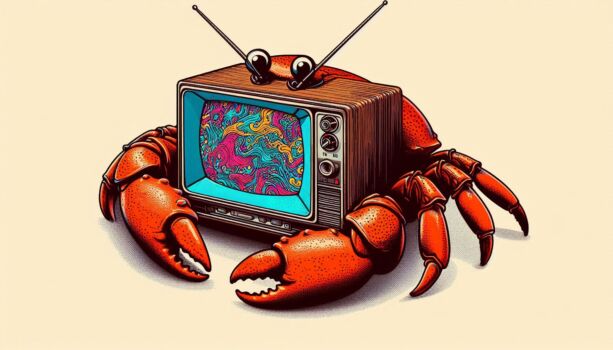

Reinventing the Crab: Is CTV just TV Again?

by on 14th Nov 2024 in News

And, if it is, what does the age of “TV 2.0” mean for advertisers? Harry Menear takes a look a the CTV streaming landscape, and the dangers of simply reinventing what went before...

There’s a phenomenon in nature called carcinisation. Essentially, across multiple species who haven’t shared a common ancestor since crocodiles and sharks were nature's hot new thing, the vast engine of evolution keeps driving in a single direction, towards a single perfect organism.

For reasons that still puzzle zoologists, evolution keeps trying to reinvent the humble crab. As it turns out, a hard shell, big pincers, and your preferred direction being sideways is, apparently, the perfect form factor for survival in and around our planet’s oceans. But what does that have to do with ad tech and connected TVs?

Reinventing the crab

Evolution isn’t the only large, inscrutable force for change that keeps returning to old forms, however. The collective efforts of Silicon Valley (and the tech sector more broadly), also have a propensity for coming up with new innovations that look an awful lot like things we already had. Whether it’s buses, student loans, and shared housing, or Elon Musk’s recent Vegas loop trial, the tech sector (and the people it sells things to) should take greater care to ensure that new things are actually new. In every industry, whether it be transportation, consumer electronics or, increasingly, entertainment, reinventing the crab.

In an attempt to drive revenues, newly evolved industries often find their way back to the systems that worked before — essentially reinventing the thing they promised to replace. Right now, the streaming industry is in the process of coming up once again with the experience of watching cable TV, a return to old models (with new technology) that could have profound consequences for the ad tech space as we move beyond the fully OTT streaming age.

The growing ubiquity of connected TV (CTV), in combination with an increasingly fragmented streaming space, is creating an entertainment (and, subsequently, advertising) landscape that looks a lot like the world before streaming changed everything. This new (old) world is creating unique opportunities and challenges for advertisers as advertising through CTV promises a return to the reach and effectiveness of traditional TV advertising with the precision of social media campaigns.

It increasingly feels like, after fifteen years of an ascendant US tech sector, a host of distinctive disruptors are rapidly taking on the characteristics of the things they swore to replace. Does that mean we’re doing backwards, or merely synthesising what worked in the past with what works today, creating a more stable era for entertainment and advertising than that which we’ve seen throughout the past half decade?

This feels like a re-run

Right now, the streaming sector is feeling the pressure of an increasingly fragmented market. Platforms are turning to ad revenue as a way to sustain their revenues as more and more services squabble over household monthly entertainment budgets.

Until just a few years ago, streaming was an unstoppable, gleaming juggernaut roaring towards a future of affordable, consolidated on-demand content-as-a-service — a utopian landscape littered with the shattered remnants of a dying cable and satellite TV industry. Today, things are very different. In the last three years, an overcrowded market and faltering revenue models have seen streaming’s momentum stall.

"The fragmentation of the streaming ecosystem has revolutionised viewing habits," comments Jon Hewson, managing director at Audience Store. The previously existing distinction between traditional linear TV and connected, on-demand TV are blurring as audiences increasingly consume content across multiple platforms, whether that’s traditional broadcast channels or streaming services. Today, people don’t differentiate between how they’re watching TV; they simply want to watch the content they love, and they expect to access it seamlessly."

Established platforms like Netflix and Disney Plus are facing fierce competition from a widening field of services — from niche, genre content (like Shudder or Mubi) to broader, freemium offerings (like Freevee and Roku Channel). The number of streaming services more than doubled in the last decade as challenger platforms arose to disrupt the status quo and traditional entertainment companies entered the fray — late but determined to make up for lost time.

The result is an oversaturated market — increasingly incapable of supporting the profusion of new services which, outside of the largest incumbents, seems to swap new players in and out faster than a season of the Circle. The biggest streaming services aren’t having an easy time of it either. Netflix UK, which managed to maintain annual subscriber growth rates in the region of 20% for the last half decade (as well as profiting from the boost to the streaming industry provided by the coronavirus lockdowns) had its British subscriber base grow by just 4% in 2022, reportedly adding just a few hundred thousand members. "SVOD fatigue is now real," says Paul Gubbins, former VP, CTV strategy & marketing at Publica by IAS. He adds that "Many TV audiences are dialling back the number of subscriptions they have, and leaning into free or low cost AVOD & FAST services."

Free ad-supported streaming television (FAST) channels are indeed a growing segment of the streaming space, with users spending an average of 1 hour and 40 minutes per evening on these platforms. Paid services are also introducing ad-supported subscription tiers, or just starting to show ads on services that were previously ad-free — usually while also raising prices. The result is that, while media in 2024 is available on-demand through multiple different streaming services, the actual experience of consuming content (and therefore ads) looks a lot more like watching traditional TV than the height of the Netflix era.

"The lines between traditional TV and CTV are blurring fast," Gubbins says. "It's no longer just an add-on—it’s TV for the modern age, where 'live TV' meets streaming in a seamless, on-demand world."

The CTV era for advertisers

CTV is a blanket term that covers any and all internet-connected television that can stream video content, including Smart TVs, set-top boxes, and gaming consoles. Whether during scheduled ad-breaks or before content plays, CTV advertising is a rapidly growing segment of many organisations’ ad spend. "Think of CTV ads as TV ads 2.0: they still play in ad breaks while you’re watching content, but they’re smarter," Gubbins explains. "Traditional TV ads throw a wide net, hoping to catch the right viewers. Streaming ads are data-driven. CTV ads combine both worlds—using data to show you tailored ads on the big screen, but with more control and precision than offered by traditional linear TV."

The reach of CTV advertising is getting longer as well, with Peter Wallace, general manager at GumGum noting, more than three-quarters of households in the UK now own a smart TV. "It’s becoming increasingly ubiquitous and, where consumers are concerned, CTV is TV now," he says. "The difference is that consumers have infinitely more choice of content to watch."

According to Justine O'Neill, associate vice president at Analytic Partners, "It’s easy to see how audiences can, and do, struggle with the overwhelming content choices." She points to research finding that, while 39% of streaming subscribers cancelled a service in the last six months, 55% joined new streaming services. "There’s a greater tendency to service hop."

For advertisers, this presents an interesting challenge. While CTV brings the ability to measure, personalise, and target advertising (in the same way that digital advertising has been refined for social media) to the traditional TV experience, the fragmentation in the streaming sector makes it harder to get a holistic view that allows advertisers to compare performance between different platforms. Gubbins admits that "There can be a lot to navigate when it comes to the growing and fragmented CTV ecosystem." He notes that audience measurement and attribution are still evolving, but affirms that advertisers are "already unlocking a lot of value," thanks to the ability to fine tune ad-targeting thanks to data and programmatic advertising technology such as DSPs & SSPs. Solving the challenge promises meaningful returns, with the results from successful CTV advertising exceeding advertisers’ expectations.

"In this landscape, it’s essential to focus on the audience, not the platform," says Hewson.

Wallace adds, "When you compare CTV to other digital channels, particularly social media-based, connected TV is a much more immersive experience with less distractions. When we watch CTV content, we’re generally relaxed and focused on the programme that we’re watching. That creates an opportunity for advertisers to potentially capture a level of attention and engagement that far exceeds any other digital channel, as long as we get the creative activation and media placement right."

So, did the tech industry just invent the crab again? Yes, and also no

There’s a lot that’s different about the way that the current streaming landscape operates. Some of it works, and some of it doesn’t. It will be a few more years before the rising tide of new streaming platforms recedes and the industry consolidates again. In the meantime, however, as O’Neill argues, "The changing landscape has resulted in a revolution in how audiences engage with content, providing advertisers with a new wealth of data and targeting capabilities. Combining CTV with other marketing channels will deliver the strongest performing campaigns yet."

Follow ExchangeWire