Sojern Reveals Further Insights on COVID-19's Impact on Travel

by on 28th Apr 2020 in News

Travel digital marketing firm Sojern has launched a new blog series focusing on the impact of the Coronavirus on global travel. Using real-time traveller audiences and insight into global travel demand, the company aims to inform marketers and help them prepare for recovery once the situation stabilises. In this post, Sojern reveals further insights on the impact that COVID-19 has had on travel to and within key European markets.

These insights are based on data collected on the 27th April, 2020. We will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Sojern's insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

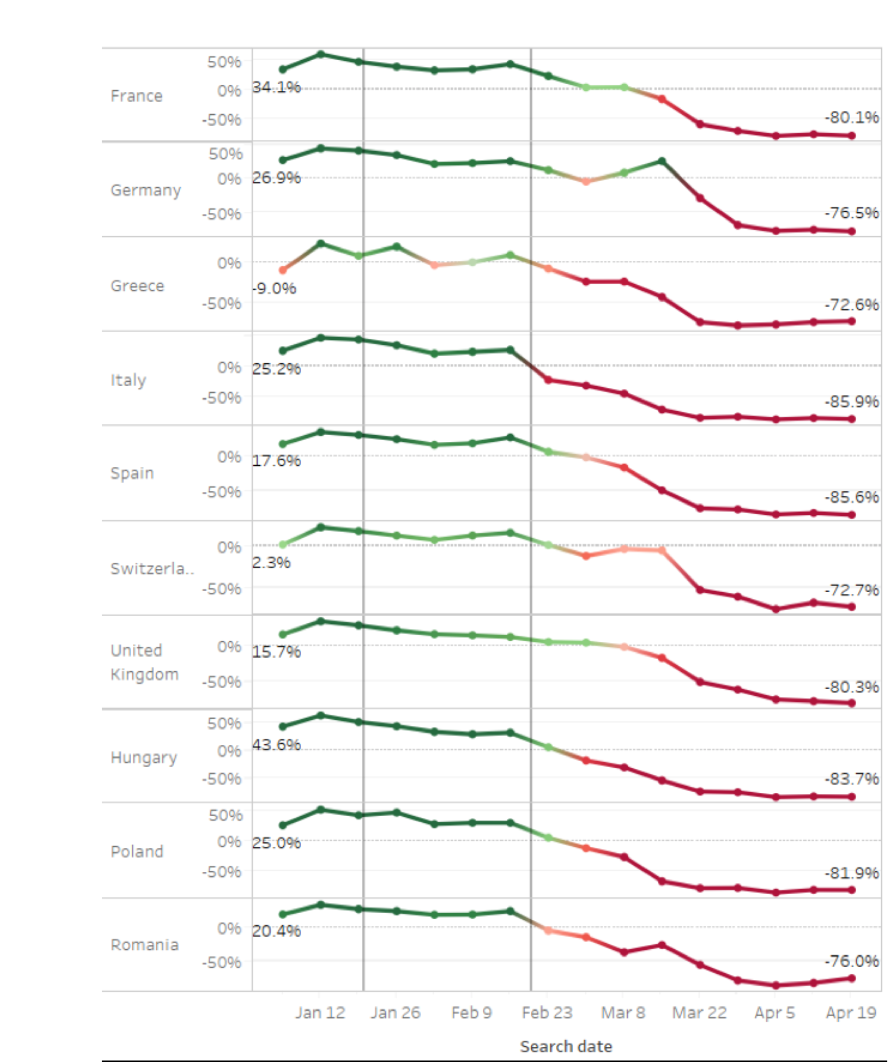

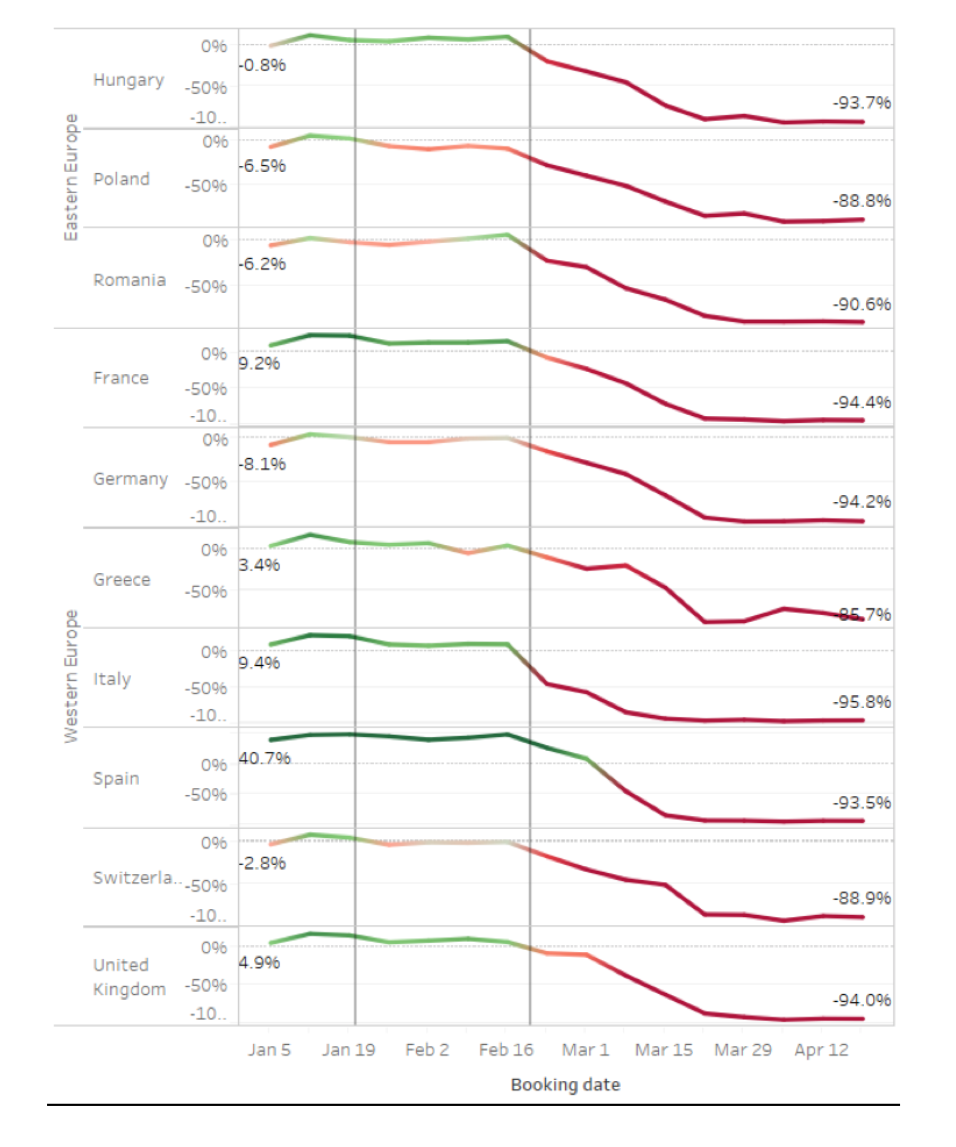

Global flight searches and bookings still down, but some bright spots

Flight searches and bookings remain down, similar to the previous few weeks. As travel is essentially at a standstill, this is expected.

What is interesting is that while down, countries that have announced steps to reduce or ease their lockdowns, are slightly less down when compared to countries that are still in the midst of full lockdown.

For example, Switzerland has reopened some businesses, such as approved hairdresser and flower shops, with the next stage of easing occurring on 11 May, when primary school children return to school and all retail stores reopen. Greece is opening registry offices and courts today (27 April), with plans to potentially reopen some shops next week. We see that travel searches to Switzerland and Greece are both down by 73% YoY, but this is slightly higher when compared to countries like the UK or France, that have not yet implemented lockdown restrictions, and are down more than 80% YoY.

Global Flight Searches to Key European Markets

Global Flight Bookings to Key European Markets

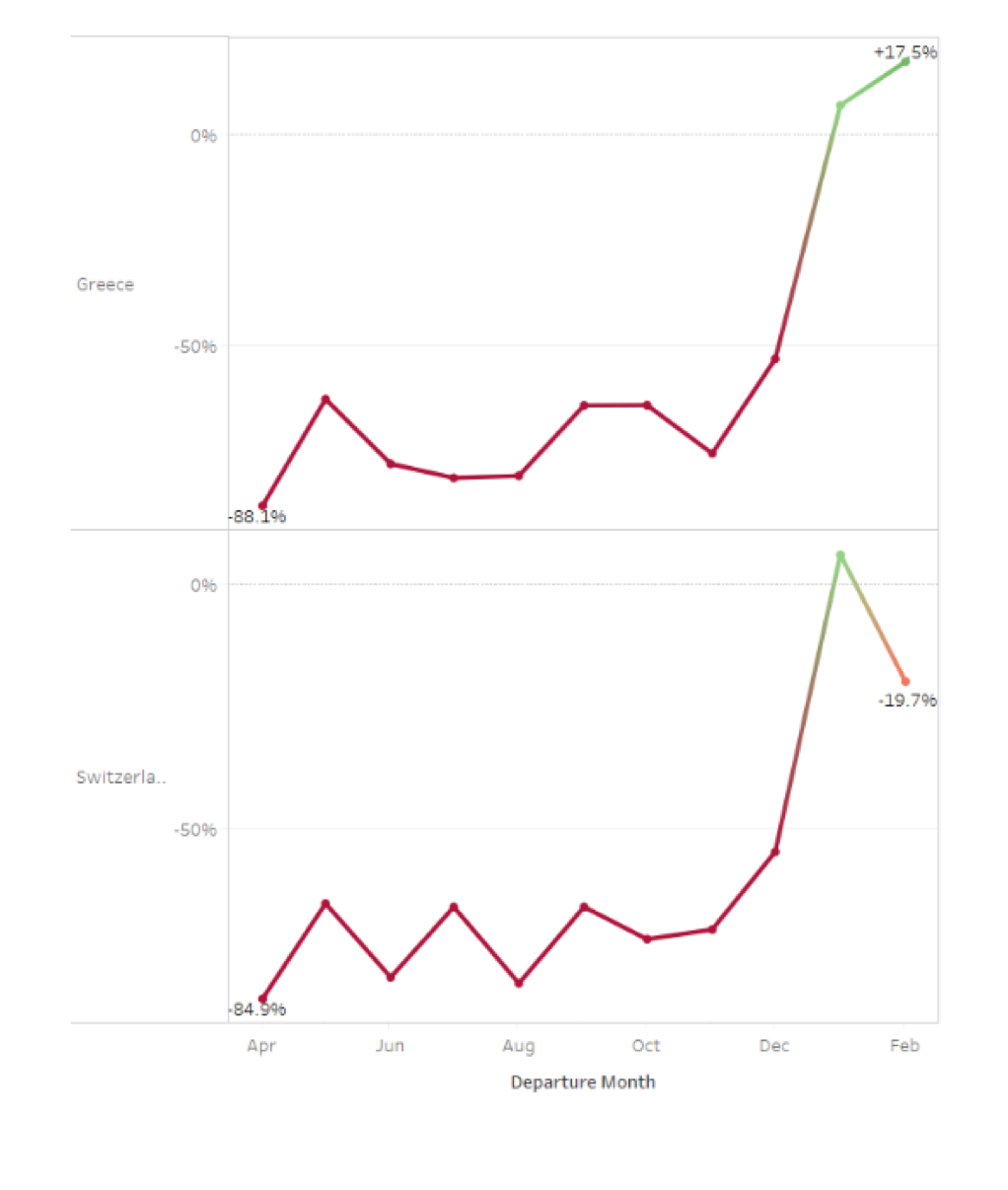

Switzerland and Greece Show Uptick in Travel Intent

When we look more closely at Switzerland and Greece long-term, we also see an uptick in Intra Regional (ie - European) travel intent as early as November. By February 2021 we see that European travel searches to Greece are up nearly 18% YoY. Switzerland is also showing a positive upwards trend for the same period, although we currently see it peak in January 2021.

Diving a bit deeper into this data, the flight searches that are currently happening, are for more immediate travel. For example, about 87% of searches for travel for the next 11 months to Greece, and 81% of searches to Switzerland at the moment are for travel in either Q2 or Q3. While bookings are a greater sign of travel confidence than searches, this is a positive sign that people are still looking for travel in the near future—far sooner than 2021.

Future Flight Searches to Greece and Switzerland from Regional Origins

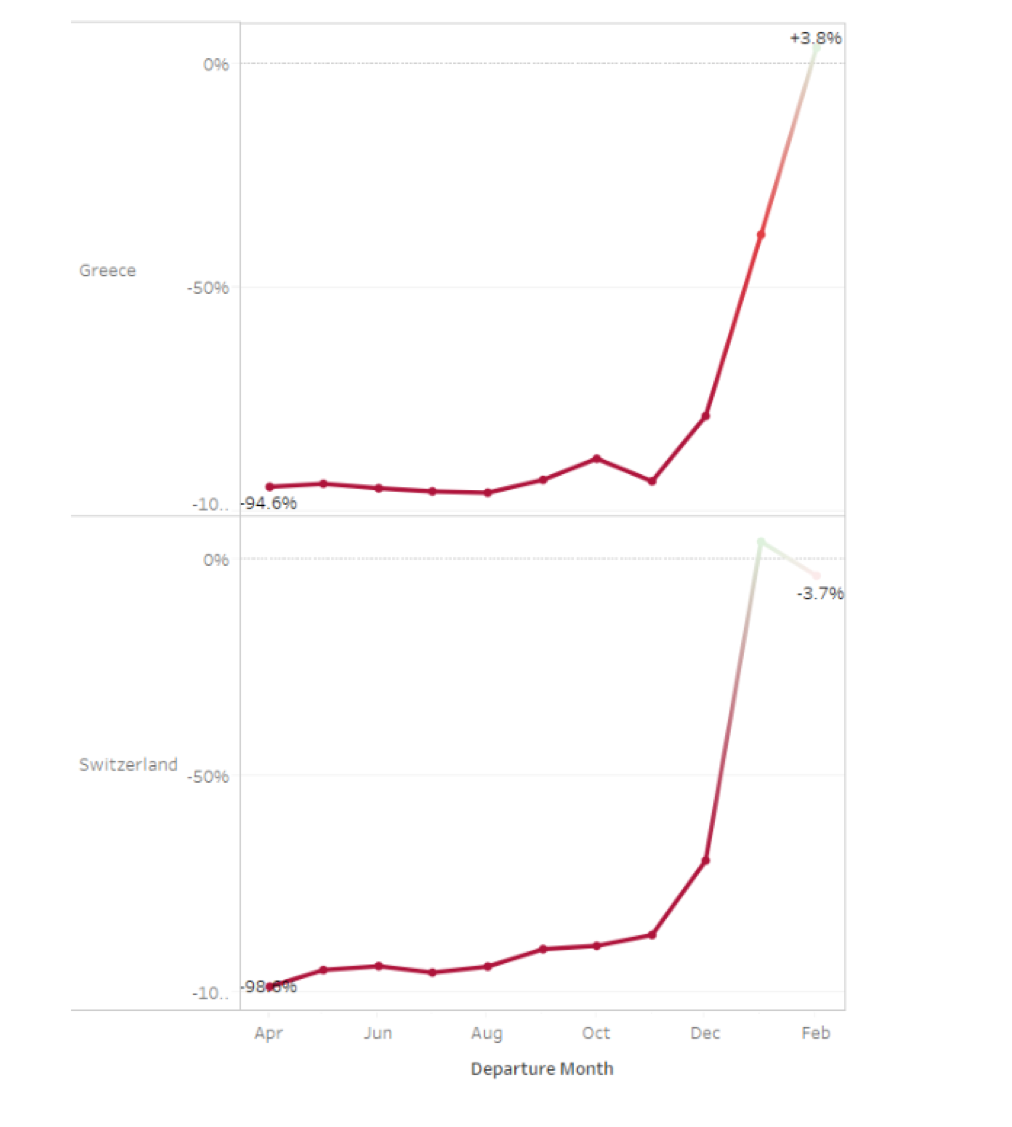

What is also encouraging is that we see an increase in flight bookings from European origins to these two countries during the same period - to the point where they are only up or down a few percentage points YoY.

Future Flight Bookings to Greece and Switzerland from Regional Origins

Czech Republic Eases Non-Essential Travel, and Travel Intent Surges

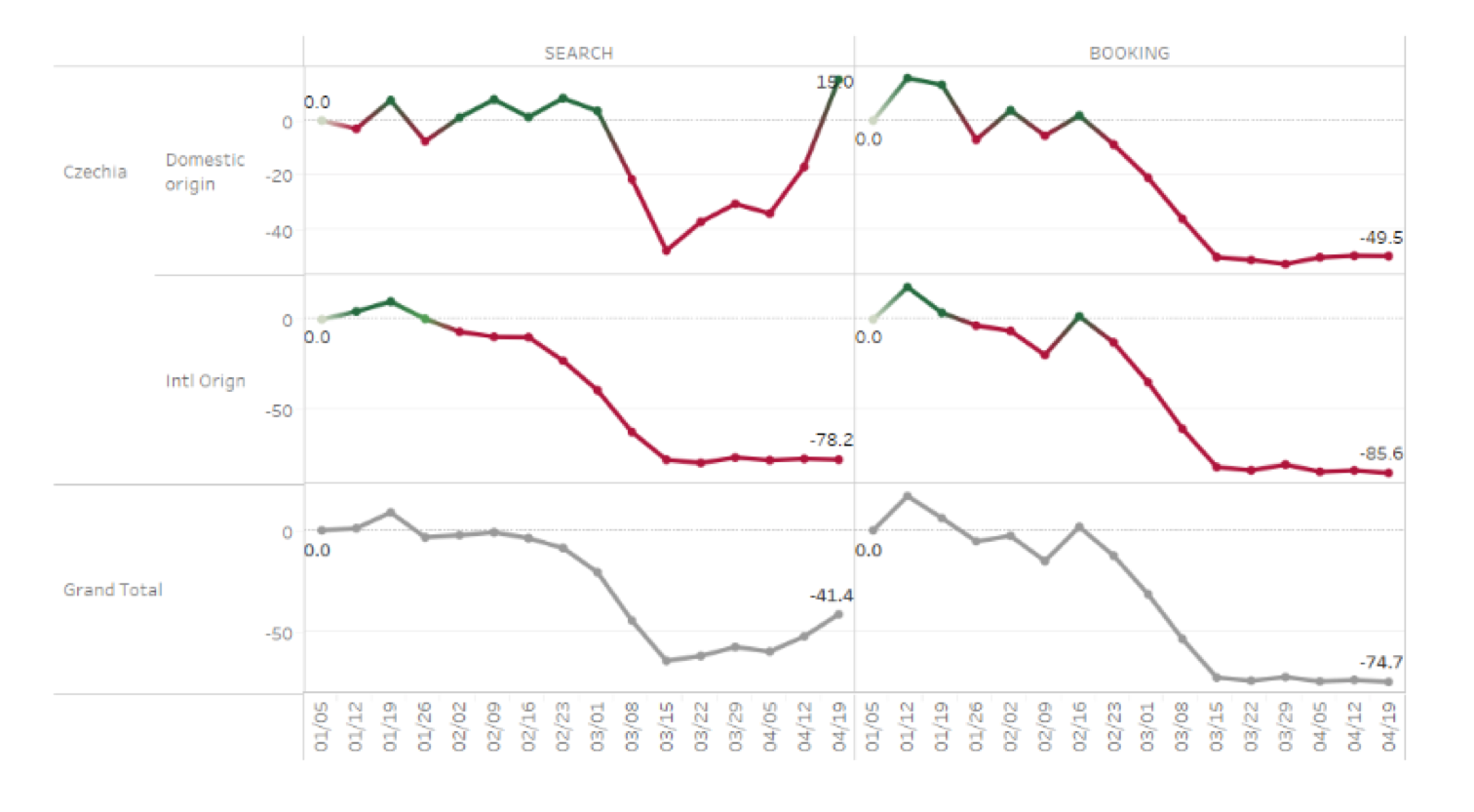

One European country that has started to dramatically reduce lockdown restrictions is the Czech Republic. Today the government has reopened universities - and in fact, non-essential travel is now permitted, although masks are required to be worn while in public. Domestic hotel searches have seen a dramatic uptick - and at last reading were up 15% YoY. While bookings are still down, this is a positive trend, showing that once travel restrictions are lifted, there is a near-automatic recovery in travel intent.

Hotel Searches and Bookings to Czech Republic

We will continue to share more insights as we monitor the situation. While global flight searches and bookings remain down at present, we do see some European countries in a position to start easing their lockdown restrictions, which is having a positive impact on travel intent, at least domestically. These forward looking insights will hopefully help travel marketers shape their strategies when the industry starts to recover from this outbreak.

For the rest of the COVID-19 insights series click here.

Follow ExchangeWire