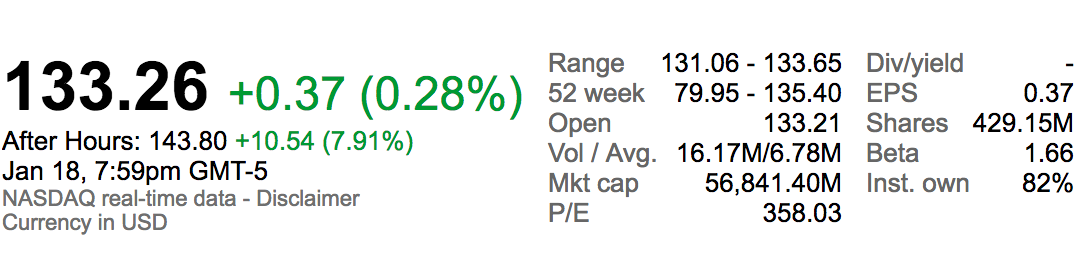

Netflix Stock is Soaring

by Rebecca Muir on 19th Jan 2017 in News

Yesterday (18 January, 2017) Netflix, Inc. (NASDAQ: NFLX) released its fourth-quarter 2016 financial results with great aplomb. This quarter marks the 10th anniversary of Netflix's content streaming offering, thus, the beginning of the disruption of the traditional TV landscape. The next decade promises to be even more tumultuous as internet TV surpasses linear TV.

In 2016, the disruptive giant Netflix generated USD$8.3bn (£6.8bn) in global streaming revenue (35% year-on-year growth) and finished the year with 93.8 million members – 19.0 million net additions versus 17.4 million in 2015.

Financial highlights

- In Q4, global streaming revenue grew 41% year-on-year to USD$2.4bn (£2bn)

- Profit rose 74% year-on-year to USD$470 m (£383m) (20% margin)

- 7.05 million net new members joined globally in the quarter, against a forecast of 5.20 million, up 1.5 million year-on-year. This was the largest quarter of net additions in Netflix's history and was driven by strong acquisition trends in both the US and International segments

- Over 47% of total members are now outside of the US

- In 2017, Netflix plans to invest over USD$6bn (£4.9) on content (up from USD$5bn in 2016)

High-quality content travels well across borders, for example, Friends is quite possibly the most watched TV show of all time, globally. In a letter to their shareholders, Netflix said: "Learning how best to match content with audience tastes around the world is driving growth." Netflix's global originals, like Marvel’s Luke Cage, The Crown, and season three of Black Mirror, continue to generate excitement and high viewing figures across the world.

Netflix's first Brazilian original series 3%, a sci-fi, post-apocalyptic thriller, premiered as one of the most watched originals in Brazil and played well throughout Latin America. Moreover, bucking conventional wisdom, millions of US members have watched the show dubbed and subtitled into English, making 3% the first Portuguese language television show to travel meaningfully beyond Latin America and Portugal.

In Q4, Netflix launched offline viewing, which allows members to download content to iOS and Android devices. This makes Netflix as accessible as possible to members in countries and locations (such as subways and airplanes) with limited and/or expensive bandwidth.

Internet video is a global phenomenon. Amazon Prime Video expanded recently to match Netflix's territory footprint, while YouTube remains far larger than either in terms of global video enjoyment minutes.

Video consumption is growing on Facebook, and Apple is rumoured to be adding video to their music service. Satellite TV operators are moving to become internet MVPDs, such as ViaSat to ViaPlay in the Nordics, DISH to Sling, and DirecTV to DirecTV Now. Insurgent firms such as Molotov.tv in France and Hulu are building native-internet interfaces for TV network bundles. CBS is releasing a major original series (Star Trek) exclusively on their domestic SVOD service (with us as international partner). Finally, the BBC has become the first major linear network to announce plans to go binge-first with new seasons, favouring internet over linear viewers.

In short, it’s becoming an internet TV world, which presents both challenges and opportunities for Netflix as they strive to earn screen time. Still operating without advertising revenue is possible while membership numbers continue to grow. Whether this is still possible when membership growth slows remains to be seen.

Source: Google Finance

Follow ExchangeWire