The Cookie Lives, But the Pie Gets Smaller

by Mathew Broughton on 25th Jul 2024 in News

First, we had the delay. Then, the abandonment. On Monday, Google announced via a blog post that it was shelving the deprecation of the third-party cookie, and would instead, “introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time.” For now, Privacy Sandbox APIs will continue to be developed, however its future role within the browser is still dependent on what precise choice users will be offered.

Though some in the industry were delighted that the third-party cookie is set to stay, and that Google folded like a poorly-constructed blancmange in the face of regulatory pressure, queries remain as to whether regulators will accept the proposed 2-tier tracking solution, or indeed whether the decision to keep the cookie will have a major effect on the industry at all.

Per ExchangeWire CSO Ciaran O’Kane, “Google’s decision not to deprecate third-party cookies in Chrome doesn’t change the general direction of this industry. If anything, it will speed up the process.

“By allowing the user to opt out of third-party cookie tracking, we could likely see a tiny opt-in rate - thus giving Google an unprecedented competitive advantage.

“It’s tough to understand Google's rationale here. I doubt this will satisfy the CMA’s competitive concerns. As long as there is a link between Chrome and Google ad tech stack, they will have problems convincing the UK regulator.

“My bet is that the announcement is a precursor to a divestiture of ad tech assets. By cutting ties between sell-side ad monetisation and Chrome privacy, Google could quickly get its Chrome changes past the CMA.

“This will probably happen in the weeks before the landmark ad tech DOJ trial. The discovery process could open a Pandora’s box for Google. A deal is likely. Ad tech will be the sacrificial lamb.

“A GAM/Adx divestiture would be transformational for independent ad tech. The next few weeks are going to be interesting.”

The democratisation of anticompetitive behaviour

Google IS deprecating the third-party cookie. Or if you’re particularly picky on semantics: Google is deprecating the value of the third-party cookie, in a way that moves culpability away from them onto the user.

Borrowing from Apple’s ATT playbook, Google is trying to shift the narrative from “Google is deprecating the third-party cookie” to “Users are choosing not to use the third-party cookie, they want Privacy Sandbox.” Looking at the move purely through the lens of privacy, it seems noble enough, but not when you look at the grains of sand in the said box:

- Instead of being run in a third-party environment, Privacy Sandbox auctions are run within the Chrome browser, or a cloud-based “trusted execution environment”. The only current options for the latter are, my goodness! Google! … or Amazon, though who knows if Google has brokered a cosy sweetheart deal, as per previous bargains with Apple and Meta.

- Under Privacy Sandbox, an imposed requirement dictates that Google acts as the top seller BEFORE non-Google auction bids are even submitted, then Google finalises the winning bid. Akin to a hypothetical scenario in which eBay bids on the auctions it hosts, then decides who won…

As observed by Criteo in testing, these changes have crippled publisher revenue for those using third-party SSPs, whilst simultaneously boosting GAM’s market share from 23% to 83%. What we’re witnessing is not a concerted push for a more privacy-focused and equitable advertising ecosystem from Google, instead we’re seeing the wolf of anticompetition disguised in grandma’s robes of user privacy.

Addressability: Still on the chopping block

While there is still an arsenal of unknowns around how the choice between cookies and privacy sandbox will be presented to users, the message is clear. Do not drop plans for the privacy-first future.

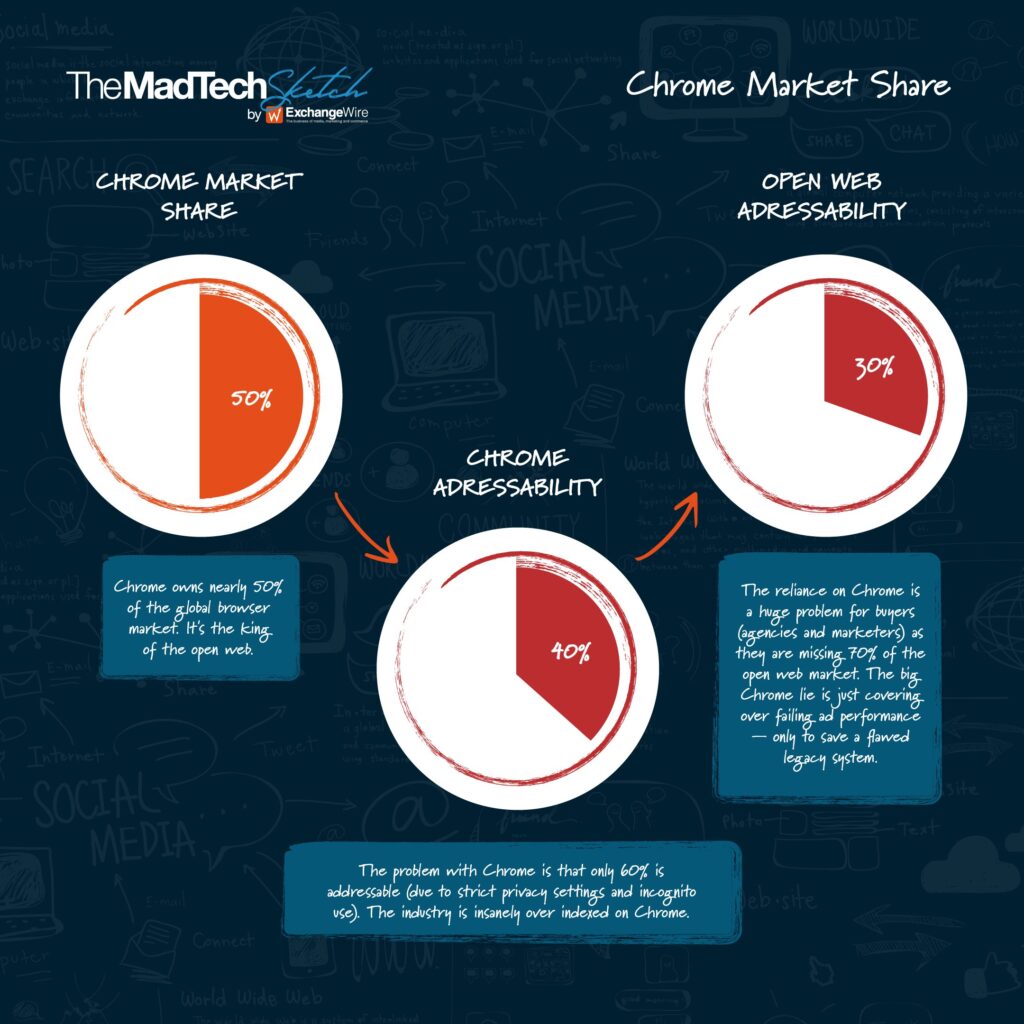

Even before 2024’s flip-flopping around the future of the cookie, open web addressability was already in a tailspin. As documented in a MadTech Sketch published in November 2022, open web addressability was down to 30%, as a result of privacy settings and increasing use of Chrome’s Incognito mode by consumers.

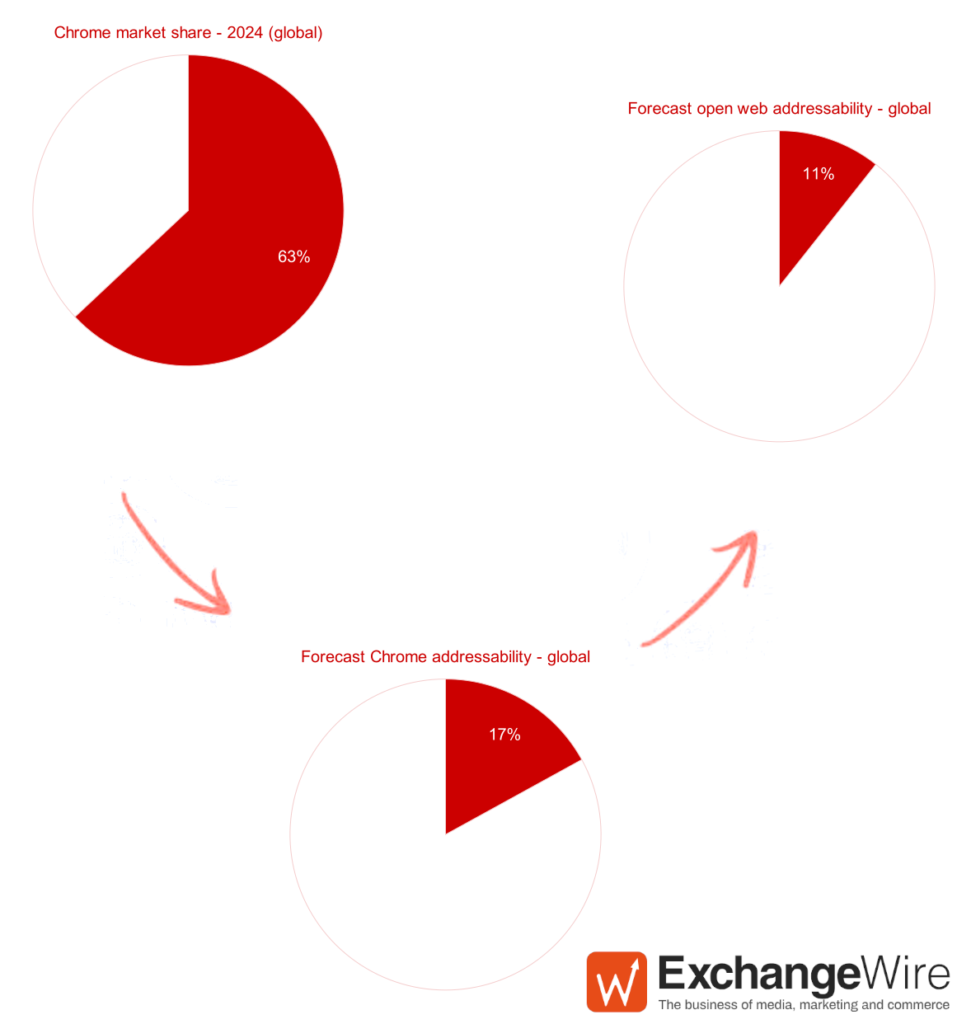

Crunching the numbers based upon expected opt-in rates for use of the third-party cookie, based upon comparable rates for GDPR-compliant cookie consent notices*, make for grim reading for those overly reliant on the aged identifier. Under these forecasts, Cookie-based addressability across the open web would plummet to just 11%.

*This was selected as the most-appropriate proxy, versus average opt-in rates for Apple’s App Tracking Transparency, as typically users are more trusting of app-based environments compared to websites. Even if assuming same opt-in rate as the latest figures for App Tracking Transparency global opt-ins, global open web addressability is still expected to halve from 30% to 15%.

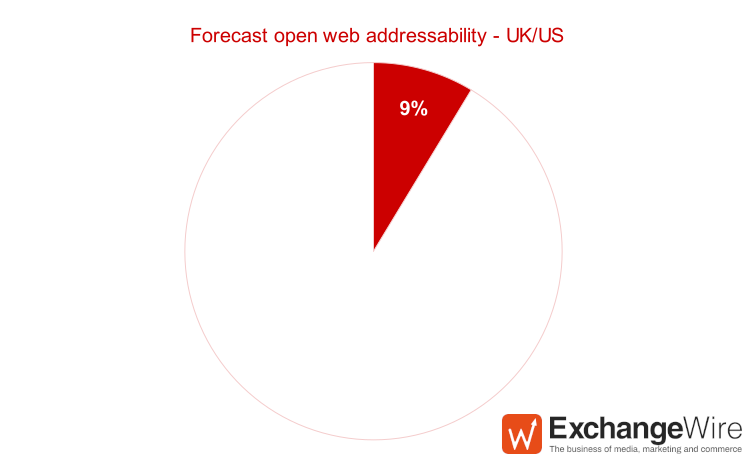

Moreover, Google’s market share is lower in the top three digital advertising markets, namely the US, China, and the UK. For both the US and UK, latest figures suggest Chrome commands a 51% share of the browser market, therefore here, cookie-based open web addressability is expected to fall below 10%.

Operating on the assumption that users would automatically be opted in to Google’s Privacy Sandbox should they decline to be tracked using third-party cookies, some may be contemplating a simple shift from a cookie-based strategy to a sandbox-based strategy.

However, in its current guise, this is far from recommended. Not only are there the severe antitrust concerns as outlined earlier, in a robust analysis conducted by the IAB Tech Lab, Privacy Sandbox was roundly criticised by the IAB Tech Lab. Limitations or lack of support were identified in a vast array of areas, including but not limited to:

- Exclusion targeting

- Interest group management for competing entities

- Avoiding self-competition in bidding

- Frequency capping

- Bid loss reporting

- Revenue accrual valuation

- Attribution reporting

- Invalid traffic management

- Ad serving latency

- Cost efficiency

- Data security

- Brand safety

These limitations stack up to potentially crippling implications for advertisers and publishers alike. On the sell-side, the latest data is stark. Tests conducted by Criteo documented an average decline of 60% in publisher revenue from Chrome. By accounting for the current level of supply integration in Privacy Sandbox, that decline in publisher revenue widens to 78%.

Further anticompetitive nudging onto the Google stack, with the average decline in revenue for Privacy Sandbox auctions falling to just 21% for auctions conducted within GAM, specifically due to the aforementioned hindrances Google imposes on environments outside of GAM. As put by Elias Selman, Criteo’s product data scientist lead, “GAM wins auctions that it otherwise would not win due to its advantage in the Privacy Sandbox environment compared to SSPs competing for the exact same display opportunities.”

The future of the third-party cookie, Privacy Sandbox, and the potential breakup of Google’s ad tech stack, will be discussed in detail at ATS London 2024, which takes place on Wednesday September 11th at the QEII Centre. Tickets and further information are available here.

AntitrustCookiesGoogleIdentity

Follow ExchangeWire