Microsoft's Earnings Easily Exceed Expectations

by Rebecca Muir on 20th Jul 2016 in News

Yesterday (19 July), Microsoft (NASDAQ:MSFT) announced earnings for the quarter ended 30 June, 2016. The company's flagship cloud product, Azure, saw revenue grow 102%, proving to the market that Microsoft is serious about closing the gap with market leader Amazon.

Microsoft's earnings easily exceeded analysts' expectations, highlights below:

– Revenue was USD$20.6bn (£15.72bn) GAAP, and US$22.6bn (£17.25bn) non-GAAP, compared to year-earlier revenue of USD$22.18bn (£16.93bn)

– Operating income was USD$3.1bn (£2.37bn) GAAP, and USD$6.2bn (£4.73bn) non-GAAP

– Net income was USD$3.1bn (£2.37bn) GAAP, and USD$5.5bn (£4.20bn) non-GAAP

– Diluted earnings per share was USD$0.39 GAAP (£0.30), and USD$0.69 (£0.53) non-GAAP, compared to year-earlier profit of USD$0.62 (£0.47)

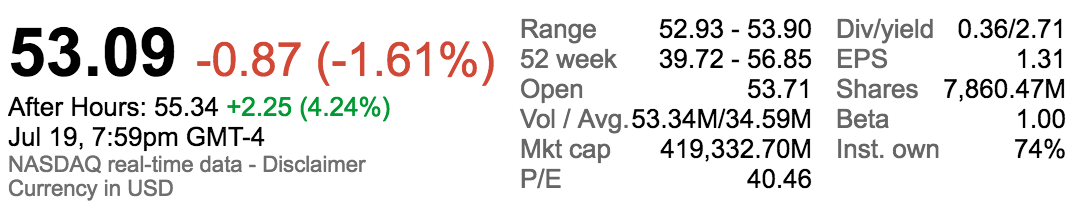

Shares of the company popped more than 3% after the report.

“This past year was pivotal in both our own transformation and in partnering with our customers who are navigating their own digital transformations”, said Satya Nadella, chief executive officer at Microsoft. “The Microsoft Cloud is seeing significant customer momentum and we’re well positioned to reach new opportunities in the year ahead.”

Cloud Services

Revenue in Intelligent Cloud grew 7% (up 10% in constant currency) to USD$6.7bn (£5.11bn), with the following business highlights:

– Azure (Microsoft's major cloud offering) revenue grew 102% (up 108% in constant currency) with Azure compute usage more than doubling year-on-year

– Office commercial products and cloud services revenue grew 5% (up 9% in constant currency) driven by Office 365 commercial revenue growth of 54% (up 59% in constant currency)

– Office consumer products and cloud services revenue grew 19% (up 18% in constant currency) with Office 365 consumer subscribers increasing to 23.1 million

– Dynamics products and cloud services revenue grew 6% (up 7% in constant currency) with Dynamics CRM Online paid seats growing more than 2.5x year-on-year

– Server products and cloud services revenue increased 5% (up 8% in constant currency) driven by double-digit annuity revenue growth

However, Microsoft are not the only company stepping into the ring to challenge Amazon and Google's cloud services. As reported on ExchangeWire yesterday, IBM reported cloud revenue growth of 30%.

Search Advertising

– Search advertising revenue excluding traffic acquisition costs grew 16% (up 17% in constant currency) with continued benefit from Windows 10 usage.

Business and Consumer, Non-Cloud

– Enterprise Mobility customers nearly doubled year-on-year to over 33,000, and the installed base grew nearly 2.5x year-on-year

– Revenue in More Personal Computing declined 4% (down 2% in constant currency) to USD$8.9bn (£6.79), with the following business highlights:

– Windows OEM non-Pro revenue grew 27% (up 27% in constant currency), outpacing the consumer PC market, and Windows OEM Pro revenue grew 2% (up 2% in constant currency)

– Surface revenue increased 9% (up 9% in constant currency) driven by Surface Pro 4 and Surface Book

– Phone revenue declined 71% (down 70% in constant currency)

– Xbox Live monthly active users grew 33% year-on-year to 49 million

Microsoft's earnings report marks its first since the announcement of its agreement to buy LinkedIn.

Although it's too soon for the social media platform to impact this quarter's earnings, Microsoft gave commentary regarding the rationale behind the deal, timing and integration of LinkedIn's rich array of data.

LinkedIn could be useful for industries like recruiting, training, and marketing, as Microsoft moves away from siloed offerings, towards collaborative tools and services that come along with joining Microsoft's cloud, Nadella said.

Microsoft: Source Google Finance

You can read the full results here, from a Microsoft Press Release.

Follow ExchangeWire