Loyalty Schemes Losing Appeal With Customers; UK Shoppers Demand More Integrated Omnichannel Experience

by Hugh Williams on 22nd Feb 2018 in News

RetailTechNews’ weekly roundup brings you up-to-date research findings from around the world. In this week’s edition: Loyalty schemes losing appeal with customers; UK shoppers demand more integrated omnichannel experience; and The mobile path to purchase.

Loyalty schemes losing appeal with customers

Lack of omnichannel integration between online and in-store loyalty experiences is leaving 71% of UK consumers disappointed, the latest research from Vodat warns.

Lack of personalisation was the top frustration for shoppers when it came to retailers’ loyalty schemes, with nearly two thirds (65%) of shoppers saying that they don’t get sufficiently targeted offers in-store. And, with technological advancements in bricks-and-mortar, a third (33%) of UK consumer now expect in-store experiences and marketing communications to be tailored based on their previous visits in order to give them more relevant encounters – and offers.

Omnichannel capabilities also proved a key consideration when it came to loyalty scheme adoption, with 81% of shoppers wanting apps that would let them collect and redeem points in the store and online. Nearly three quarters (72%) of shoppers now expect to receive an immediate discount sent to their smartphone upon entering a store, highlighting the role of mobile loyalty in meeting connected customers’ needs. Indeed, a third of shoppers (29%) said that mobile connectivity was now an essential part of their in-store visit, while a further third (34%) expected to be rewarded for using their mobile within the store when logged on to in-store WiFi .

UK shoppers demand more integrated omnichannel experience

Although the UK won’t be moving to a purely virtual, exclusively online retail world anytime soon, there is a clear demand for increased integration across online and in-store, according to the results of the ‘Future of Retail’ survey, by InternetRetailing Expo. This is both in terms of the shopping experience and the customer data collected (or not) at each point.

Almost a third (30%) of those surveyed say they would like their offline purchases to be added to their online profiles so that brands could have a single view of their tastes and purchase behaviour. Unsurprisingly the in-store experience remains a powerful force due to the physical experience of purchasing a suitable product. Even though 93% of respondents had ordered a product online within at least the last month, 43% claim to still buy all their clothing in-store.

Half of respondents (48%) would like more retailers to enable them to see how an outfit might look on them virtually – whether online or instore. In fact, 10% claimed that if retailers offered customers the chance to see how an outfit would look on them, without physically changing, either online or in-store they would purchase more, with 17% claiming they would not only purchase more but also return less.

The mobile path to purchase

The mobile path to purchase can be characterised as unfocused and fleeting, according to recent data from Verto Analytics.

The survey finds that the average mobile shopping session involves six different apps—including 1.5 shopping apps—and is relatively short: 80% were under four minutes.

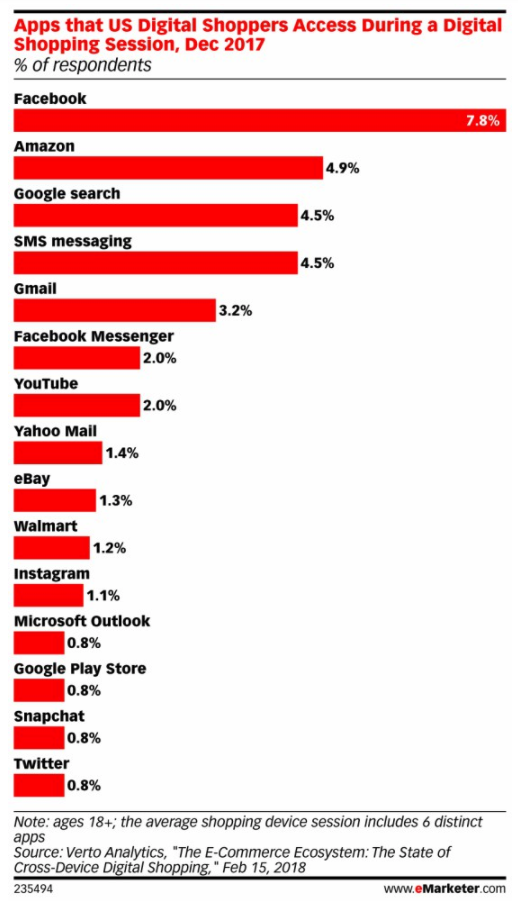

The apps that take the largest share during a shopping session are a mix of social, search, texting and shopping. Facebook is visited in nearly 8% of sessions, while Amazon (4.9%), Google search (4.5%) and SMS messaging (4.5%) all have similar levels of use.

App usage doesn’t differ wildly between genders: Women spend 3.2 minutes per session compared with three minutes for men. But age does play a role. Millennials, for example, spend the least amount of time per session (2.6 minutes). By comparison, Gen Xers spend 3.4 minutes, baby boomers spend 4.3 minutes and those 75 and older spend just shy of five minutes.

M-CommerceMobileOmnichannelPersonalisationUK

Follow ExchangeWire