The Big Tech Financials Roundup - October 2022

by Mathew Broughton on 1st Nov 2022 in News

The financial results of the big tech and social media companies is typically seen as a barometer for the wider tech economy, and of course digital advertising. In this article, ExchangeWire senior editor Mat Broughton examines the results for Q2-Q3 2022 and gives his verdict on the health of the industry.

If you read the headlines and introductions accompanying the big tech financials bonanza, you would be forgiven for thinking advertising was in a right pickle. “Bad omen”; “Tremors”; “Choppy”; “Continued volatility”; and “More pain on the road ahead”. Yes, we have seen either a slowdown in revenue growth, or even a decline, in the past quarter. However, I would argue that these results do not justify these doom-laden headlines on the state of digital advertising.

Instead, these firms are predominantly overexposed to competitor gains or face restriction in targeting scale, or, in Mr.Zuckerberg’s case, both. On the latter, this shouldn’t come as a shock. We’ve now had years to prepare for identifier deprecation and the move towards privacy-first. On the former, isn’t a competitive market a healthy one?

Snap

- Revenue up 13% year-over year to USD$1.11bn (£956m)

- Net loss of USD$362m (£312m), compared to loss of USD$72m (£62m) in Q2 2021

- Daily active users up 19% year-over-year to 363 million

Snap remains an enigma in terms of its financial performance. One quarter the firm will report a surprise profit, the next it will report stinging losses. Overall, media reaction to Snap’s Q2 financials has been broadly negative, and the refusal to forecast future financial results is not a good look. In this quarter though, the firm openly discusses its three main issues, “The combination of macroeconomic headwinds, platform policy changes, and increased competition.” For platform policy changes read “Apple has mullered our measurement abilities”, for increased competition read “Eight people are joining TikTok every second”.

On the plus side for Snap, double-digit percentage growth in both revenue and users despite its challenges is highly encouraging. The net loss this year is primarily attributable to the 20% reduction in headcount the firm initiated and, while job losses are never something to be celebrated, streamlining has proven effective for the agency holding groups, with most now boasting recovered, or enhanced, headcounts following Covid-enforced layoffs.

- Revenue down 1% year-over-year to USD$1.18bn (£1.02bn)

- Advertising revenue up 2% to USD$1.08bn (£930m)

- Subscription revenue down 27% to USD$101m (£87m)

We won’t dwell too heavily on Twitter’s most recent financials, considering the firm has had the unique circumstance of sitting in purgatory for months while Elon Musk flirted, refuted, and has now finally acquiesced to buying the firm. However, the fall in subscription revenue is certainly notable, particularly given that the company is unlikely to perform a rapid Netflix-esque turnaround here as the firm lacks the scale of premium content as the Stranger Things maker (though the “spat” between Zimbabwe and Pakistan over cricket and a fake Mr Bean is certainly popcorn-worthy).

Musk has moved rapidly since closing the deal, axing a swathe of the Twitter board including CEO Parag Agrawal - though this is hardly a surprise given the acrimony of the takeover. (point 79 on page 33 remains my favourite piece of legal text from 2022).

Prior to the deal closing, Musk wrote openly on Twitter suggesting that the firm would be tweaking its advertising to ensure relevancy, stating “Advertising, when done right, can delight, entertain, and inform you[...] For this to be true, it is essential to show Twitter users advertising that is as relevant as possible to their needs. Low relevancy ads are spam, but highly relevant ads are actually content!”. While it is not certain how Musk intends to bolster this relevancy, given the controversy regarding bot accounts, the Trump-era toxicity of the platform, and the offloading of MoPub to AppLovin in 2021, it will at least be fun to watch.

Meta

- Revenue down 4% year to USD$27.7bn (£23.8bn)

- Net income of USD$4.4bn (£3.8bn), down 52% year-over-year from USD$9.2bn (£7.9bn)

- Average price per ad decreased by 18% year-over-year

- Reality Labs (ie Metaverse) revenue down 48%.

Oh dear. Oh dear, oh dear. Meta’s issues continue with falling revenue; declining average revenue per user (ARPU); increased operational costs; and the failure to hit a wide array of analyst expectations. Apple’s ATT is undoubtedly kicking the firm where it hurts, with ad revenue falling by over USD$1bn (£861m) over the course of the year, despite a mild increase in users.

Investors are getting nervous about Meta’s continued stay in the confidence doldrums. Altimeter Capital chair and CEO Brad Gerstner has written a scathing open letter to the Meta board demanding a reduction in the firm’s headcount , which has climbed an extraordinary 28% over the year to hit over 87,000, and more reserved spending towards its much-derided metaverse ambitions.

Aside from cost-cutting, the main question is, what is Meta’s short-to-mid-term strategy?

Privacy-preserving measures such as ATT are here to stay, and the firm will surely see a further knock once Privacy Sandbox fires up on mobile and Chrome. Shifting Instagram to a photo-video hybrid platform to counter TikTok is a compromise which is sure to further damage user trust. The next US presidential election, typically a boon period for its core Facebook platform, isn’t until 2024 and will be more heavily scrutinised in terms of political advertising and social media activity than ever before following the infiltration of the Capitol on January 6th 2021. Even if the firm’s metaverse play comes off eventually, this won’t be anytime soon.

Board changes in the next 18 months are likely as the firm seeks an injection of new ideas to drive it through this turbulent period. It may even risk anticompetitive scrutiny by acquiring these new ideas from other firms via M&A. Doubling up to three years, if reverse gear cannot be found, don’t be surprised to see pressure on Zuckerberg’s position.

Important caveat: In October, Meta announced legs. Let the resurgence commence…

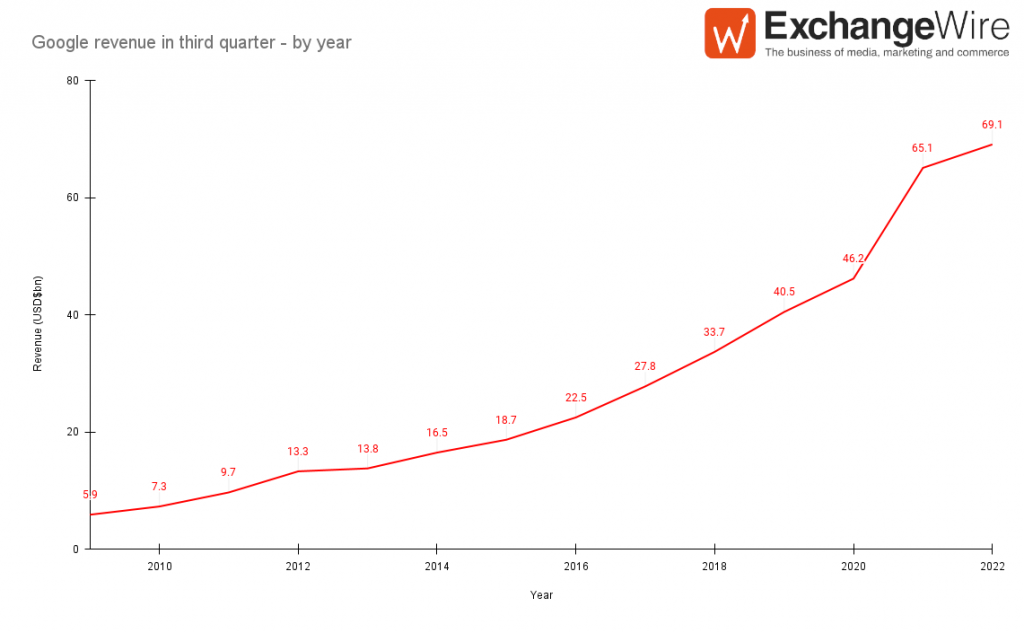

- Revenue up 6% year-over-year to USD$69.1bn (£59.4bn)

- YouTube revenue down 2% to USD$7.1bn (£6.1bn)

Many analysts have interpreted Google's slowdown in revenue growth, alongside other hits to big tech bottom lines, as a direct hit to digital advertising in the current economic game of Battleships, a conclusion easy to come to with Alphabet CEO Sundar Pichai bemoaning “a tough time in the ad market”. However, this is simply not the case.

Let’s cast our minds back. Google, a company which had grown its quarterly revenue to an eye-watering USD$46.2bn (£39.8bn) in Q3 2019, up 683% from ten years prior, astonished investors and other fans of particularly large numbers by reporting explosive growth of 41% over the year to hit USD$65.1bn (£56.0bn). Since then we have seen an overall economic slowdown, as well as Apple’s ATT and plucky upstart TikTok eating away at the Alphabet spaghetti, most prominently seen in the downtick in YouTube revenues, previously a steadily-growing line item for the firm. And yet revenue has continued to climb.

Moreover, Pichai’s “tough time” would be more believable if other firms in our nebulous industry were generally struggling. And the fact is: They’re not. All four agency holding groups have increased their forecasts for this financial year, not decreased them. Independent ad tech firms are also flying, with the likes of PubMatic (+27%); The Trade Desk (+35%); Magnite (+20%) and Integral Ad Science (+34%) all displaying strong revenue growth.

Google’s slowdown is therefore more a reflection of an extraordinary growth surge over the course of the coronavirus pandemic and, more encouragingly, competition, rather than emblematic of a slowdown in advertising as a whole.

Amazon

- Net sales increased 15% to USD$127.1bn (£109.4bn)

- Advertising services revenue up 30% to USD$9.5bn (£8.2bn)

Revenue generated by Amazon’s advertising services continues to dramatically outpace that of its overall business. ExchangeWire has discussed the opportunity in retail media at length in recent months, and Amazon is definitely stretching its legs here. The segment is still wide open, with national and vertical specialists able to compete with the likes of Amazon and fellow US retail media colossus Walmart, opening more doors for independent ad tech firms and agency partners to work with retailers and marketers alike (oh what a slowdown we’re having).

Apple

- Revenue up 8% year-over-year to USD$90.1bn (£77.6bn)

- Services revenue, including advertising, up 5% to USD$19.2bn (£16.5bn)

Currently, Apple’s financials hinge primarily on revenue from its hardware devices and App Store. However, the company has long been seen as a sleeping giant in advertising, with its vice-tight grip on its own platform, more lucrative than that of Google’s in terms of consumer spending power, and diversified portfolio across music, games, and television. With the current energy crisis doubtlessly harming the profitability of device manufacturing, it will be of no surprise to see Apple make a firm push towards the high-margin ad business.

Even if Apple’s own advertising revenue remains a minor line item for the firm, it has a seismic effect on the industry. Just this week, as part of its iOS 16.1 release, Apple revealed a new directive requiring app developers to process advertising and promotional purchases as in-app purchases, meaning it can take a 30% slice of all these payments. Most notably, boosts for social media posts fall under this definition, further kneecapping Meta and potentially affecting the growth of both Snap and TikTok. The only thing that can now seemingly dent Apple’s ambitions for, frankly anything, on its platform is necessary antitrust enforcement, with active investigations taking place across the globe.

Still, at the moment, Apple CEO Tim Cook can rest easy and spend his time enjoying frivolous activities such as waving the chequered flag at Formula One races, and doesn’t he look thrilled about it?

In summary

The seismic duo of geopolitical dissonance and inflatory aftershocks from Covid means we are facing the most turbulent economic time since 2008, perhaps in living memory. Add in the monumental shift to digital advertising business models that have needed to be seen, and you would surely expect to have seen the digital ad industry in a death spiral…

… except we haven’t.

Independent ad tech continues to grow, exhibiting nimbleness and adaptability that makes Google’s epic FLoC-up and Meta’s trudge towards its unrealistic dystopia look embarrassing. Agency holding groups, offering a diverse range of services beyond “show someone that toaster they looked at last night”, including creative, PR, and retail media, are soaring. So what if revenue flows away from Google and Meta, and more firms see a share of the pie? Competition is the sign of a healthy market, not one in sickness.

AdvertisingBig TechGoogleMetaSocial Media

Follow ExchangeWire