Sojern Releases Latest Findings on COVID-19 Travel Impact

by on 12th May 2020 in News

With access to real-time travel audiences and unmatched visibility into global travel demand, Sojern is in a unique position to share the current travel trends at the forefront of marketers’ minds. These insights are based on data collected on the 11th May, 2020. We will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Sojern's insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

Global Flight Searches and Bookings Remain Much the Same as Previous Weeks

Flight searches and bookings remain very much the same as in previous weeks, and until airlines resume more regular operations and borders start to reopen, we expect these trends to continue.

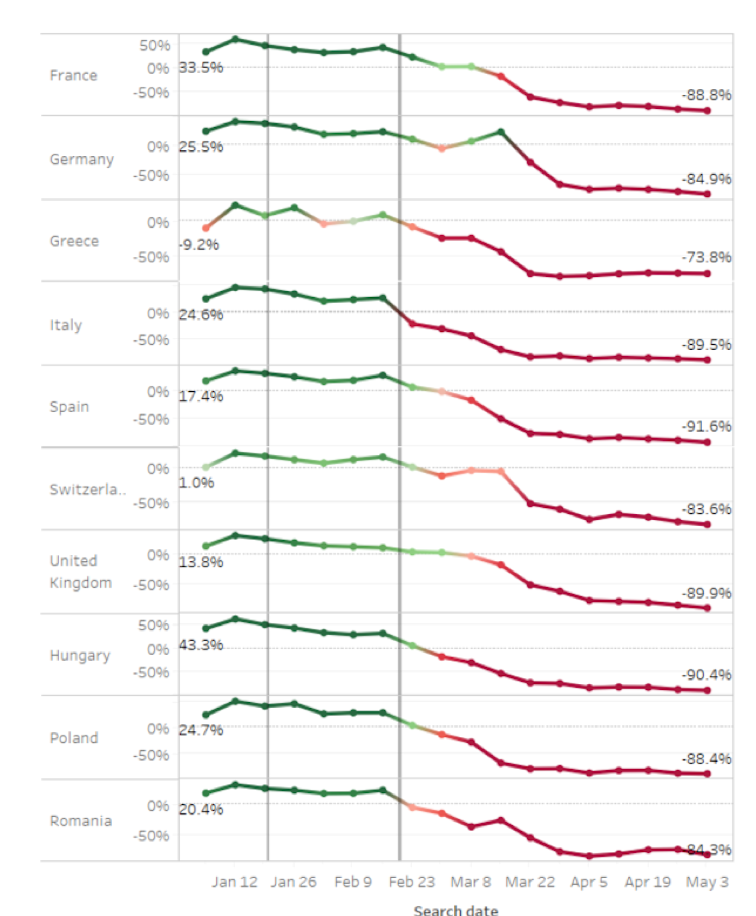

Global Flight Searches to Key European Markets

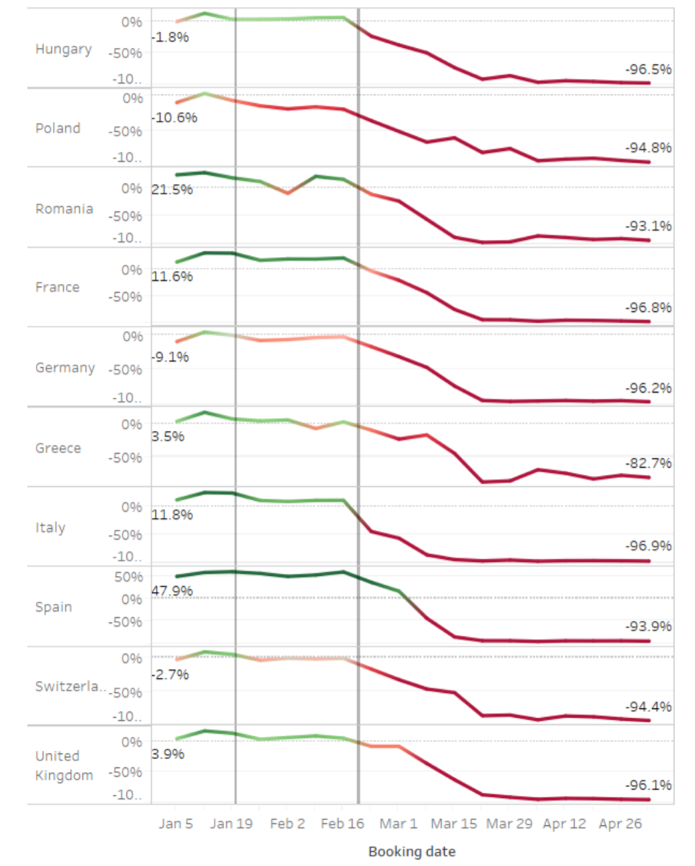

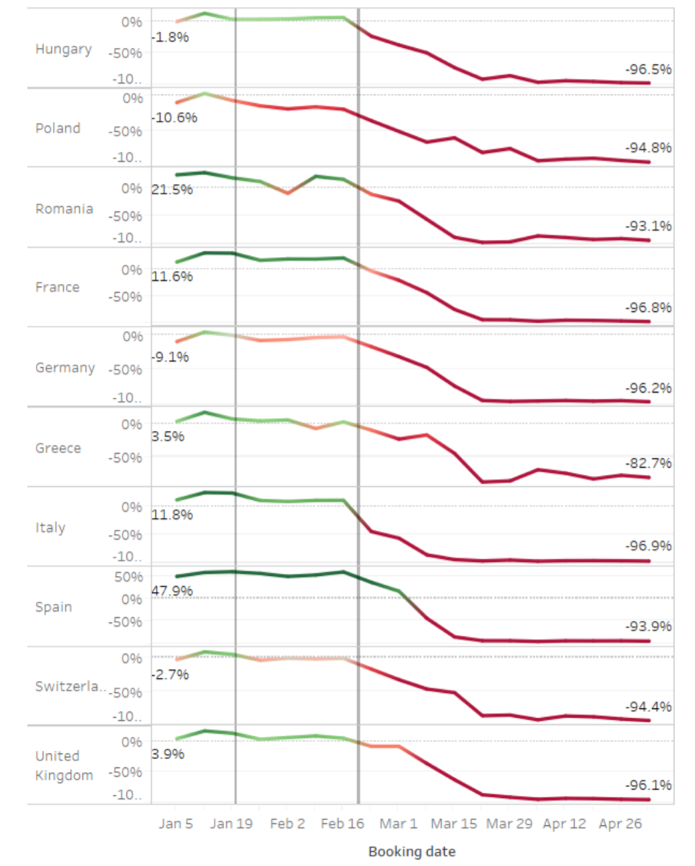

Global Flight Bookings to Key European Markets

DACH Sees Increase in Domestic Hotel Intent

One European region which has been particularly proactive in it’s approach to COVID-19 is DACH. Each of these countries has seemingly controlled the spread of the disease, and are starting to gradually ease lockdowns. We can see the impact of these easings on travel intent.

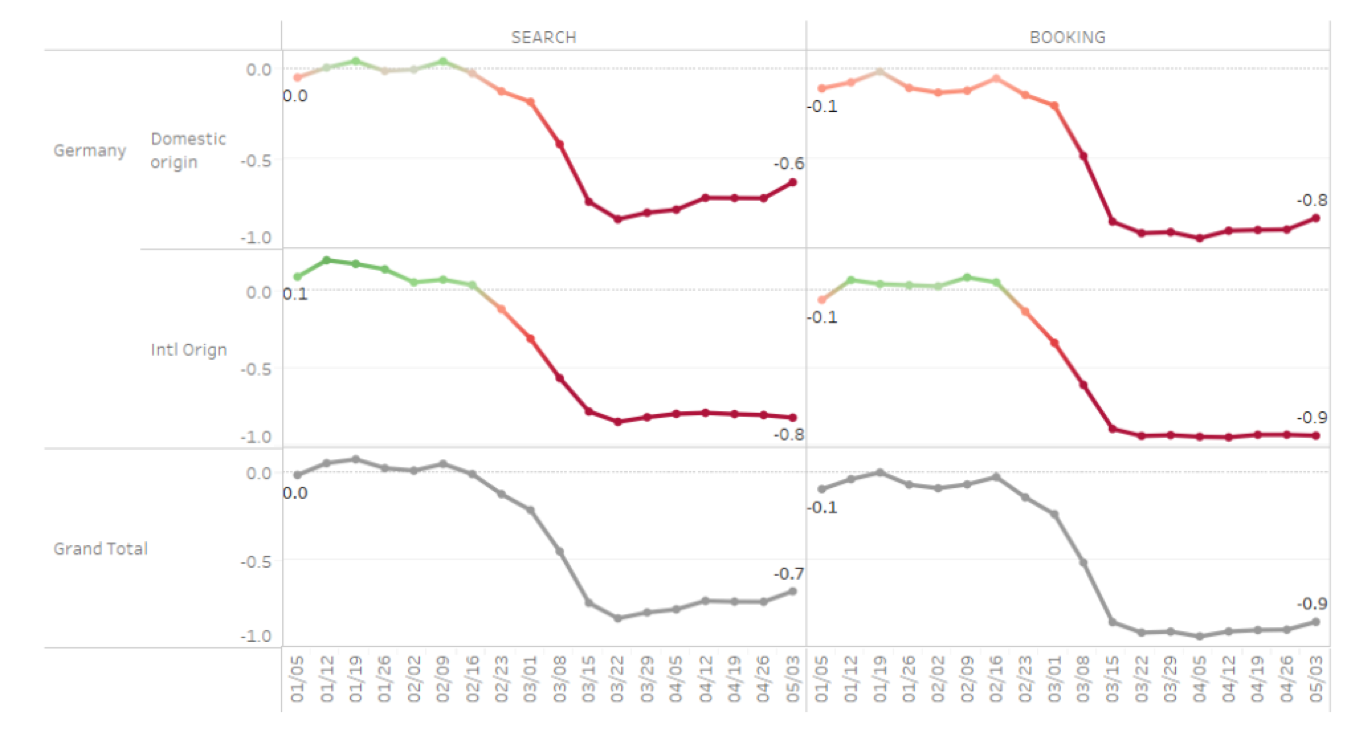

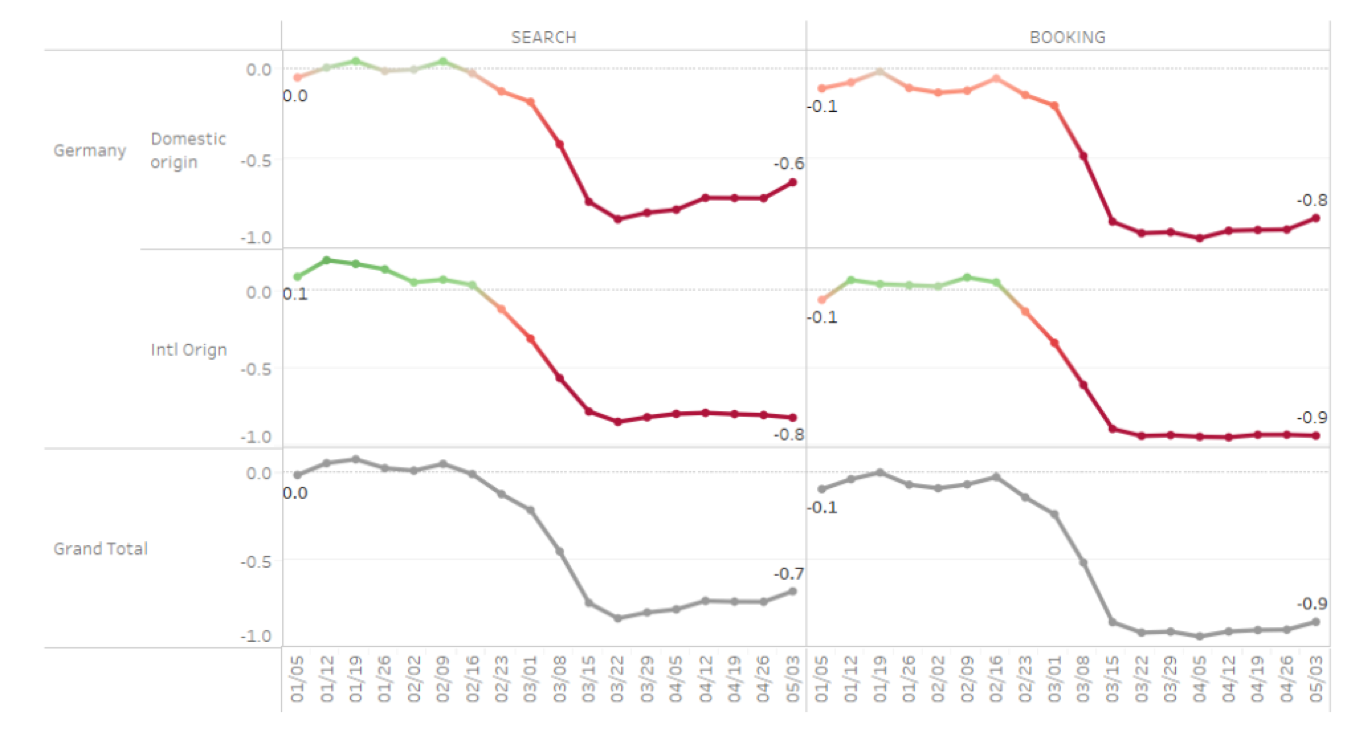

Germany’s 16 federal states will each decide when to reopen hotels, with some happening sooner than others. Berlin, for example, will allow hotels to reopen from 25 May. Domestic hotel intent in Germany has been improving in recent weeks, and the latest information indicates that domestic hotel searches are down 60% year-over-year, up from a YOY low of 80% only a few weeks ago.

Hotel Searches and Bookings Germany

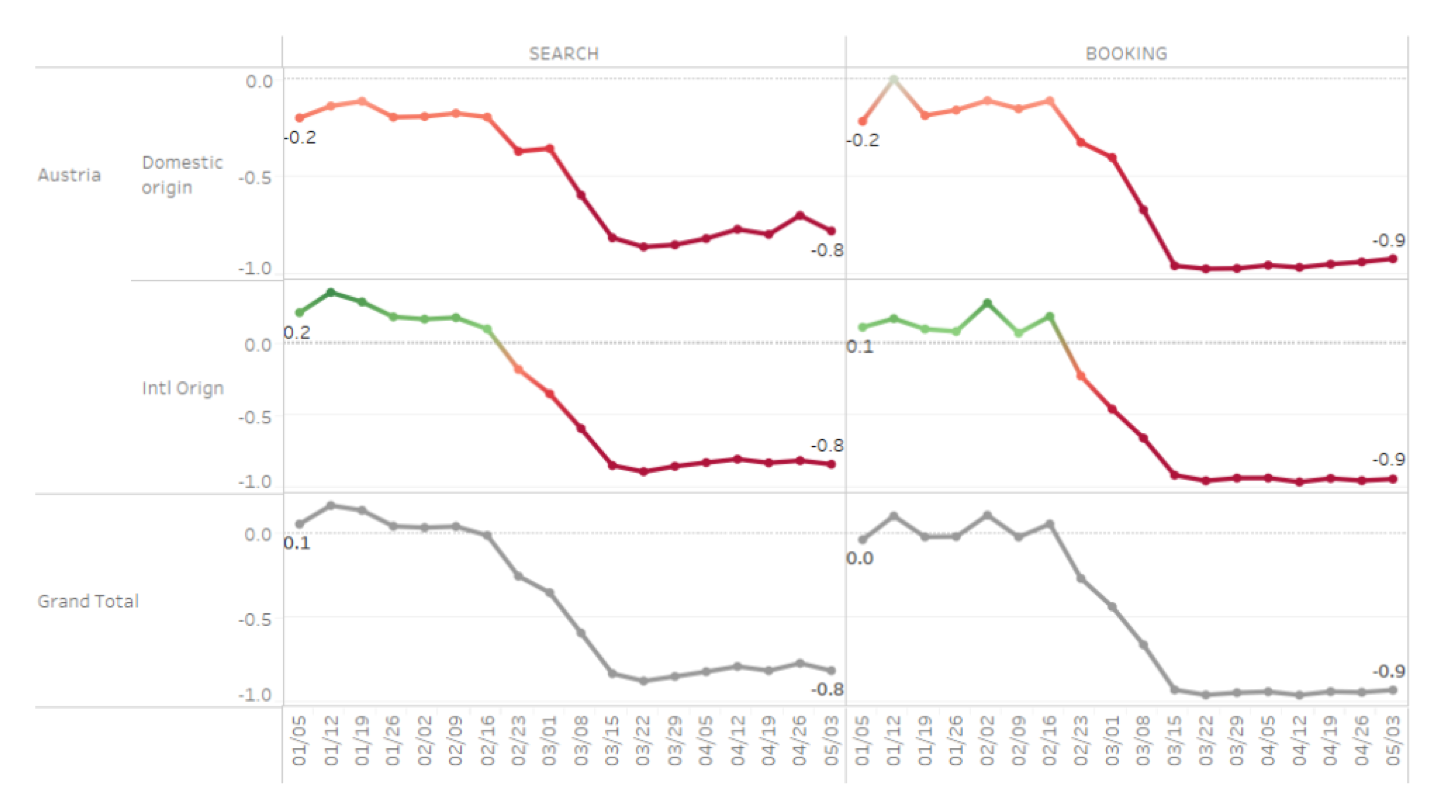

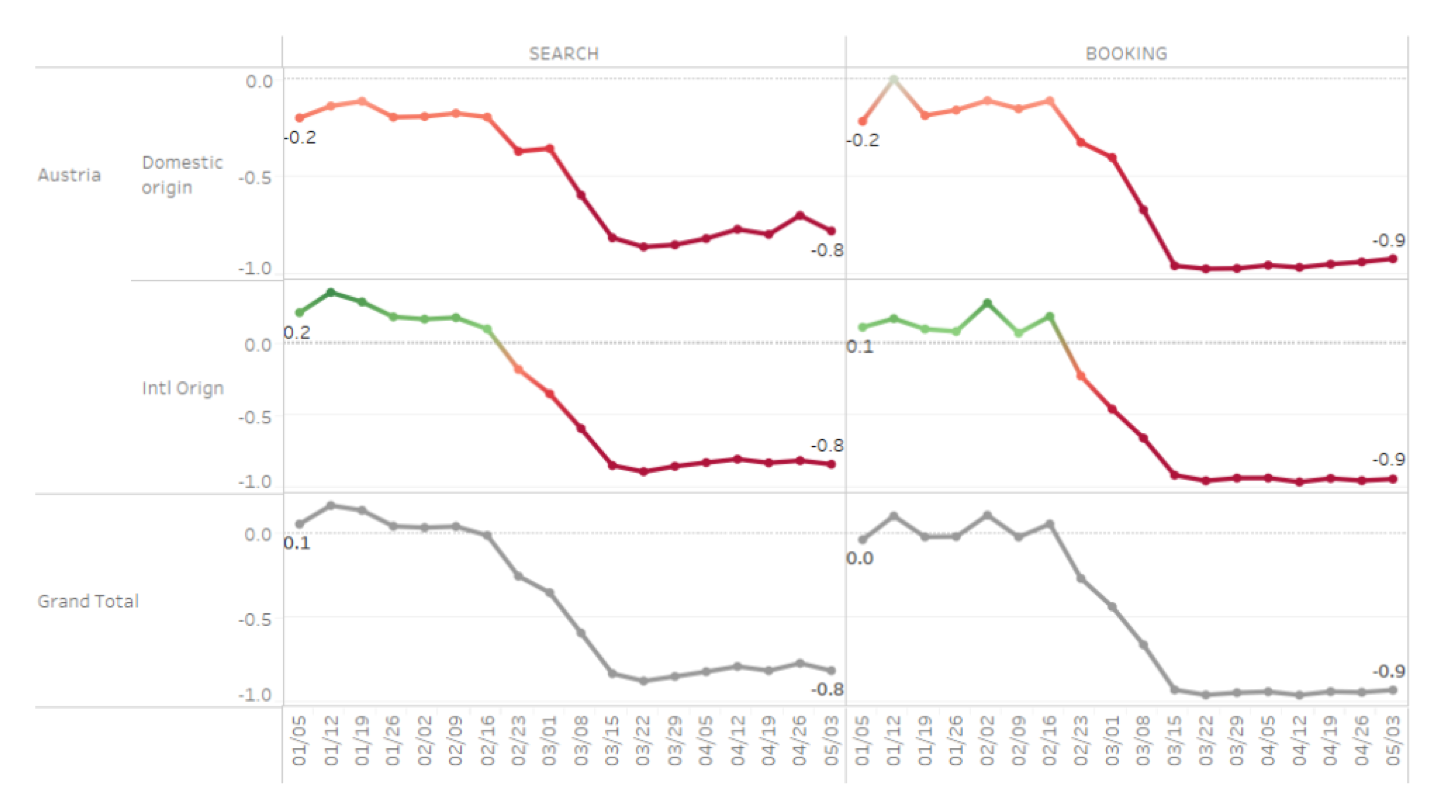

Likewise, hotels in Austria are set to open in a couple of weeks, on 29 of May, and they are seeing a very slight increase in domestic hotel intent, although YOY searches remain far lower.

Hotel Searches and Bookings Austria

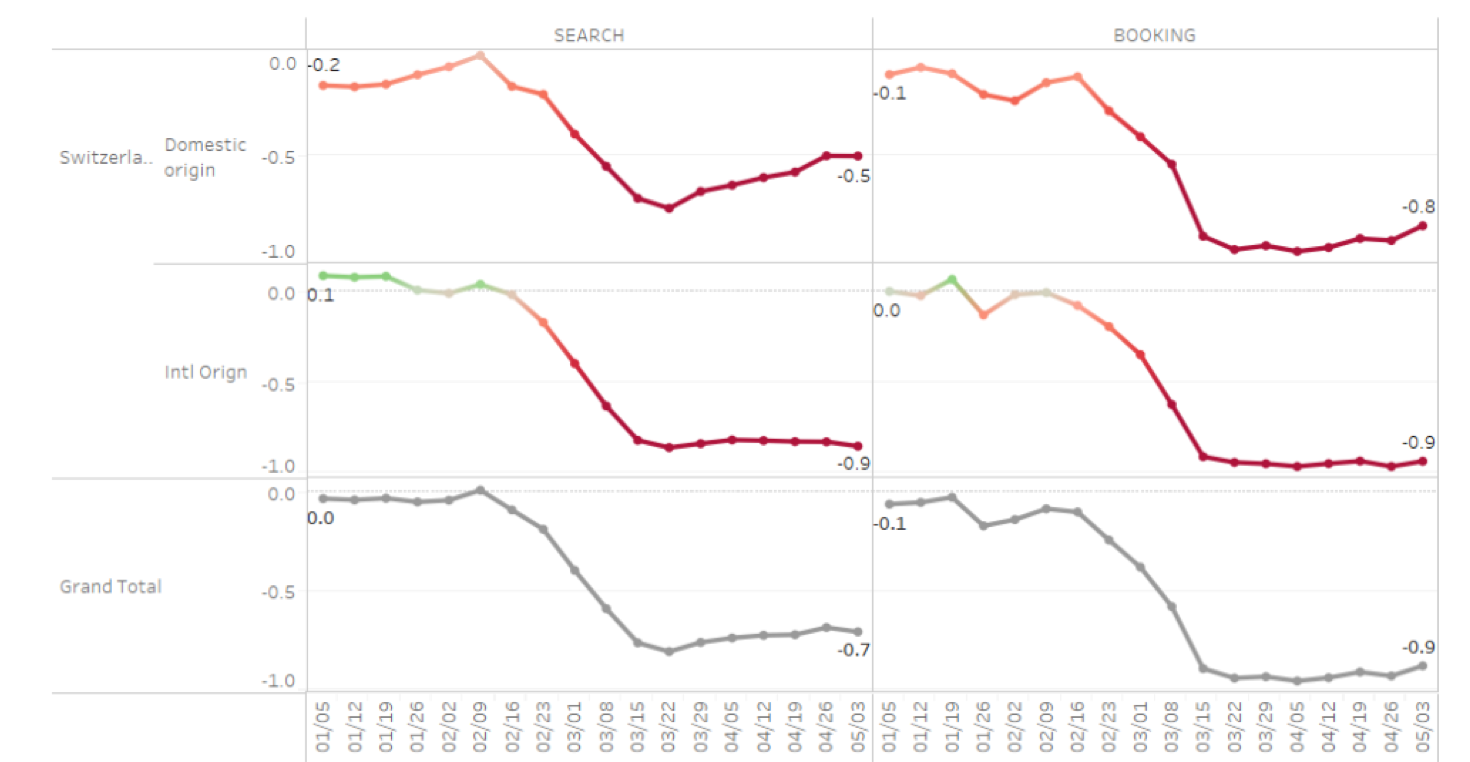

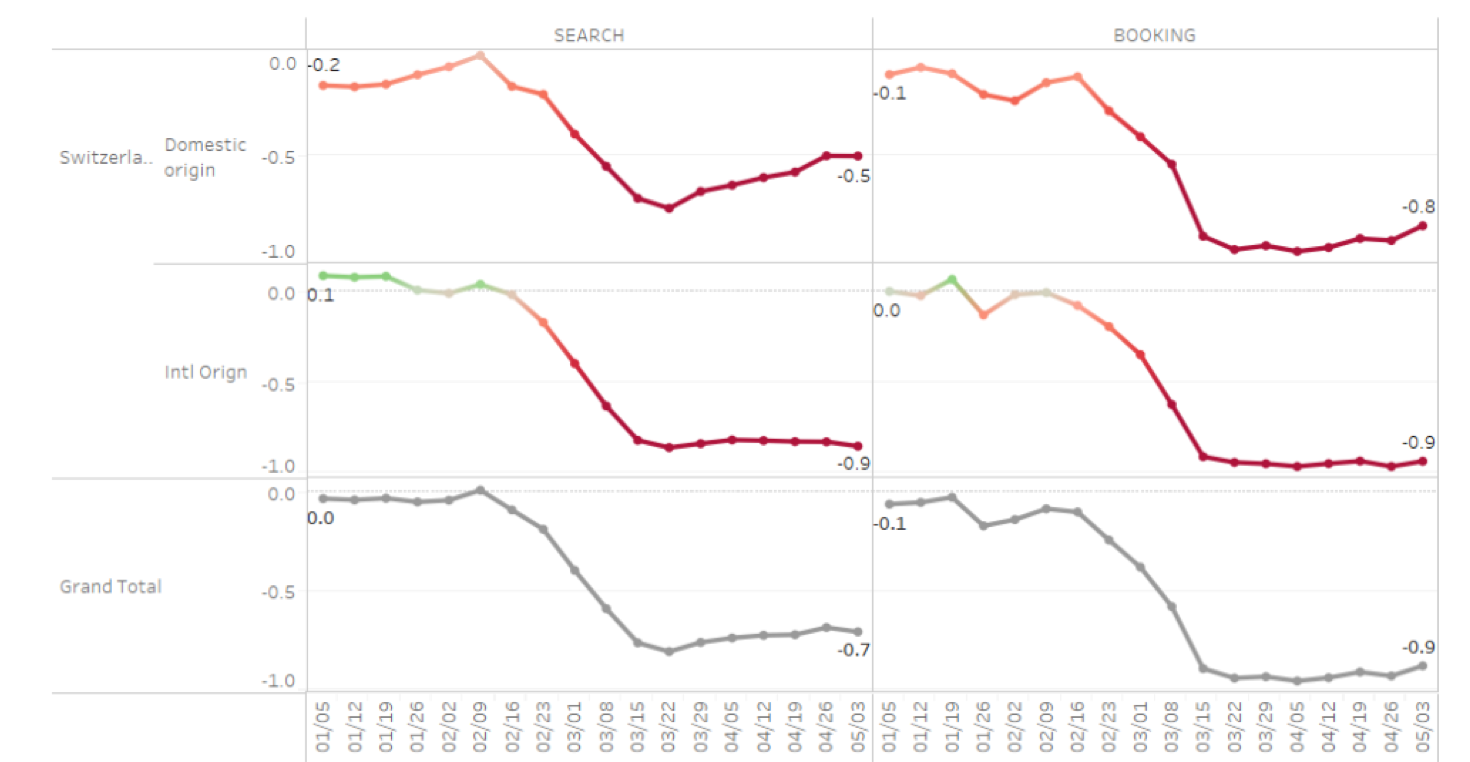

Many hotels in Switzerland are open if they are able, and as a result, we can see the impact on hotel intent. Currently, hotel searches are down only 50% year-over-year - up from several weeks ago. While bookings remain low, we expect this to increase as further lockdown restrictions are loosened, and people feel more comfortable traveling, at least domestically.

Hotel Searches and Bookings Switzerland

Greece Attracts Interest from European and Middle Eastern Travellers

Greece has done incredibly well when it comes to their COVID-19 response. Due to early lockdowns, they’ve limited the number of fatalities. Should this trend continue, the Greek government is planning to reopen to tourists in July.

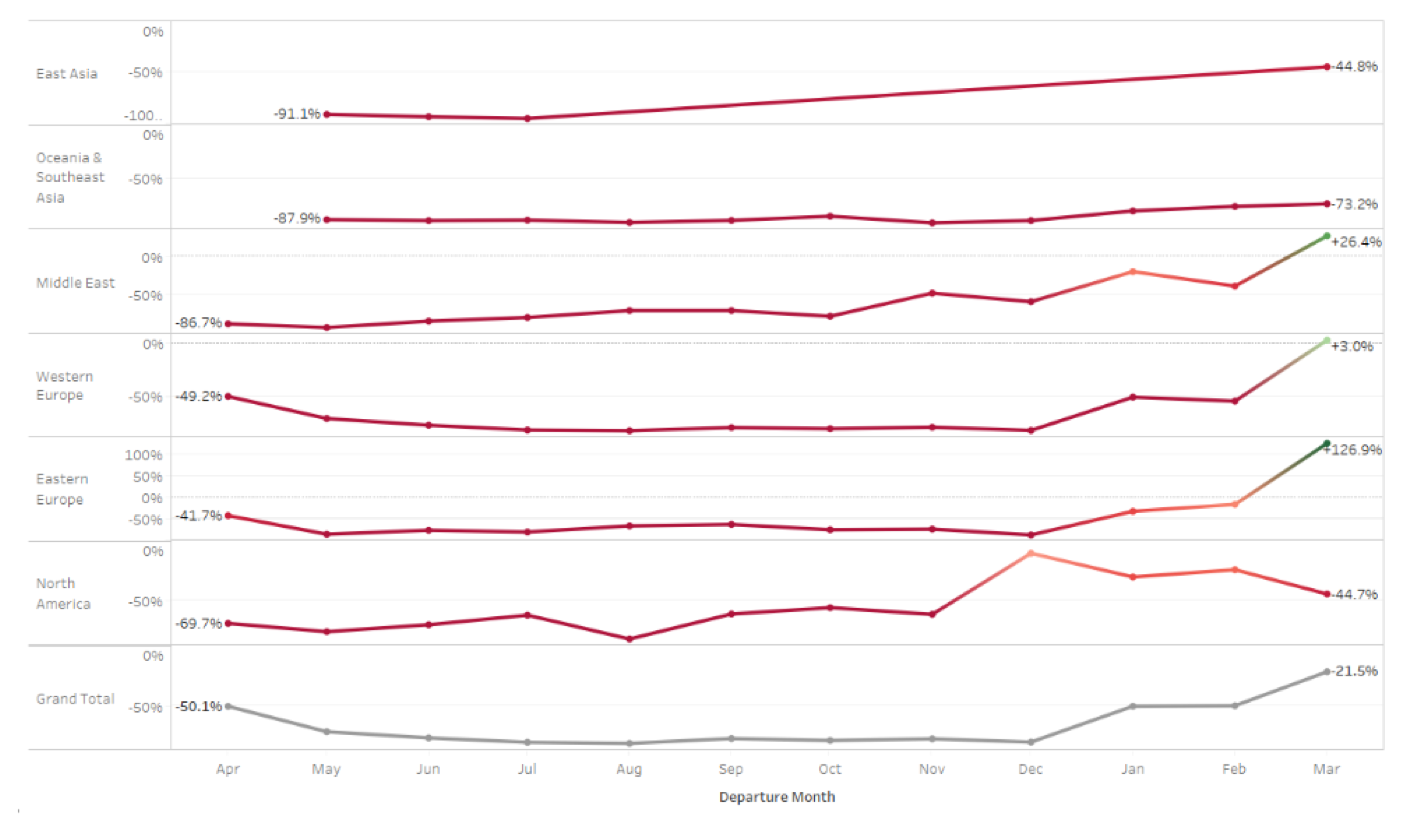

While the extent of this reopening will depend on airline availability and frequency, it’s looking like some travellers are already looking at the potential of a Greek holiday. In particular, travel intent seems to be highest from within Europe as well as the Middle East. And while we don’t see major improvements until 2021, it’s worth noting that half of all Greek searches from the Middle East and Eastern Europe, and over a third of searches from Western Europe, are for travel to Greece in Q3. We will continue to monitor this as the easing of restrictions continues.

Flight Searches Inbound Greece by Region

We will continue to share more insights as we monitor the situation. As some European countries begin to ease their lockdown restrictions, we are seeing slight upticks in domestic and even regional travel intent. These forward looking insights will hopefully help travel marketers shape their strategies when the industry starts to recover from this outbreak.

For the rest of the COVID-19 insights series click here.

Covid-19DataEuropeMeasurementTravel

Follow ExchangeWire