% of total programmatic transactions were conducted in the UK. France overtook Turkey as the number two market in EMEA, accounting for 10% of the market share, followed by Turkey and Germany with 9% each.

"The programmatic media marketplace continues to expand from the impressive momentum recorded during 2015", says Arthur Muldoon, Accordant Media CEO and co-founder. "It is also very significant to see the attention and progress being made towards protecting marketer’s media budgets against non-human traffic and viewability threats."

Thus, viewability reached new heights, the report claims, improving 61% year-on-year, while non-human traffic decreased by 81%. Not least due to seasonal changes following the Christmas quarter, CPMs in the first quarter decreased quarter-on-quarter, but still recorded a year-on-year increase of 13%.

Interesting:publishers are beginning to provide pre-bid ad placement data, possibly reacting to advertisers’ demand for more transparency. For 23% of impressions at auction in Q1, 2016 pre-bid data had been released.

Video drives offline sales

Investment in video not only impacts sales and strengthens the ROI, it has also proven complement TV, a new study by Videology finds. The study analysed the impact of video over a significant time period in driving in-store purchases for a number of brands and across multiple campaigns.

Video investment, the research concludes, has a positive ROI. In the study, the gross revenue ROI of video in relation to TV was 1.27x higher. That does not mean that video delivers a better ROI or scale than TV. But, used complementarity to TV, video drives offline sales.

"Video certainly performs as a medium in driving sales activity offline – with every case study showing a positive ROI. Econometric modelling provides the closest we have to empirical evidence of the relationship between media consumption and purchase activity in bricks and mortar stores so it's great to see the power of linear TV and video in combination. When you look at consumption trends it instinctively makes sense but this is the first time we’ve been able to really objectively prove it", said Rich Astley, UK MD, Videology.

ROI is also positively impacted by quality of inventory, the study also claims. Clients with higher percentages of video budget devoted to Broadcast content have a higher video ROI relative to TV, reaching a TV-relative ROI of up to 250% when broadcast content reaches 60% of the investment mix.

AdvertiserDataDisplayEMEAExchangeMeasurementMedia SpendMobileProgrammaticPublisherUKVideoViewability

Follow ExchangeWire